Honey, I Insured the Biologicals🧪(Kshema, Digisafe); Down in the Indus Valley🐅; Indian Farmers' Missing Brides🥻

State of Agritech - 7th March 2024

Programming Note: Upcoming ABM Townhall Events for the month of March-April: 1) Designing Snake and Ladders Game for Transitioning Farmers 2) State of Soil Testing 3) State of Aquaculture. Members can learn more and RSVP here

<A Quick Word from the Sponsors>

The second cohort of the Global Agritech 101 course concluded last Saturday. The third cohort dates are out. Dates: April 20th-27th-May 4th. Time: 8 PM - 10 PM IST // 930 - 1130 AM ET // 230 - 430 PM GMT)

The course comprises three modules:

Thesis: Agritech hasn’t created a dent in the universe simply because we’ve been playing chess so far without seeing the chessboard.

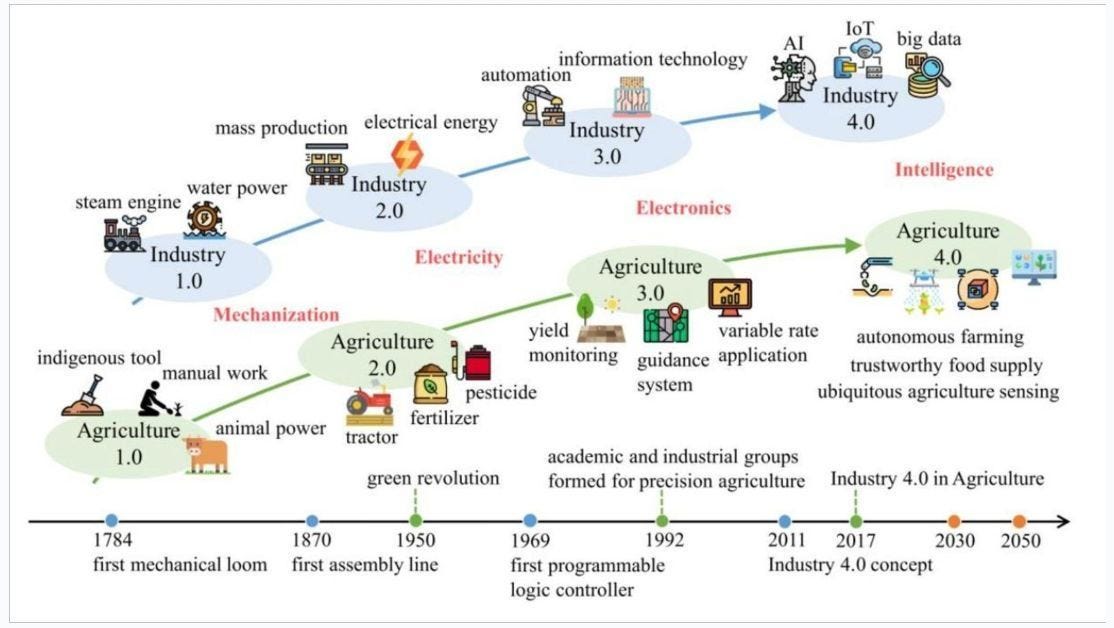

Evolution - If you wish to play chess well, how about figuring out how the game has been changing?

Value Chain - If you wish to play chess well, how about understanding the chessboard, its constraints, and how it has been changing?

Technology - If you wish to continue playing chess well, how about predicting how the game will change?

More details on the course modules are here. You can sign up here (outside India) and here (inside India) if you wish to join us.

Ministry of the Future

01/ Honey, I Insured the Biologicals🧪

Irrespective of which generation of agri-input biologicals you are dealing with, when you are dealing with agri-input biologicals, you are dealing with a multivariate riddle of consistencies.

For you are grappling with consistencies at the product level (vulnerable to degradation and shorter shelf life), performance level (affected by the microbiome of the crop with low knock-down effect), and last, but not least, improper application level requiring deeper understanding of agronomy and crop life cycles.

Can Agri-Insurtech be the perfect partner to weather the consistency challenges of biologicals in a volatile cropping season?

Thanks to climate change, crop insurance is no longer a nice-to-have capability. The ongoing bundling of insurance products with agritech solutions will soon become mainstream.

[ABM Members might want to check the June 23 Townhall when ABM Member Sri Malladi, CoFounder AgriRain shared their experiments in bundling irrigation tech solutions with rain insurance for farmers in India.]

Over the past few years, agri-Insurtech has come of age in India with IRDAI approving agri-insurtech startups like Kshema coming to the fore with several agri-focused product offerings, besides insurance brokers like Digisafe, Gramcover, and many more making deep inroads in a complex crop insurance market environment.

Essentially speaking, in an Indian context, I see three approaches to agri-insurtech in smallholding contexts, depending on whether they are serving loanee farmers and non-loanee farmers.

Loanee farmers are those who have a Crop Loan or Kisan Credit Card (KCC) account for notified crops and are covered compulsorily under the Pradhan Mantri Fasal Bima Yojana (PMFBY). On the other hand, non-loanee farmers are not required to have a loan but can still participate in the scheme if the proposed crop is notified for insurance by the state government. The scheme is compulsory for loanee farmers obtaining Crop Loan/KCC accounts, while it is voluntary for non-loanee farmers who have an insurable interest in the insured cropsOne - The Center and the State [Federal] governments bear over 90 percent of the premium. This naturally distorts incentives. I’m talking about the ‘Pradhan Mantri Fasal Bhima Scheme (PMFBY scheme), which, as per the latest data, ‘enrolled 40 million in 2023-24, an increase of 27% from the 31.5 million enrolled in FY23’.

Two - Niche agri-insurtech players like Kshema are coming up with specific products for non-loanee farmers.

Three - Agritech players are partnering with insurance brokers like Digisafe and Gramcover for loanee farmers.

The recently launched parametric insurance for fish farmers is a case of the third kind with Absolute partnering with DigiSafe Insurance & Assam AgriFin Xamahar Challenge Fund with World Bank funding

Besides PMFBY, I see Kshema designing products for the RWCBIS scheme as well. What is the difference between the PMFBY scheme and the RWCBIS scheme?

The Pradhan Mantri Fasal Bima Yojana (PMFBY) and the Restructured Weather Based Crop Insurance Scheme (RWBCIS) differ in their methodology. PMFBY is based on yields, providing comprehensive insurance coverage against natural risks from pre-sowing to post-harvest, aiming to stabilize farmers' income and encourage adoption of innovative techniques. On the other hand, RWBCIS is a weather index-based scheme that compensates farmers for anticipated crop losses due to adverse weather conditions like rainfall, temperature, wind, and humidity. The key differences lie in the methodology of these schemes, with PMFBY focusing on yield-based insurance while RWBCIS uses weather parameters as proxies for crop yieldsHow do you design painkiller product lines that tame the complexity and alleviate the pain of compliance required in insurance, while providing a smooth customer experience for farmers and agritech players? We will find out soon:)

02/ Down in the Indus Valley🐅

Election Fever and temperatures are on the rise in India. India recently became the fifth-largest economy in the world, overtaking its erstwhile colonizer, and going by bullish estimates, is expected to become the third-largest economy by 2030.

Riding on the India story,

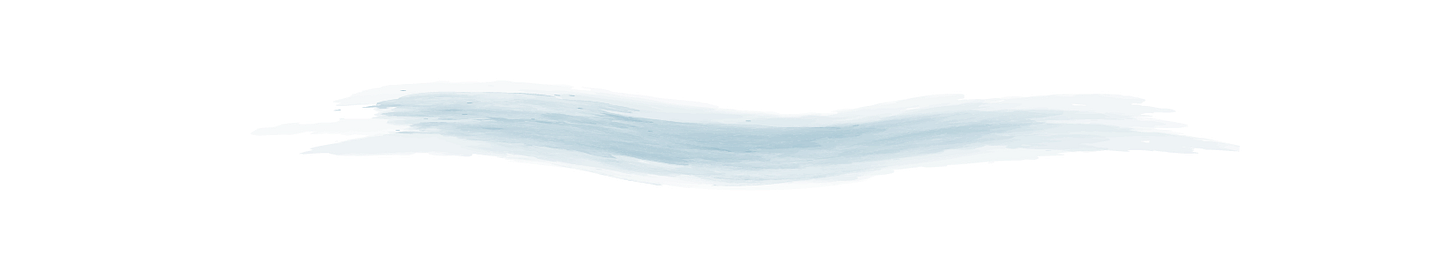

and his team at Blume Ventures have been churning out binge-worthy long-form narratives on the Indian startup ecosystem - with a lovely catch-all moniker ‘Indus Valley’ -and in its third edition, it is no different.Here is a quick summary of the report from Ravishankar Iyer

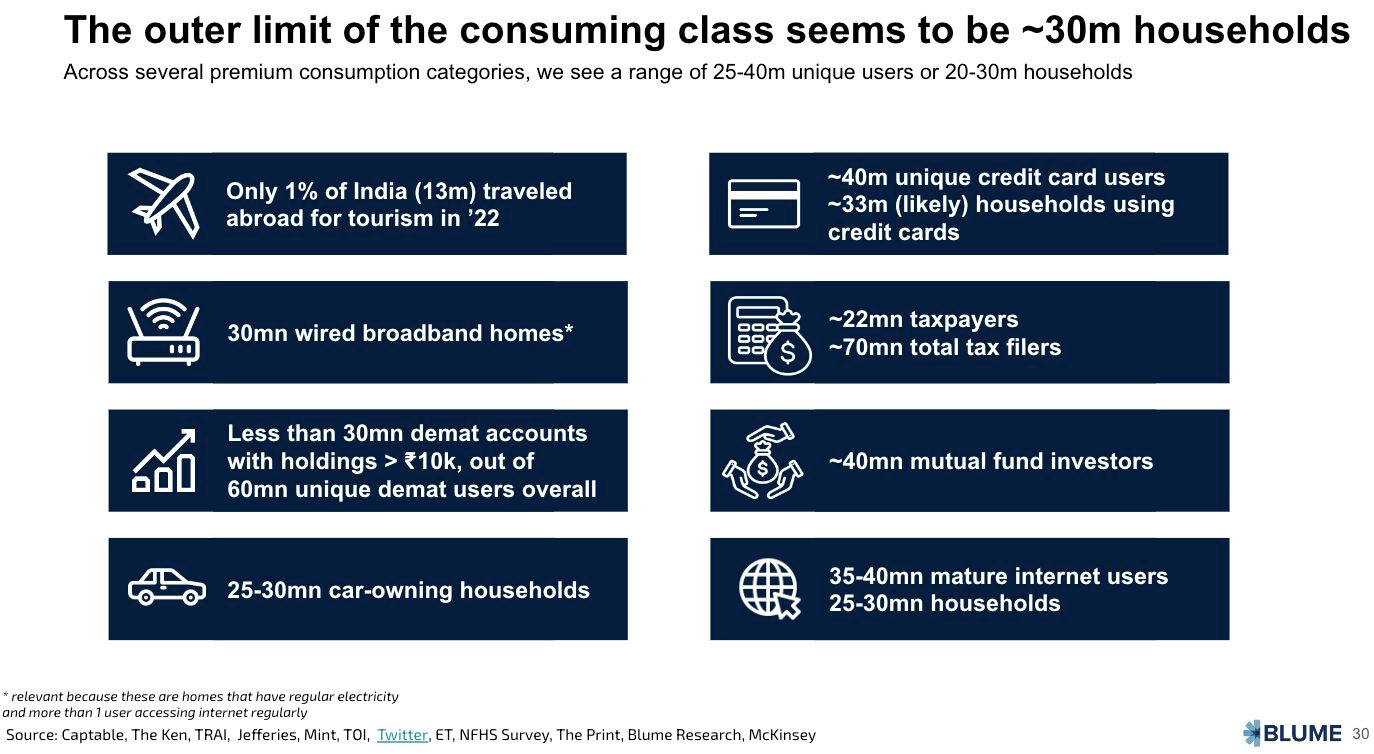

Here is a conspiracy theory that is worth indulging in. Indus Valley Reports is a subversive, data-driven commentary to show how the Indian Economy Story tenuously depends on a tiny sliver of thirty million consuming households and needs to get more inclusive.

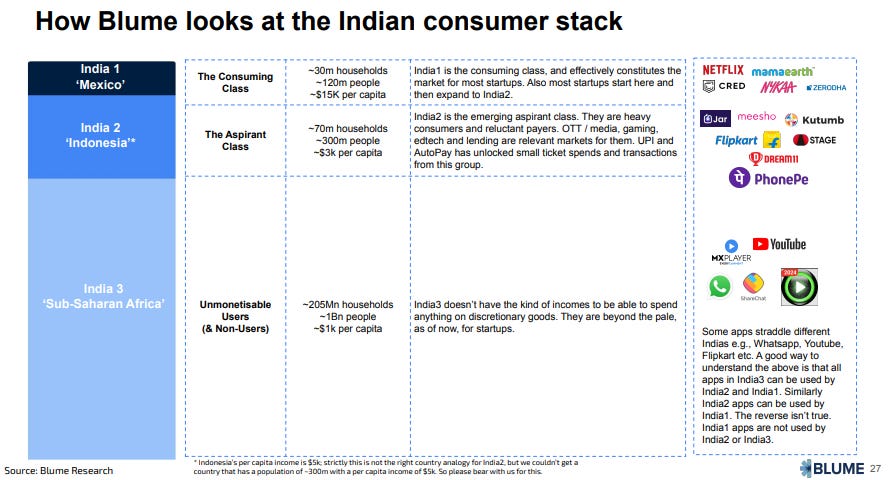

The highlight of the Indus Valley Report is the India123 framework to categorize the many Indias that coexist as one.

And so if you were to see the forest along with trees of data, you could very well reductively sum up the report and conspiracy theory thus:

‘Bharat’ appeared twice and ‘agritech’ went missing in the 2024 Indus Valley report. In the 2023 Indus Valley Report, ‘agritech’ murmured through a lone mention of ‘Waycool’ under B2B e-commerce platforms, and in the 2022 Indus Valley Report, it purred through a lone mention of eNAM under Public Digital Infrastructure.

Although it is tempting to conflate India 3 with rural, going, the truth is that the ‘India1 Consuming class’ and the ‘India2 Aspirant class’ are widespread through rural and urban landscapes. You could find India1 thriving in rural Gujarat as (a classic case study of the Lewis Model at play, Coastal Andhra Pradesh, and in all the blue states. You could find India 2 aspiring in the Red States along with India 3.

Indus Valley Report was launched a few days before the Indian Government announced the results of the Household Consumption Expenditure Survey (HCES) that was conducted from August 2022 to July 2023. Would these numbers change our perspective about India’s Economic story being a tad too dependent on India1? I will have to find out.

As an agritech analyst who dreams of transforming Indian Agriculture in my lifetime, it grates me to say this. Yes, India 3 seems ‘unmonetizable’ from a consumer-focused startup standpoint. If one were to gauge the potential of rural India for Prime Minister Modi’s Vision of Viksit Bharat [Developed India] @ 2047, what would that long-form narrative look like? We will find out soon:)

03/ Indian Farmers’ Missing Brides🥻

Sigmund Freud, in one of his books, talks about understanding the psyche of a city. He says that if you want to understand the psyche of a city, you simply have to go and watch a successful movie running in the city.

If you want to understand where the future of Indian Agriculture is quietly playing out in unevenly distributed terms, you must pay attention to the movies playing out in the western state of Maharashtra. Marathi cinema has always been a trailblazer and this story of a farmer's struggle to find a bride who understands the travails of farming strikes chords at various levels. (hat tip to Varadmurti Patil)

Gregory Bateson, in one of his books, argued that the history of our time can be perceived as a history of malfunctioning relationships. Our relationship with farmers is malfunctioning because we don't understand our bodies and what it takes to grow food that nourishes our bodies.

Farmers' relationship with farming is malfunctioning as the economics of farming is unsustainable amidst pressures to treat farms as factories, further exacerbated by climate change. Farmers are not getting brides for their sons and daughters with the agrarian crisis further accelerating with crop failures and women and their families not ready to embrace rural life.

In the face of extreme uncertainty, faith in the divine is increasing and whenever I go to rural India, I see more marches to temples and jathras and whatnot.

How do we heal these malfunctioning relationships?

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.