Distinguishing Risk from Uncertainty

Why is it a matter of life and death for startups to distinguish risk from uncertainty?

State of Agritech - 15th February 2024

In Today’s Edition:

01/ Distinguishing Risk from Uncertainty

Why is it a matter of life and death for startups to distinguish risk from uncertainty? Case in Point: Regulatory Body SEBI’s Interim Order on Indian Agri-Investment Tech Player Growpital and their Public Response. What are its implications for the Indian Agritech Ecosystem? Can Agri-Investment players address the gap in public spending on Indian Agriculture? How to rethink agri-investment tech business models to bring more skin in the game for farmers?

01/ Distinguishing Risk from Uncertainty

Around June’23, I profiled agri-investment tech player Growpital and later contrasted them with US-based agri-investment player Fractal. Responding to my story on Growpital and its regulatory arbitrage gameplay, Rituraj, CEO, of Growpital, wrote

"Growpital is eagerly looking forward to levelling up from the regulatory arbitrage. The first mover, in our case, we take on the heat as well as the benefits through this arbitrage and when the right scale kick in, the regulation will evolve and we firmly believe that it will be favourable for all the stakeholders involved - Growpital, Farmers, Investors, Zetta Farms projects and land owners. The models at the global level mostly involve the land to be kept as collateral, but in our we like to keep it at a very low capex, just to keep the cash flow churn at the right rate.”

As expected, ‘after receiving the benefit through this arbitrage’, attracting 184 crores INR (~221 Mn USD) of investment, they have ‘taken on the heat’ head-on. They have further appealed to SEBI that freezing their bank accounts would affect their managed farm operations- farmers’ payouts and wage disbursements significantly.

Few days ago, Growpital put out its first public statement with an explainer of sorts that frankly disappointed me when it became a motivational hustle spiel instead of striving to build trust among partners and other stakeholders in the Indian agritech ecosystem.

Given that there are a dime a dozen Ponzi Scheme players in this space with a strong deja-vu memory of what happened in the plantation sector during the 90s, isn’t it reasonable to expect more from an ambitious startup ‘building an ECOSYSTEM to bring in the next wave of agri revolution’?

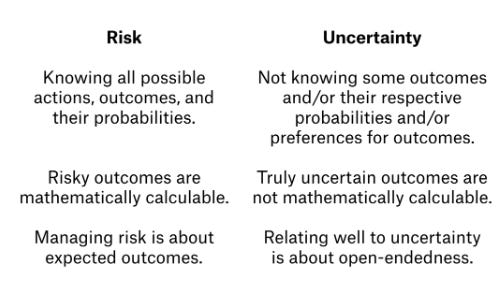

Mind you, if you are a first mover in farmland investing space, it is a matter of life and death to distinguish between uncertainty and risk.

Why is this important?

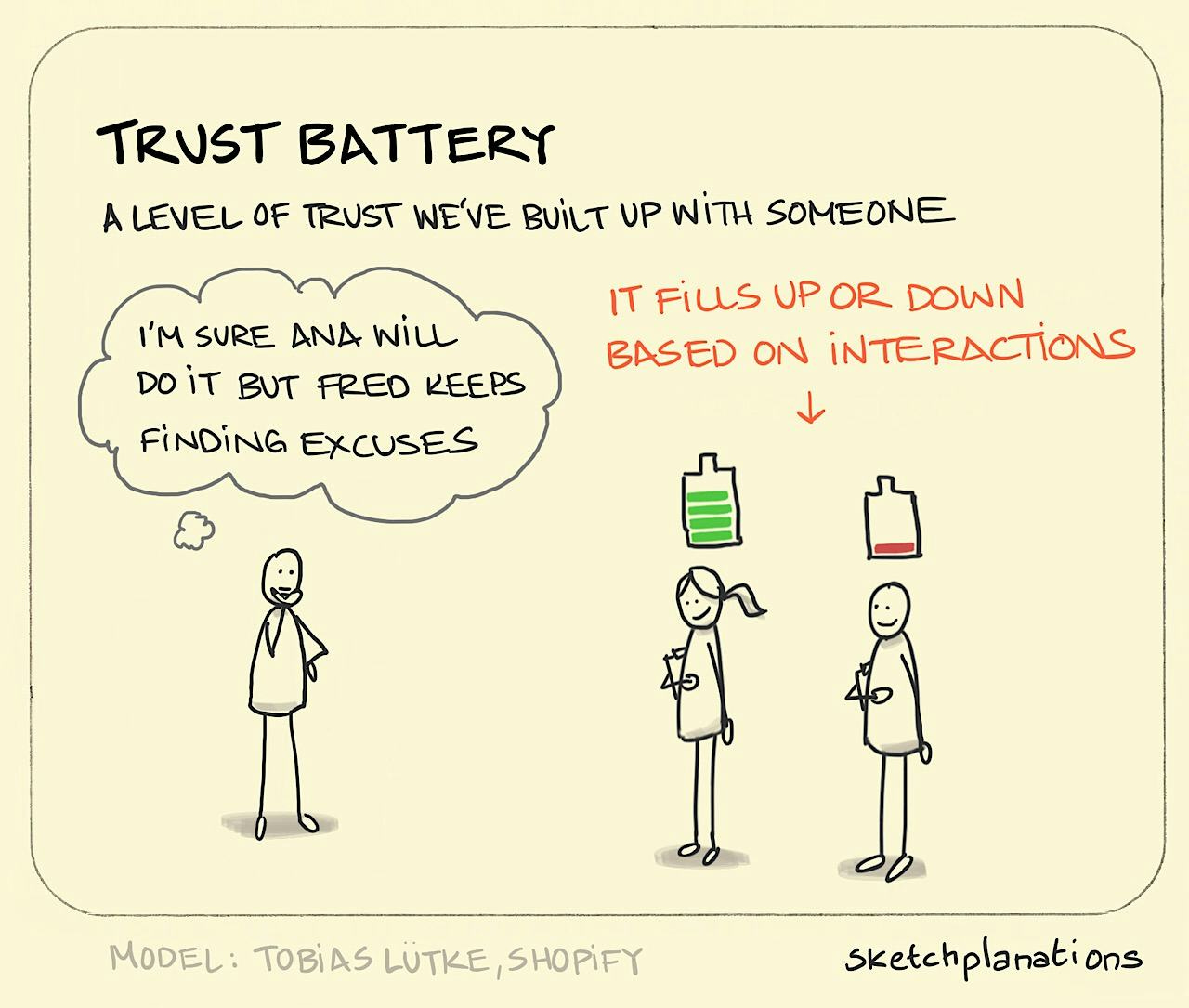

When startups communicate about ongoing crises that are spurred by not working with regulators and bringing them up to speed, ‘Trust battery’ is built by clearly distinguishing the difference between risk and uncertainty and bringing it into perspective when communicating with all relevant stakeholders.

What is a trust battery?

If Growpital knew that they would take the heat on along with the benefits, what was the need to say in public that ‘The SEBI notice caught us off guard”?

I don’t know if they had taken any help from a crisis communication consultant/ agency to spell out their public statement. I wish they had approached this far more sensitively.

“The freezing of accounts was not a consequence of any wrongdoing on our part but rather a precautionary measure based on speculation over we building a Collective Investment Scheme (CIS).” - Growpital’s Blog - Navigating Challenges: A Commitment to Transparency and Growth.

Perhaps, given the ongoing investigation by SEBI, they had to be tight-lipped and talk about what happened broadly without going into the details. SEBI’s final decision on the matter is awaited.

If the intent was to raise capital from retail investors, why did they choose this LLP route instead of registering with RBI or SEBI as a Collective Investment Scheme?

Here is a quick timeline of the critical events that show how far the tentacles go and why this is critical for the health of the Indian agritech ecosystem.

October’22 →Growpital ran a campaign in Tyke (currently deleted) for raising funds and was oversubscribed, raising red flags among institutional agritech investors.

June 30th, 2023 → SEBI received a complaint email to look into Growpital and safeguard the interests of the investors.

July 4th, 2023, → Livemint published an explainer story on Growpital, highlighting the risks involved in agri-investment.

October 5, 2023→ Growpital announces its corporate farming project in Nagaland with its partner Toka MPCS.

November 30th, 2023 → Zetta Farms, among others, invests in promising Indo-Swiss Dronetech startup SUIND

Side Note: Will SUIND face challenges in due diligence when they raise their funds soon?

6. January 2024→ Growpital formally announces Indigro Capital

“It is an extension to our Fund Stack after Growpital to invest into projects, entities and startups having their focus in agri to revive the agriculture economy as a whole and generating best value alongwith profitable results. We are looking forward to create a $25 Million fund size for deployment.” - Rituraj

January 2024→ Growpital announces its expansion plans.

“👉 Agri-Tourism

👉 Create Backward integration over Agri inputs

👉 Creating Forward Integration through value-addition setups and developing trade channels

👉 Strengthening new age aggrotech startups by investing in them

👉 Creating pool funds for developing and executing profitable farm projects and investing in entities and startups.”

Side Note: Indian Agri-tourism investment tech venture Cosy Farms was profiled in ABM in Nov'23

January 29th, 2024 → SEBI announces its ad-interim ex-parte order on Growpital

February 2024 → Growpital communicates its responses and going by their mail trail, conducts a webinar on the same.

February 2024 → Growpital makes its first public statement promising to ‘reflect on our values and commitment to transparency towards all stakeholders involved including partners, farm workers, office team, land owners, associates etc’

Now why is it necessary to study these agri-investment tech developments in greater detail for the Indian agritech ecosystem?

If you look at Indian numbers, the share of public expenditure on agriculture has been declining ‘from 11 percent to 9.5 percent between 2010-11 and 2019-20, with a CAGR of -1.65 percent’

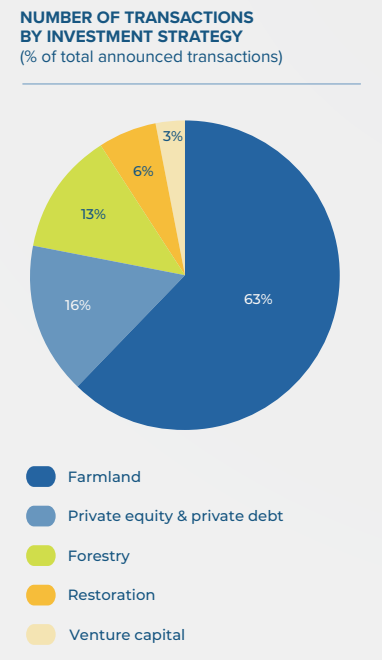

If you look at global numbers, ‘there has been a high concentration in farmland funds, with 63% of the deals focused on agriculture real assets’

Farmland investing, as it largely stands today is a glorified digital feudal system that separates ownership of an asset from its management. Of course, India has a lot of historical regulatory challenges in providing land as collateral, Why not provide fractional ownership to farmers (if not a co-farmer relationship) so that they have better skin in the game?

Or better, why not let agri-investment players invest along with farmers by taking passive, minority stakes in the land that farmers already own? Instead of teaching farmers to farm through technology, why not raise the stakes for them to up their game in sustainable agriculture?

If Growpital is serious about “Desh Ka Culture - Agriculture” and wants to ‘strive for a golden future in agriculture’, why not offer such models with adequate skin in the game for farmers to flourish as farmers and not workers?

Agri-investment players in India and SEA markets, with their appetite for scale, have the potential to mitigate the gap in public spending and build infrastructure that can provide livelihood options for farmers with a guaranteed off-take agreement in place.

When Livemint quizzed Rituraj about why Growpital is not under the Collective Investment scheme in July’23, his response was documented thus:

“5. Why is it not under a collective investment scheme?

According to the founder of the firm, under a collective investment scheme (CIS), there is a lack of control by an investor over the funds allocated to any activity. However, in Growpital’s case, there are certain powers vested in the partners. For instance, important decisions such as obtaining a loan or debt from a bank require approval from more than 60% of the partners in the LLP, added Sharma. obtaining a loan or debt from a bank require approval from more than 60% of the partners in the LLP, added Sharma.”

Growpital’s decision to not go for CIS seems centered around the following rationale

1) CIS Regulations do not permit any collective investment scheme to offer assured or guaranteed returns. Growpital wants to offer assured tax-free returns. So, they do not want to become CIS.

2) LLP Regulations don’t necessarily have a cap on the upper limit of partners inducted. SEBI in its interim order notes that ZF Project 1 had 4500 partners.

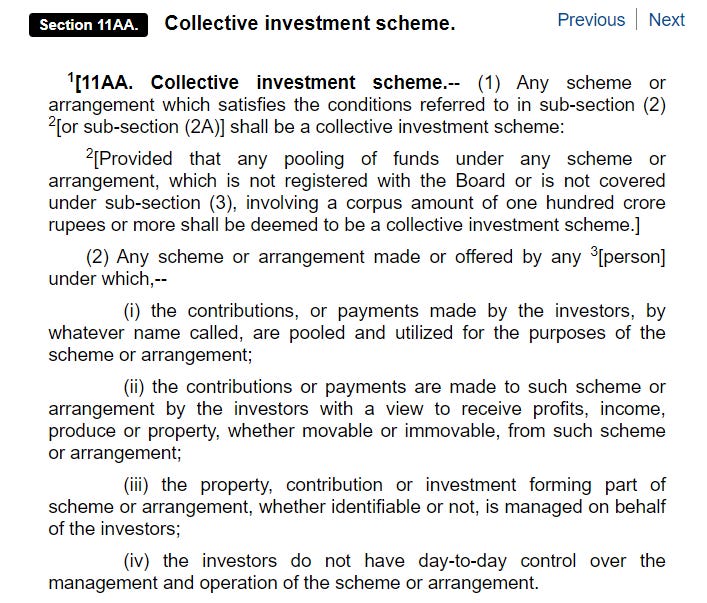

Now what does the law stipulate as conditions for the existence of a collective investment scheme?

Sumit Agrawal, in his article on Livemint on Growpital, points out the grey uncertain area involved in SEBI regulating the Collective Investment Scheme:

The crux of the uncertainty (not risk) is this: We are not sure whether it is deemed to be called CIS if the investments exceed 100 crore or only if it meets these four conditions stipulated by SEBI.

What is stopping Growpital from communicating this uncertainty (and not risk)?

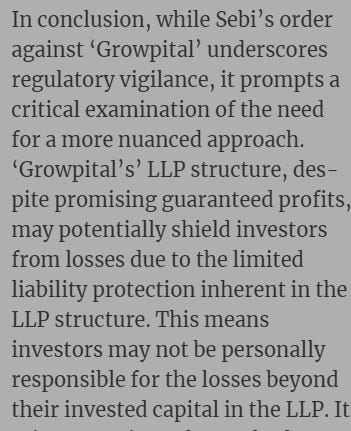

Sumit provides helpful context that clearly shows that Growpital’s decision to not go for CIS may end up providing a potential shield to investors.

If the LLP structure is offering protection to investors, why is Growpital insisting that partners end up transferring all their rights to Growpital? This and when you dig into investor forums and quorums, you realize that there are tons of unanswered questions.

Although SEBI in their interim report accused Growpital of not revealing farm information, when I looked at their AMA with Tyke, I saw that it wasn’t the case.

When regulation is non-existent/grey with a long history of ponzi rotten apples, founders bravely take a leap of faith and navigate the uncertain waters. Had Growpital taken the regulators alongside their journey, would this story be different from what it is now?

Given the amount of risk farmers undertake in farming, agri-investment models have a great potential to offload the risk through structured investments along with prudent planning. I sincerely hope SEBI’s ruling doesn’t inhibit this ecosystem from flourishing to solve complex problems that bedevil us in this sector.

I hope:)

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.