Bioprime's Primary Bet

How to disrupt the biologicals category by becoming a venture fundable agri-biotech startup in India?

Hello Friends,

Today marks a new beginning for Agribusiness Matters. A sponsored deep-dive on an Indian agri-biotech startup, Bioprime Agri Solutions Pvt. Ltd. Although I have received a few requests before, for obvious reasons, I have not considered doing sponsored deep-dives.

Until now.

Renuka (CEO, Bioprime) and I kept circling over this experiment for several months, ever since we collaborated on the op-ed we co-wrote in December 2021 along with Mark Kahn. And at one point, I decided that I must go ahead and do this…

...while acknowledging the handful of butterflies in my stomach as I type this. I am aware that sponsored deepdive can raise several existential red flags, when not done right. But try one must, making a heap of all one has at stake, if one has to discover something new. Since I deeply value the trust you repose in me as a reader and subscriber, it is my duty to explain how I approached this process without compromising my ethics as an agritech analyst.

I decided to write on Bioprime as the company ticks four checkboxes that I look for in a sponsored deep-dive company:

The company’s founding philosophy aligns with the fundamental ethos behind Agribusiness Matters: To encourage systems thinking in Agriculture.

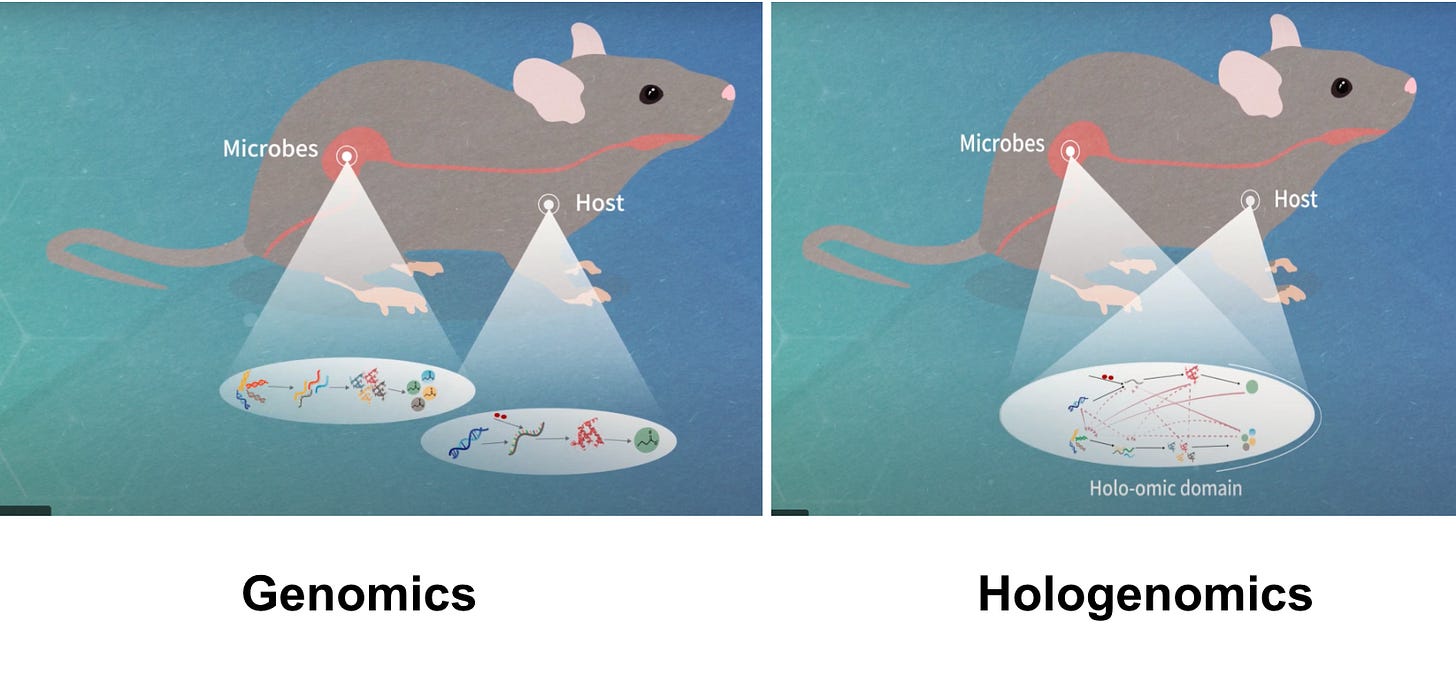

Bioprime’s product philosophy is fundamentally based on the paradigm of seeing plants as cooperative. If that sounds woolly, worry not. We will explore in detail the paradigm of hologenomics that is essential if you want to make sense of recent agritech startups coming to the fore such as Inner Plant or Sound.Ag.

The company is challenging some of the implicit rules of the sector and therefore its lessons have great applicability to a lot of agritech players in the ecosystem worldwide.

Outside India, AgraQuest, Becker-Underwood, Pasteuria and more recently, Marrone Bio have been poster boys and girls for venture capital exits in the biological sector.

Inside India, barring a few exceptions, biologicals and agri-biotech players aren’t typically perceived to be venture fundable. Biological players (and their acquirers) are largely viewed from the lens of capex-heavy, private-equity fundable business models.

"Private equity investments in the Indian agri-tech space grew more than 50% annually to aggregate approximately ₹6,600 crores till 2020" - Bain & Company and Confederation of Indian Industry (CII) Report.“..In order to upscale and modernize, companies in these [agriculture] sectors need capital infusion. Also, companies have to set up vast distribution networks to reach out to the large, but scattered, farmer population, which again needs a lot of capital investment” - Dhanraj Bhagat, Partner, Grant Thornton India LLP, in a Mint story on PE in Agriculture

The story of Bioprime could offer agritech players a valuable lesson: What does it take to build a venture-fundable biologicals business without spending massive sums on building distribution networks?

Much like it takes a village to raise a child, it takes an ecosystem to make an agri-biotech startup venture fundable. We will explore this in detail below.The company’s story must be interesting, aligning with the larger trends that I am seeing in the ecosystem.

Bio-inputs are coming into the mainstream limelight at a time when full-stack agritech platforms are maturing and biological players are partnering for distribution with agri-input firms and full-stack agritech platforms.

How would these moves affect the Davids (read as agri-biotech startups manufacturing bio-inputs) and Goliaths (read as Big 6 agri-input companies) of this sector?

Should biological players change the behaviours of farmers in the market in order to be successful? (My colleague Shane Thomas has an interesting take on this) Or can biologicals succeed in the market without changing the default behavioural expectations of farmers that have been primed by traditional agrochemicals?

Lastly, but more importantly, the company is open to discussing the pros and cons of its product approach. Can I write a balanced piece that explores the ground realities with the same amount of candour I bring in my regular agritech commentary?

Although biologicals are largely being positioned as a clarion call to reduce chemical use and improve soil organic matter by replacing traditional agrochemicals, the race is now gearing up to build bio-herbicides, bio-fertilisers, bio-pesticides and bio-fungicides.

Mind you, we are in the nick of a new era of reimagining crop nutrition in an era of climate change. The industry terminology is shifting from CPP → NPP

On ground, this shift is much more complex than terminology change.

Like it happens in most domains, regulation lags behind technological innovation and has been hazy for most parts, groping for the right framework to regulate biological products in the market worldwide. Barring a few, most countries find it easier to do Ctrl C+ Ctrl V of existing fertilizer and pesticide guidelines and tweak them slightly for regulating biologicals in their markets.

Given the uncertainty in the regulatory climate, there is a significant entry barrier for startups to go through the regulatory compliance process before they enter the market.

“It is not atypical in the EU for regulators to take 5–6 years to approve a new product for a single zone, and for the tests required (not including regulators’ fees) to cost over £ 500,000. This means that to get a new product to market can cost up to £ 3–5 million in the EU.” - Interview with Dr. Minshad Ansari, CEO, Bionema

“Any new company or product will need atleast 20-25 Lakhs (~30K USD) expenditure and 15-18 months before it can hit the market [in India] - Renuka, CEO, Bioprime”

How would these hazy regulatory winds affect the future of biologicals and its upcoming product pipelines (attuned viruses, onco-nanocapsules, vaccine adjuvants) which is, umm, well, getting more and more fascinating by the day?

Disclosure: This is NOT investment advice. This is written for fun, educational purposes to formulate an inside-out perspective of the agritech ecosystem in the throes of change. I HAVE NOT invested in this startup nor benefited financially from its fundraising. This will be my stance, going forward for future sponsored deep dives.

Now that the disclaimers and disclosures are in place and we have a bunch of exciting questions to explore, Shall we get started?

Bioprime’s Primary Bet

One of the perennial joys of pursuing systems thinking in agriculture is exploring the parallels between humans and plants.

Human health is better appreciated by seeing the human body as a dynamic ecosystem thriving in cooperation with bacteria, fungi, archaea, viruses, protozoa, mites and worms.

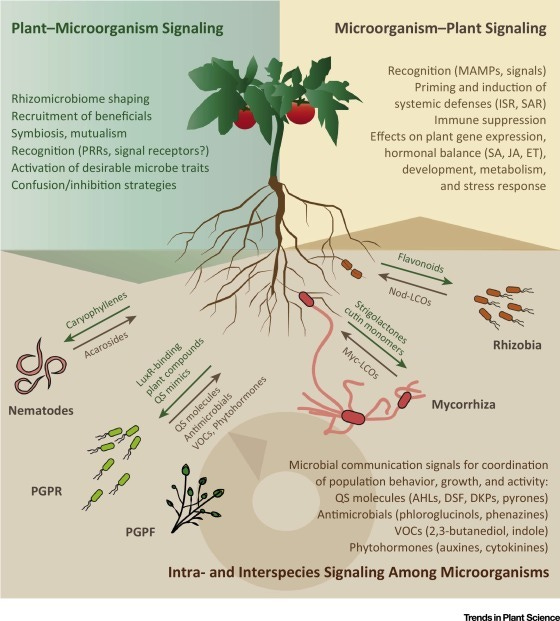

Plant health is better appreciated by seeing the plant as a dynamic ecosystem thriving in cooperation with its microbiome, constantly relaying information through its microbiome on a real-time basis to decide what to do next.

Whether we are talking of how a cow is able to eat grass (the answer lies in microbes, my friend) or how plants can improve their nutrition use efficiency, if we really want answers to fundamental questions in biology, what we are now discovering through the emerging paradigm of hologenomics is that we need to study not just the organisms or their microbes, but the two in tandem.

But why does it matter?

As we are seeing with the rise of agritech startups like Bioprime or Sound.Ag or Inner Plant, there is immense applied potential to address the vexing question in the minds of every agronomist in 2022.

How to approach crop nutrition when climate change dismantles most of our reductionist host-centric (plant) approaches to crop nutrition?

Allow me to double-click on this point. How does a plant adapt itself in response to climate change?

When the environment changes, the standard textbook approach so far has been that you can select those genetic variants which will help you adapt better. But there is one catch: This is a bloody slow process. How can we make plants adapt faster? Enter the microbiome.

“Microbiome gives increased flexibility…You've got this enormous catalogue of microbes full of genes that do stuff and you can change them instantaneously” - Professor Tom Gilbert in Introduction to Hologenomics

Now all of this is great in theory. But what happens in reality?

As much as we see rampant abuse of antibiotics in human bodies (especially in the case of India), we see rampant abuse of synthetic chemicals by farmers, habituated to instant gratification offered by technology.

We do to ourselves what we do to plants.

If you have been onto the ground, you would know that, with advancements in technology, farmers are increasingly demanding one-spray (much like one-click behaviours) solutions to unfold within hours of applying chemicals.

That the Goliathan Agrochemical Industry has been going through an existential crisis in its audacious pursuit to “feed the world” sustainably without further messing up with soil organic matter in an era of climate emergency is widely known.

The Davids working hard to earn the trust of farmers, helping the Goliaths change their stripes and dance to the changing tunes of customer expectations aren’t widely known.

To figure how Davids (small biological players/agri-biotech startups) can thrive in these challenging and fascinating times in the nick of change, I began to look at Bioprime closely.

“Bioprime” was founded in 2016 by three PhD scholars who brought together their idea and philosophy behind their approach to biologicals, bringing together “Bio” -all things nature derived/inspired and “Prime” - modulating/activating/instigating pathways.

Since plants don’t have organs unlike the human brain, they use messenger molecules which correlate to a particular response in a particular environment.

Plant signalling involves the conveying of information within and between plant cells from receptor systems to effectors. Signals can take many forms, including chemical and electrical, and signalling can occur locally within a single plant or between different plants, including plants of different species.

Now, if you talk “science” to investors ( which is not always a great idea), what they will tell you in response is that biologicals are great because while it takes typically ‘$300 Mn to bring a new chemical crop protection to market, it takes only $10-15 Mn to take a biological product to the market’.

But how can a fledgling agri-biotech startup go about doing this in today’s market constraints?

Let us talk of Indian ground realities. India still doesn’t have end to end (ideation to field testing) facility if you are an agribiotech player working in agriculture.Hello Ecosystem!

When I asked Renuka what did she get from the accelerators who helped them take their product to the market, I got a list longer than my weekend grocery list.

Company Incorporation: 1) BIRAC and BIG- Proof of Concept grant in aid 2) Venture Center - Incubation, Yechnology development Proof of Concept

Prototype Testing: 1)RICH- Research and Innovation Circle of Hyderabad - Market Access and Commercialization

Market Testing: 1) Collaboration with Delta Agrigenetics for channel GTM strategy - Value Proposition and Product Market Fit 2) Atal Innovation Mission New India Challenge and LEAP fund - Scale Up 3)BIRAC Seed Fund 4) Ignite - GTM Strategy

Market Validation: 1) Agricultural Universities Validation - Dharwad, Rahuri, Dapoli - Toxicity tests Gaziabad and Chemistry - Shelf Life, Composition 2) PUSA UPJA - Financial modelling, New crop new market expansion 3) Social Alpha Challenge and Tata trust FPOs SHGs tie ups, market penetration 4) Cisco Agri Challenge- 10X Growth Hack

Mind you, all of this incubation and acceleration processes unfolded during the first four years of the company’s incorporation (without diluting much of equity, much to the delight of VCs), before Omnivore announced their first investment in Bioprime bringing them under their OmnixBIO Accelerator, alongside ThinkAg partnership for industry connects and ISB Enable-Startups Track Acceleration Program for capacity building.

So far so good.

But is this enough to make an agri-biotech startup venture fundable?

One of the key areas where I see many agri-biotech startups struggle is the domain of distribution. Most of them don’t have the financial muscle to build two-tier deep distribution networks. Because their products haven’t penetrated deep enough in the market and they haven’t scaled enough to manage their operations, agri-input players are wary of collaborating with them for GTM partnerships.

It’s the classic cold start problem we see in the early stages of marketplaces and platforms.

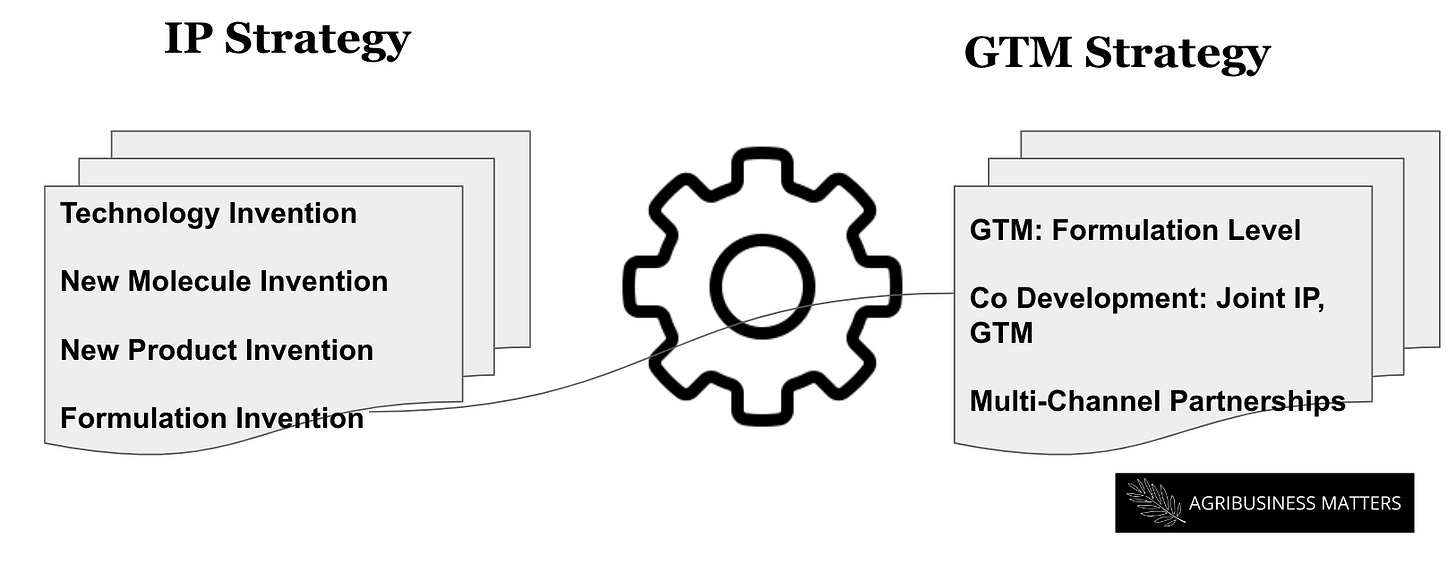

When I began digging into this to see how Renuka’s team have addressed this, I found a fascinating clue in the way IP strategy is enmeshed with GTM strategy. This flywheel between IP Strategy and GTM Strategy makes sense if you think in first principles and it could be an interesting gameplay to observe when biological players scale in the market worldwide.

At the end of the day, if you think about it, biological players currently are of three kinds.

Those who are demanding farmers to change their behaviours, understand complex science about climate change, micronutrition, nutrition efficiency and push them to change the way they grow food, fiber and feed.

Those who are telling farmers: You don’t have to change behaviours. We will continue to sell traditional agrochemicals - mix few micro-nutrients, heavy metals in seaweeds- and call them under a more fashionable label called “biologicals”. Sure, regulation is hazy, but over time, we will iron things out.

Those who are telling farmers: You don’t have to change behaviours. Our products have walked the long mile - They been designed from a product philosophy that doesn’t compromise its science, complies with nascent regulations AND does what you expect of them even when you buy them from a local pesticides retailer shop near your village.

Today, it is clear that India is one of those countries that has a comprehensive and more stringent, regulatory framework laid out when compared to the EU (which has released a draft biostimulant agreement, but nothing conclusive yet).

Unlike India, EU’s draft biostimulant guidelines doesn’t force you to explain mode of action. And in such an uncertain environment, it is extremely hard to be the third kind of player, given the early stage of maturity of biologicals and biostimulants (don’t conflate the both) in the market where regulators and ecosystem at large still don’t understand the complex science behind it.

But try one must.

Isn’t the sole purpose of innovation to walk the uncertain path, doing hard things that very few understand and bravely march forward?

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.

thrilled to see an extensive and comprehensive assessment of a sub-sector - AgriTech Biologicals.

is GMO the same as AgriTech - Biologicals?