Gentle Reminder for Tomorrow's ABM Townhall on State of Agritech

Dear Friends,

Tomorrow is a special day in the brief annals of this newsletter. It has become an annual ritual here at Agribusiness Matters to talk all things agritech with the industry OGs.

October’22: Agritech Dialogue with Mark Kahn in Clubhouse [Non-paywalled Summary of the dialogue]

October’23: “Is Agritech Party Over”? [Paywalled Summary of the dialogue] with Mark Kahn and Shubhang Shankar

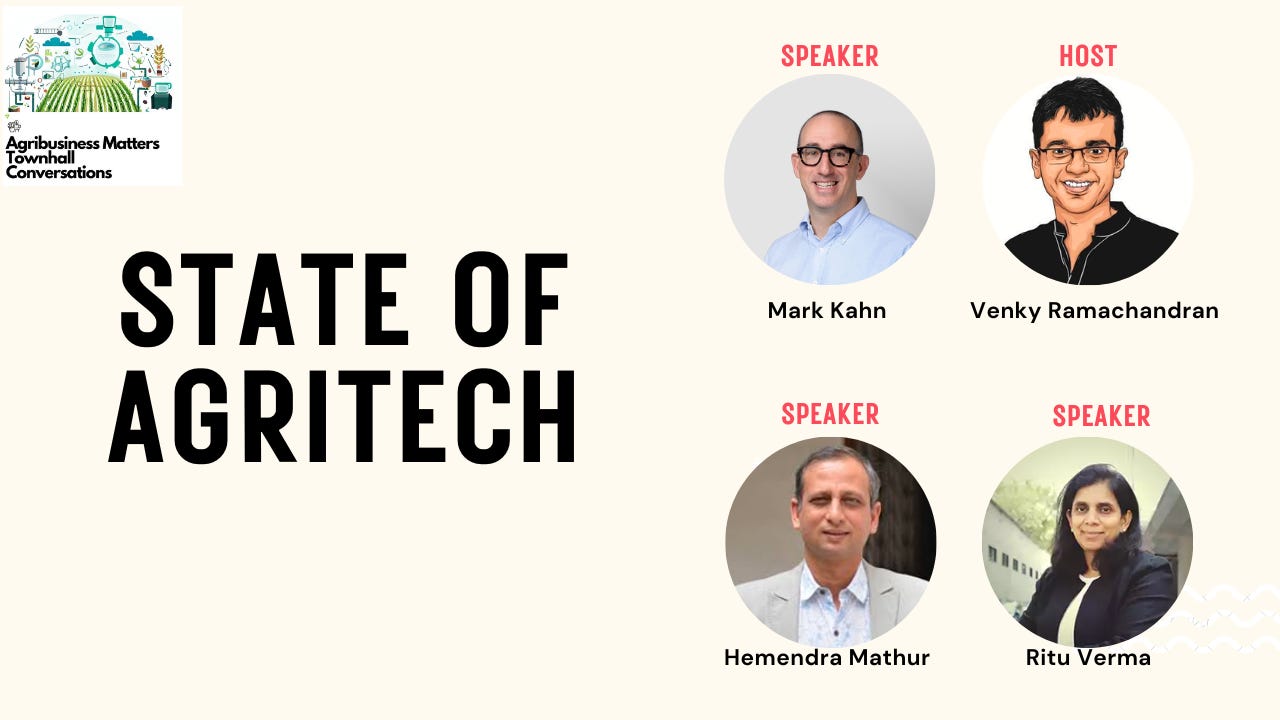

December 2nd 2024: State of Agritech with Mark Kahn, Ritu Verma and Hemendra Mathur [ABM Members can RSVP here]

I’ve been putting “Agritech” onto a therapist couch chair ever since I published “Will the Real Agritech Platform Please Stand Up?” in Oct’20 and followed it up with “The Agritech Full Stacker’s Dilemma”. If you zoom in and see the panoramic picture, we’ve seen three fundamental thresholds of agritech.

The first threshold happened in 1957, when the concept of agribusiness was spelt out for the first time by HBR profs, and the second threshold happened in 1980 when GPS and GIS technologies entered the fields, birthing the agritech as we know it. The third threshold happened around 2023 when agritech realized that it cannot survive without joining hands with climate-tech and bio-economy and rural-tech waves.

2023 has been a year of reckoning.

Investments in AgFoodTech plunged in 2023 by 65% and first-time deals only accounted for 22% of AgFoodTech investments. [Source: ThinkAg Agrifoodtech Investment Report]

How do we make sense of today's agritech investment landscape in which the difference between private equity and venture capital is almost blurring? Agritech is a sector where today every form of intervention can be counted for impact. Anything you do in agritech magically becomes “impact” driven the moment you sprinkle it with the term “smallholders”.

How do we critically evaluate the impact thesis of agritech?

Can “a pure-returns-focused fund” be serious about sustainability and impact? Despite its importance, why is patient capital still a rare ingredient in agritech? Despite the shifting narrative around GMVs and investors losing apparent interest in trading, trading has become a sine-qua-non to play the VC funding game. Is that inevitable given the structural nature of this business?

With declining IRRs/MOICs and exits in this space, are we doomed to be on the eternal hunt for the ultimate agritech venture capital playbook? Or should we rethink our scaling hypothesis? What are some of the fundamental assumptions we’ve baked in so far that need to be re-examined?

As you can see, there are a lot of questions to ask with an eminent panel such as this. Do join us. It should be a fun evening. ABM Members can RSVP here.

Thanksgiving offer will continue till the 5th of December and you can become a member of Agribusiness Matters at 50% discount. You also get a 50% discount on all of my Gumroad products (including the self-learning version of Global Agritech 101) if you key in this discount code: KPAXXU

If you are facing CC challenges with Stripe, you can try out these links or try out UPI via venkat.raman.kr@icici

Hope you enjoy your Sunday!

Cheers

Venky