11. The Agritech Fullstacker's Dilemma

Whether it is Absolute Foods or Dehaat or Unnati, venture funding is flowing more towards agritech full stackers. Can they survive when the momentum funding market eventually loses, well, momentum?

“It wanted to raise a smaller $10-20 million round, but the investor interest has forced them to extend the round. It could be $50 million now with the remainder coming in as an extended round.” - Talking of Absolute Foods raising $90 Million

"VC Money is Jet-fuel and should not be used in a Maruti Swift or even a Lamborgini” - Mark Kahn

Dear Readers,

Hi! My name is Venky. I write Agribusiness Matters every week to help us make sense of vexing questions of food, agribusiness, and digital transformation in an era of Climate change. Feel free to dig around the archives if you are new here.

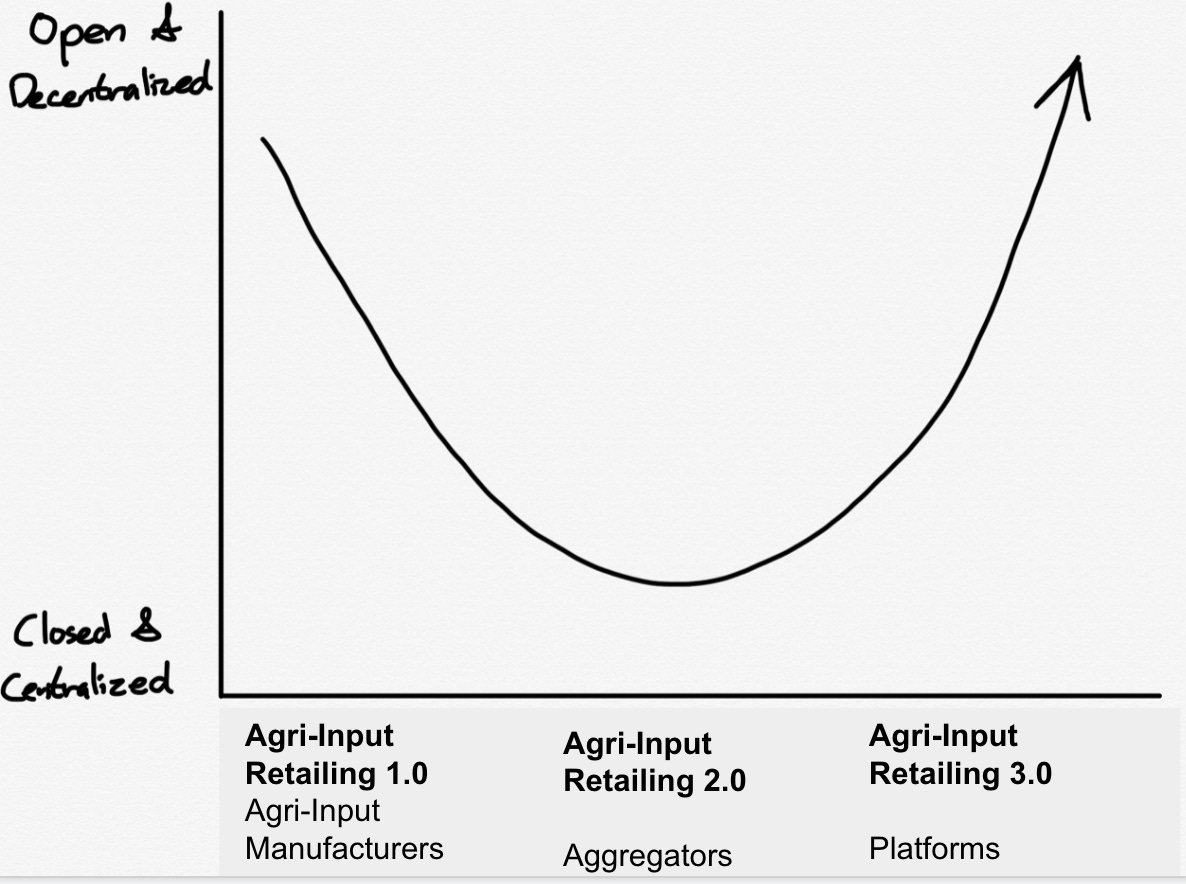

01/ Couple of weeks back, when I wrote my subscriber-only article, 9. Farmart, Plantix Dukaan [Store], DotPe, and Agri Input Retailing Platform Wars, I had mapped the three stages of evolution in agri-input retailing.

Here is how I summarized the article in the subsequent Saturday Sprouting Reads:

Agri-Input Retailing has come a long way.

For the longest period of time, whenever agri-input manufacturers thought of agri-input retailers, the easiest way they solved their problems was by offering them a loyalty app. Soon, every agri-input manufacturer wanted the retailer to order their respective products from their respective apps. Can you imagine the plight of an agri-input retailer owning 15-20 brands?

From 2015 onwards, aggregators like Agrostar, Dehaat, Unnati, Gramophone came to the fore with a business model in which they owned the customer and suppliers followed the suit. They went for the hub and spoke model. They went full-stack in order to control the value chain and aggregate demand faster than the supply, paying the price by commoditizing the supply.

Today, with the advent of Farmart, Plantix Dukaan, we are seeing a new wave of decentralized platform play.

02/ In response to my article, an agritech investor wrote, “It’s not full-stack when you don’t own the active ingredient. Disney is full-stack, They own IP, distribution and have end customer’s credit card.”

Fair point.

It’s funny when I think about how my opinions have come full circle.

In 2019, when I wrote, “Will the Real Agritech Platform Please Stand Up”?, I wrote,

“If you are in the business of selling agri-inputs through free-but-biased agronomy content advice, can you really call yourself “agritech” player?

If you are in the business of transporting potatoes, onion, and tomato (POT) from farmers to food grocers in the country with an assured delivery period of 12-15 hours, can you really call yourself an “agritech” player?

The problem is further compounded by the fact those who originally started off with agronomy advice and selling agri-inputs are now looking at buying produce from farmers and creating subsequent market linkages.

And those who originally started with facilitating reverse-auction of farm produce among farmers and traders are now looking at selling agri-inputs.

In such a case, who on earth would you call a real “agritech” player? Anyone and everyone?”

In that article, I had proposed a framework to define agritech and coined a new term called “Integrators” to describe a new league of agritech players, taking pains to differentiate them from “Aggregators”.

The term “Integrator” stuck for reasons I can hardly take credit for. When Kalaari Capital wrote about India’s Agtech opportunity, they talked about the opportunity ‘to be an integrator’. Even startups like Aqgromalin, willy-nilly, chose to call themselves an “integrator”

Today, with more grey hair, I find myself asking: Whether you are an “Integrator” or “Aggregator”, if you are a “full stacker” in agritech, what problem are you really solving in the agriculture domain? What is the blessing and more importantly, the curse of being a full stacker in agritech?

It also brings forth an important question: What constitutes a fair definition of full-stack in agritech?

As I had written in Unbound Agriculture, tracking Amazon’s entry into agri-inputs:

If an Indian agritech startup engages in locational arbitrage, selling inputs to farmers in State A (with a different taxation structure) by buying from distributors and dealers from State B (and not agri-input manufacturers, who, let’s not forget, in strictest terms are more packagers of Chinese Imports), can they be really called a full-stack agritech firm?

If a farm-to-fork startup is showing fancy GMV numbers by buying produce from traders and commission agents (while shooting Bollywoodian underdog story capsules of rural farmers empowered by the divining powers of technology), can they really be called a full-stack agritech firm?

What really is full-stack play in agritech? What is the quintessential dilemma of a full-stacker in agritech? Let’s dive in.