Beer Game Problems in Agriculture

Few Reflections on Last Week's Story and an Update on an Upcoming Event

Dear Readers,

Last Saturday, I published Netafim’s Beer Game Problems. It was a case-study on how the bull-whip effect plays with predictable discontents in the Indian agri-input supply chain, whether it is the case of selling pesticides or micro-irrigation systems. This was a companion piece to my earlier piece where I explained the historical origins of Bull-Whip Effect and how it plays out to wreak havoc in the lives of the farmers.

Truth be told, studying the Bull-Whip Effect in Indian Agriculture has become some kind of an obsession for me. Every time I dig open the rabbit hole, it challenges my conventional understanding of economies of scale.

Let me start with a hypothetical question. Who has a better chance of taming the bull-whip effect in Agri-Input Supply Chain? Option A: Dehaat Option B: Ninjacart? (If, and that is a big if, they see this as a problem worth putting their thinking hats on in the first place.)

Let me give you a clue.

Check this recent Live Mint Story on Dehaat, where Shashank Kumar, Founder and CEO at Dehaat shared an interesting data factoid.

Some 26-27% of our revenue comes from farm input sales and distribution, and the remaining from market linkage of produce.

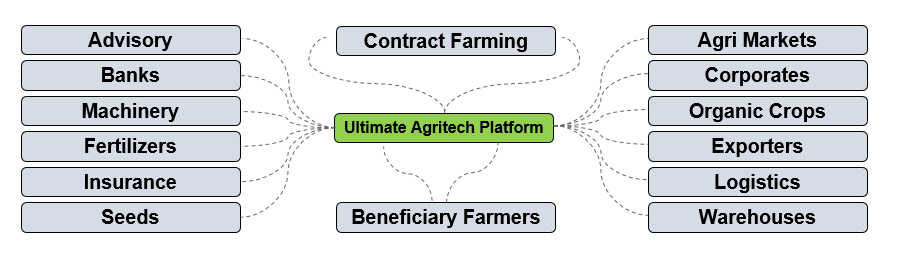

Given that most agritech players are chasing the holy grail to build one collaboration platform, which brings together both ends, the input side on the left, and the output side on the right, of the agriculture stakeholders, I find it interesting to speculate how these two startup players will use their operational strengths to tame the bull-whip effect by correlating the demand at the site farthest downstream with the systems that are available in the upstream sites.

Here is one illustrative version (not a definitive one) of how this collaboration platform could marry different players from both ends. I had drawn this earlier for an article I published defining the Agritech platform stack. This article, btw, is more than two years old, and today, I would define agritech platform differently.

Many years ago, when I first encountered Bull-Whip Effect, while building traceability software applications in the agri-input supply chain, I was a restless product manager trying to find a solution. Going by the conventional wisdom (read as How P&G Solved Bull-Whip Effect in FMCG), I naively thought that the problem would be easily solved if we incentivise the agri-input retailers to share their sales data with us. However, it was easier said than done.

Most agri-input retailers were hesitant to give the data for obvious reasons, and there were far too many instances of data manipulation in collusion with agri-input manufacturers’ sales team to optimize their cost of credit with the agri-input manufacturer.

If you look at this behavioural pattern along with the way both of these startups are operational in their markets, I am more inclined to think that Dehaat has a better chance of cracking the bull-whip effect than Ninjacart.

Nevertheless, this merits a deeper discussion on how Ninjacart by their centralized operations are creating the necessary conditions for bull-whip effect. We will talk about it later.

One Quick Event Update: I will be going Live in LinkedIn on August 15th to talk about data and how it could be used to build an Aatmanirbhar Bharat (political shorthand for self-sufficiency in the age of the pandemic).

I have few unconventional perspectives, drawing from how our public data sets in Indian Agriculture don’t often speak with each other and what lessons we can learn from Greek philosophers like Parmenides and Aristotle (Hint: Ontology).

It should be fun, for sure. You can RSVP for the event here.

That’s all for today. Enjoy your day!!