Mineralization of Agritech

State of Agritech - 26th July 2024

In Today’s Edition

1/ Indian Farmers and $70 Bn Extinction of Critically Endangered Indian Vultures

Did Indian Farmers and their beloved cows lead to the death of vultures and an unchecked increase in the feral dog population in the country?

2/ Mineralisation of Agritech

Reflecting Over Mineral in the wake of Alphabet winding down Mineral

3/ Ninjacart vs Farmart: 2023 Impact Report Analysis

Will Ninjacart become Farmart before Farmart becomes Ninjacart?

4/ How India Eats and Pays the Price For It

Insights from Bain’s Study, “How India Eats” and Samanvaya’s “Future Nutrition - Understanding our Toxic Transitions”. Why India’s Food Services Market is much more exciting than the Food Delivery Market? What are the unintended consequences?

5/ South Indian Farmers Embrace Tobacco

Is the large-scale failure of cotton production in India forcing farmers to shift towards paddy in the north and tobacco towards the south?

6/ Glimpses from the recent Coimbatore Agripreneurs Meet

7/ Pondering over the vision of Agribusiness Matters

1/ Indian Farmers and $70 Bn Extinction of Critically Endangered Indian Vultures

Did Indian Farmers and their beloved cows lead to the death of vultures and an unchecked increase in the feral dog population in the country?

In 1993, when the generic drug for the nonsteroidal anti-inflammatory drug diclofenac was approved in India, prices became dirt plastic cheap and Indian farmers started using them indiscriminately for their ageing cows to make sure that they remained active.

In a country like India with the world's largest cattle population (>538 Million), we have abysmally poor veterinary infrastructure. One recent data study states that 3,000 veterinarians graduate from 54 veterinary colleges each year. Organic Farming Poster Girl state Sikkim has the highest ratio with around 2 veterinarians per 10,000 people. Most states have between 0.5 to 1 veterinarian per 10,000 population.

“The biggest issue is the lack of a clear structure of veterinary and para-veterinary professionals. This leads to misallocated personnel management and poor conception of staffing for veterinary care. Alongside this, of course we produce a paltry number of veterinary professionals and fund veterinary care wholly inadequately both in urban and rural livestock settings.” - Arvind Badrinarayanan, veterinarian turned healthtech entrepreneur

So what will the farmers do?

They hunt for cheaper options to manage their cows. When word spread around that diclofenac does a reasonable job as a painkiller in treating udder and hoof pain, it began to be widely used.

Since Indian culture frowns upon cow slaughter and there are many challenges in managing older cows that are not fit enough for fodder, you could probably empathise with the farmer's intent to help his beloved cow.

What did this lead to?

"The first documented case of diclofenac use in India is dated to 1994, by 1996 half of Keoladeo National Park’s vultures were dead. By 1999 not a single one was left."- Stone Age Herbalist

Vultures are keystone species and perform important ecological services, including controlling the population of other scavengers such as feral dogs that can transmit rabies.

They are designed to eat corpses, but not those full of diclofenac.

“..Dairy cooperatives and rural distributors make certain drugs available for rural farmers to use, diclofenac was incredibly useful because of its cost factor, which is hugely important when looking at drugs for cows (because dosage is calculated on a weight basis), in fact a replacement for diclofenac for livestock has yet to be found in terms of pricing and there is a huge amount of suffering among farmers and livestock animals as a result” - Arvind Badrinarayanan, Veterinarian turned entrepreneur

One recent study shows that about 70% of the population disappeared within a decade. Although India formally banned diclofenac for animals in 2006, I won't be surprised If it is still being used.

“Before 1994, human death rates in districts surveyed averaged about 0.9% per 1000 people, a baseline that accounted for whether there were a lot of vultures in a particular district. But by the end of 2005, areas that were traditionally home to large number of vultures saw a 4.7% hike in human death rates on average, or roughly 104,386 additional deaths per year. Meanwhile, death rates in those districts that weren’t the typical homes of vultures remained stable at 0.9%.

To calculate monetary damages, the team relied on previous research that calculated the economic value of what Indian society is willing to spend to save one life at roughly $665,000 a person. That put the total economic damages from the loss of vulture populations at $69.4 billion a year from 2000 to 2005 - Vivian La in Science on India’s Vulture Crisis

The story doesn't end here.

When the vulture population collapses, somebody has to eat the cows' corpses which end up in landfills and waterways, further spreading the disease. Who will that be? Do you have any guesses as to why we hear more cases of feral dog attacks across India?

"One study estimated that the feral dog population increased by an additional 5.5 million as the vultures vanished, which led to 35.5 million additional dog bites - 47,300 deaths from rabies - between 1992 and 2006. All this at the cost of around $34 billion." - Grey Goose Chronicles

Rajeshwaran Selvarajan has been writing extensively on India's livestock predicament and I recently learned that the industry doesn't have a clear framework on animal health.

“Animal health is not limited to disease control or treatment of sick animals at a high cost. Unfortunately, even the World Organisation for Animal Health does not realize it and emphasizes only tackling communicable diseases. - Rajeshwaran Selvaraj

Startups like Faunatech are addressing this infrastructure gap by offering diagnostic and screening products for subclinical mastitis, besides a variety of players like Dr. Pashu offering telemedicine support

Given the critical importance of livestock in India and how it impacts human health, can we step up to build a strong infrastructure of animal health professionals in this country?

2/ Mineralisation of Agritech

When I read Elliott Grant’s non-obituarish take on Alphabet winding down Mineral, it left me with mixed emotions.

“In soil science, mineralization is the process by which the nutrients in organic matter are released in a form that makes them available to the plants around them. I think this is a fitting metaphor for the new chapter of Mineral - as our technologies will be mobilized into the agriculture ecosystem, with the goal of making it more sustainable, and more resilient.” - Elliott Grant

Perhaps, it is my need to expect Elliott to introspect on their failed attempt to figure out a business model for Mineral that went beyond licensing their technologies to agribusinesses.

It would be a convenient case of narrative bias to read my 2021 deep dive on Mineral.ai (Part 1, Part 2) from the lens of their 2024 winding down. In my deep dive, I sketched out their product principles to spell out their product trade-offs: no last-mile problems; no b2c; no vertical integration; no physical equipment products

→ Thou shall stay away from last-mile problems. Let them be the concern of our partners who will work on the ground with farmers and retailers and other players in the last mile of the value chain.

→ Thou shall not build separate products for different players in the industry. In working with the partners, we will learn how to build models that let us absorb the complexity of the plant world and convert them into repeatable technologies.

→ In learning how to build models for the complexity of agriculture, thou shall model the distributions of the data and model the dependencies in those data, mimic them as much as possible into a model that we can sample afterwards, from which we can derive newer data sets. (Check this for a detailed illustration of this point)

Mineral’s transition towards mineralisation of agritech shows the immanent challenge of differentiating agritech startups in the Global North (read as thin markets) purely based on technology.

Sadly, Mineral left too soon without fulfilling the promises many of us hoped for - an ag-centric LLM or a digital twin platform that could scale within their product trade-off constraints.

While it was sad to see the number of patents they had (something I learned from Shane’s take), I am not quite sure how licensing of technologies would play out without teams to support in the first place.

As Shane rightly points out, to see how licensing could play out in Ag, you could go back to Intel of the 90s era or perhaps consider a more modern equivalent.

As I wrote in my in-depth analysis of InnerPlant for paid subscribers of this newsletter:

“The post-Monsanto era of genetically engineered seeds and microbes is already here - It’s just not evenly distributed.

If you are a kid of the nineties, you would have heard the phrase, “Intel Inside”. It was a popular phrase to point out the simple fact that the computer had Intel processors as an infrastructure element inside CPUs. If things go as per plan, we can expect a similar magnitude of infrastructure with “InnerPlant Inside”. Is that why this was called InnerPlant?

What makes InnerPlant “Modality” type of agribiotech platforms is the fact that their competitive edge lies in their ability to generate genetically engineered crops that can communicate their stresses through sensors and orchestrate various partnerships required for farming operations to improve farmers’ yields.”

They raised $30 Mn in a Series B round a few hours ago.

It’s one thing to speculate alternative licensing futures of Mineral. Without a culture of outsourcing/contracting/ fundamental R&D that goes into the technologies among the Big Ag players, it would have been impossible for Mineral to pursue this route.

And so we come back to square one - Can an agritech player survive with a pure-blood technological identity without becoming a traditional ag business (read as vertical integration) or an equipment manufacturer?

Many moons ago, Rhishi Pethe wrote an interesting blog that made an interesting point that the world comprises two teams - those good at agronomy and those good at software, ML/AI tools and infrastructure.

What would it take to break this duality?

3/ Ninjacart vs Farmart: 2023 Impact Report Analysis

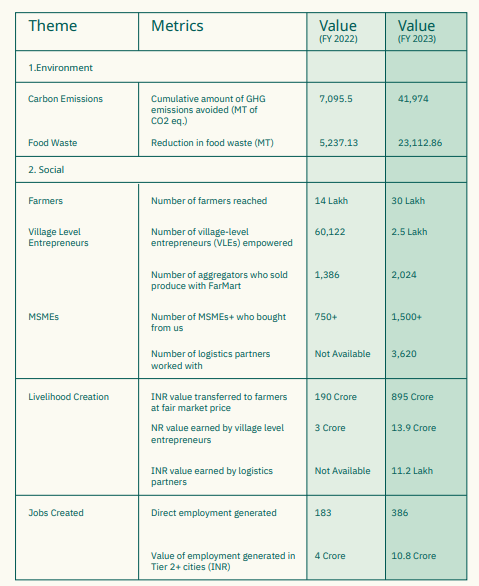

When I reviewed the 2023 impact reports of Ninjacart and Farmart, it became an interesting exercise of contrasts.

Ninjacart’s atomic unit of change is an interesting, albeit vague phraseology-agri-citizen -including farmers, traders, importers, exporters, enterprises, and retailers-which conflates farmers with farming stakeholders

Farmart’s theory of change centers around the Good Food Economy which, thankfully, makes the distinction between farmers and traders clear. “Good Food Economy” is a fairly crowded positioning hanger, with multiple stakeholders, including 24 Letter mantra organic, staking claim to it.

Ninjacart’s Impact Metrics, even if they seem vague- what does quality of life mean in context with Ninjacart? How is trust measured through behaviours? How is accessibility measured? - stand clear ground in conveying their focus towards traders and retailers, highlighting their credit offerings subtly without spelling them explicitly.

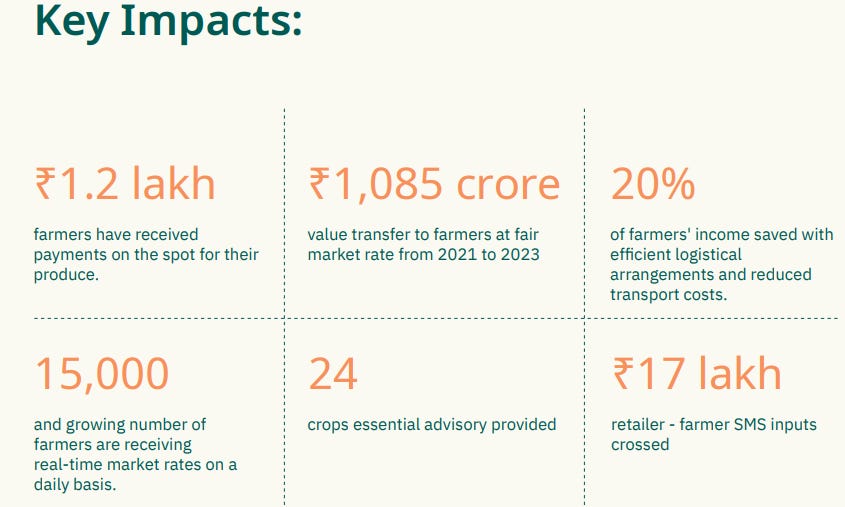

Farmart’s Impact Metrics seem better aligned with their theory of change. It focuses more on the production side of things, especially with crop advisory and farmer-retailer linkages.

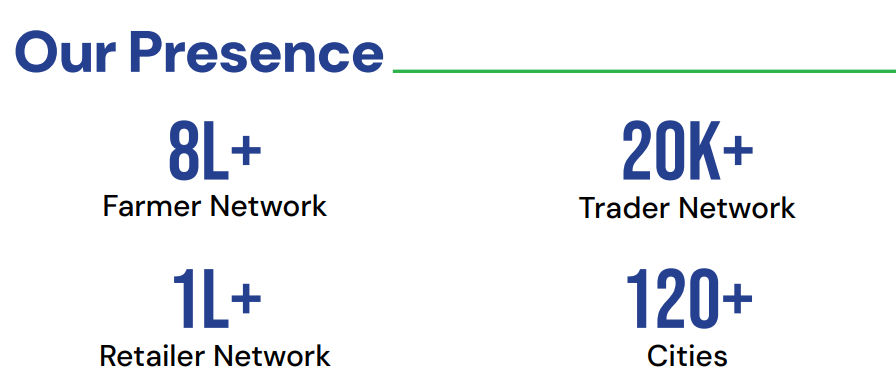

Given the history of its pivots, Ninjacart doesn’t highlight the role of aggregator/VLE and is content to showcase its presence through farmers, traders, retailers and cities.

In contrast, given the history of its pivots, Farmart focuses on Village-Level aggregators, essentially comprising the intermediary ecosystem that bridges farmers to the markets.

Given how Farmart defines Aggregators here through “quality of life” measured further via “time savings” and 16 crore INR worth of additional income generated, you could argue that Ninjacart’s “Agri-citizens” are the equivalent of Farmart’s Village-Level Entrepreneurs.

In contrast to one single community app approach by Farmart, Ninjacart talks briefly of its constellation of app ecosystem on a player-player basis.

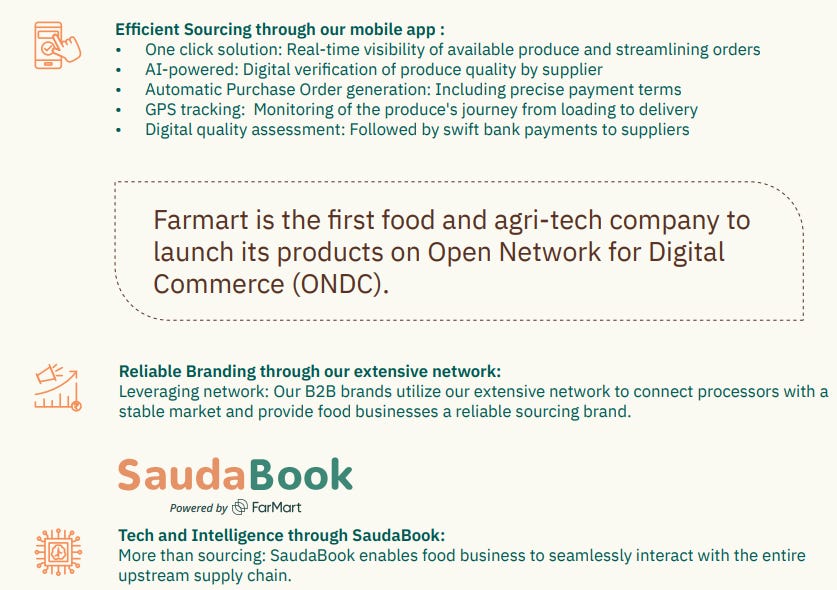

Farmart’s focus thankfully goes into the devil’s details operational side of their platform, focusing on the challenges involved in sourcing, besides announcing their presence in ONDC.

Farmart Impact talks further on logistics efficiency (prompt payment assurance, quality rejection solutions, labour disruption resolution, congestion-free unloading and payment), sustainability through optimizing storage, minimizing storage and curbing wastage and jobs created across Tier-2 and Tier-3 cities

Given that their Impact 2023 report was published before Farmart announced their latest round of debt funding from ResponsAbility Investments, the dots connect back in hindsight with a stronger focus on the ESG side of things.

While I would have loved to see far more granular detail in the Impact reporting of Ninjacart, there is a particular reason why I feel tempted to juxtapose the impact reports of Ninjacart and Farmart.

Will Ninjacart become Farmart before Farmart becomes Ninjacart?

In bearish storms of the market which survives by ruthless optimisation of assets and resources, can we expect the two to combine the twine that shall never meet - the north (Farmart) and south (Ninjacart) -and aim for a bigger pie of the puzzle?

Diligent readers of Agribusiness Matters would know that I have argued against this, given the complexity of the Indian market. Who knows? Perhaps, with the right operating environment, I have a hunch this could very well happen.

I am happy to be proven wrong though.:)

4/ How India Eats and Pays the Price For It

I found Bain’s Study, “How India Eats” deeply fascinating for two reasons.

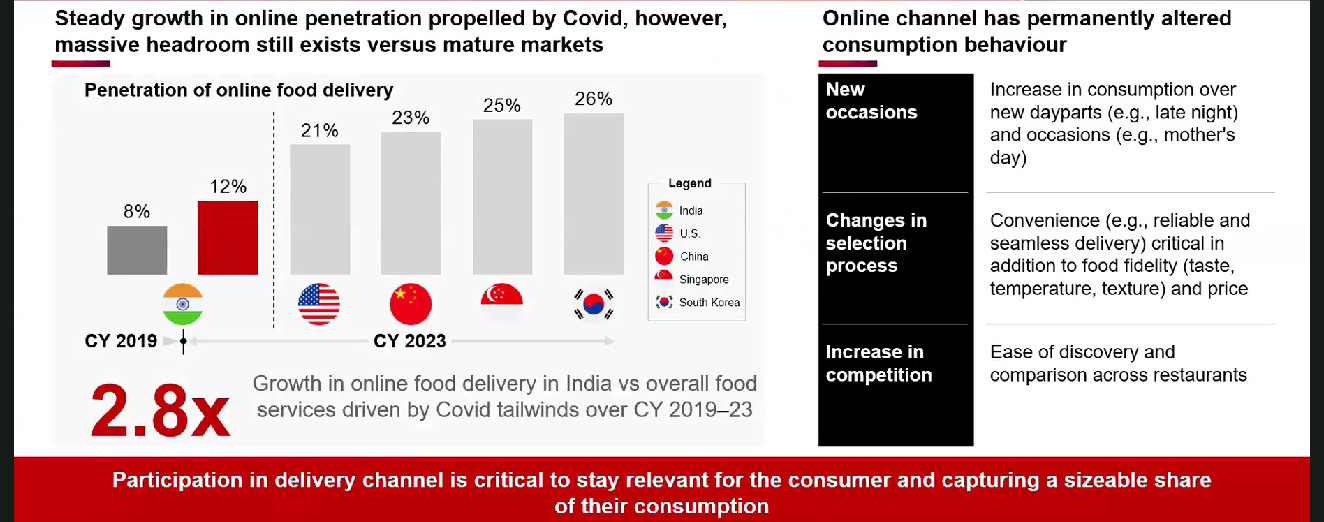

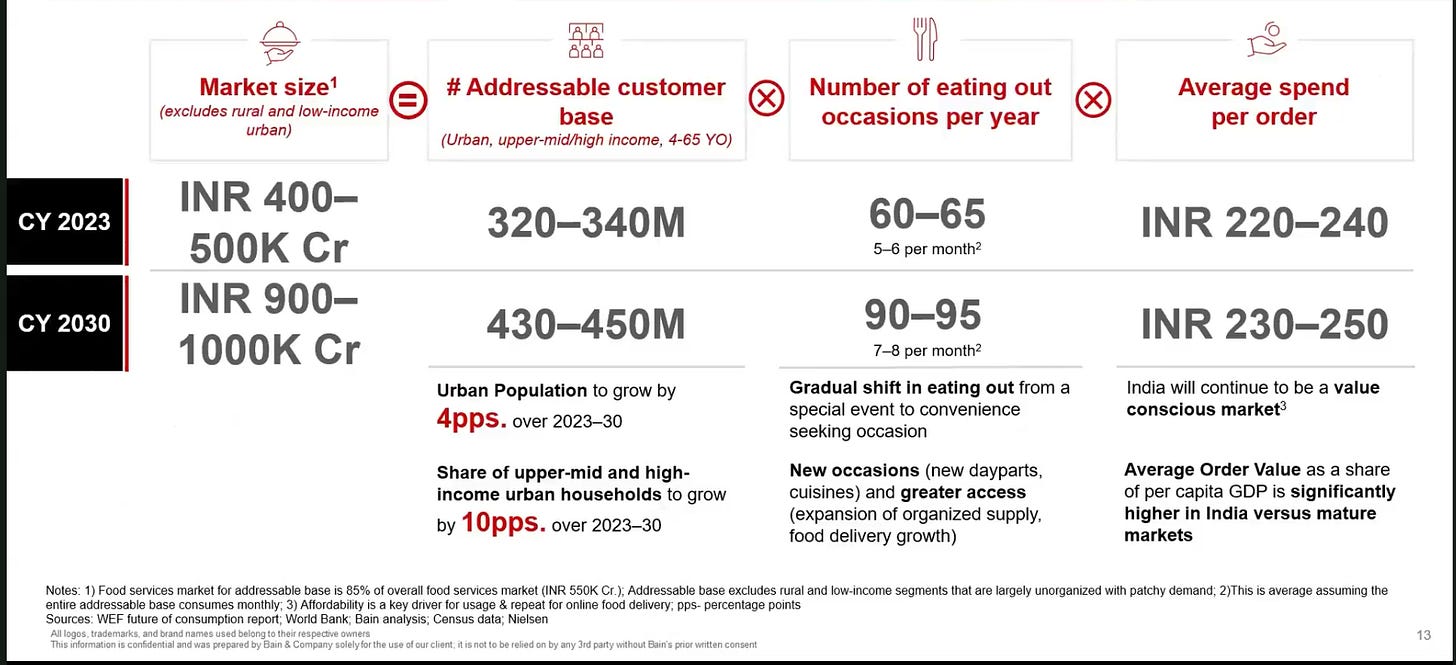

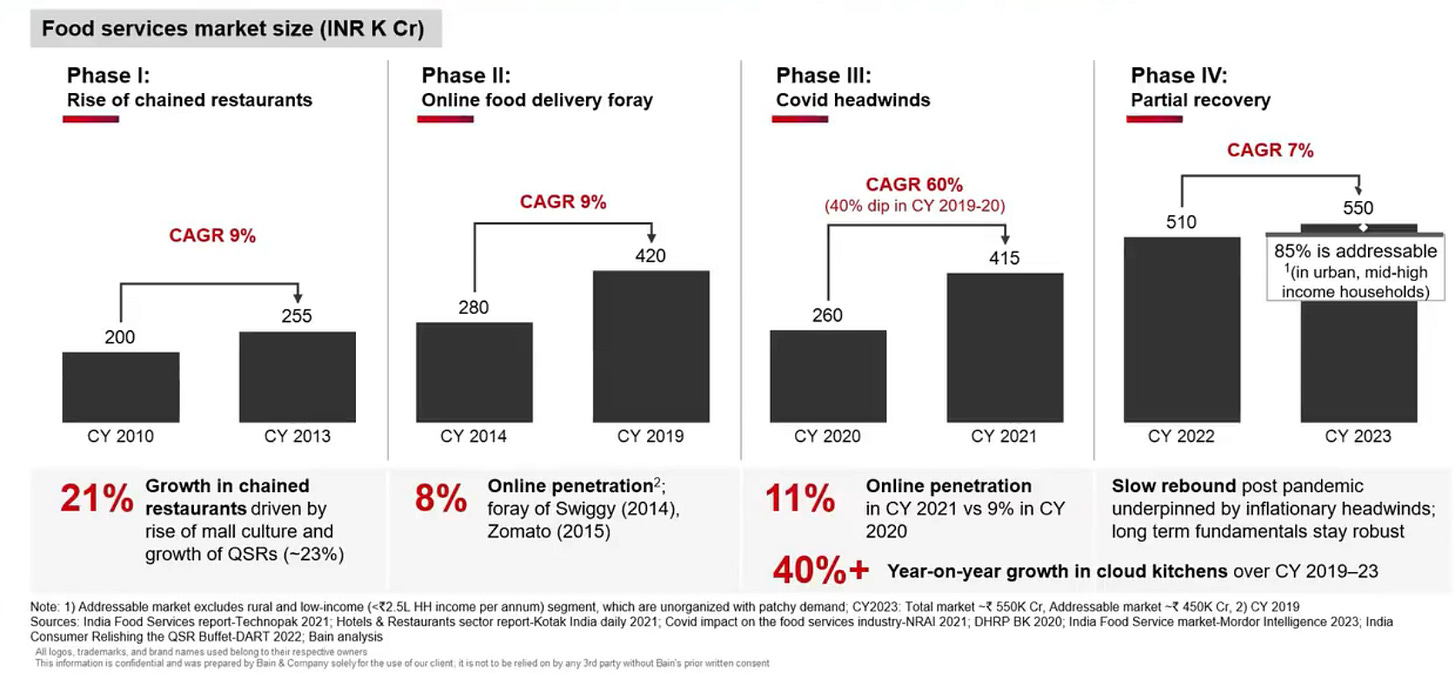

India’s food services market (550 K crore market)) could get much more exciting than the food delivery market and D2C food brand gameplays. It helped that Cloud Kitchen grew by 40% year-on-year from 2019-2023 and QSR and Cloud Kitchen are expected to grow at 1.4X (1.4 X Food Services market) by 2030

It shows, quite unintentionally, how the burgeoning growth of India’s food services market could correlate with the price Indians are starting to pay for their health.

Before we talk about the Faustian bargain, let’s first talk through the nice things.

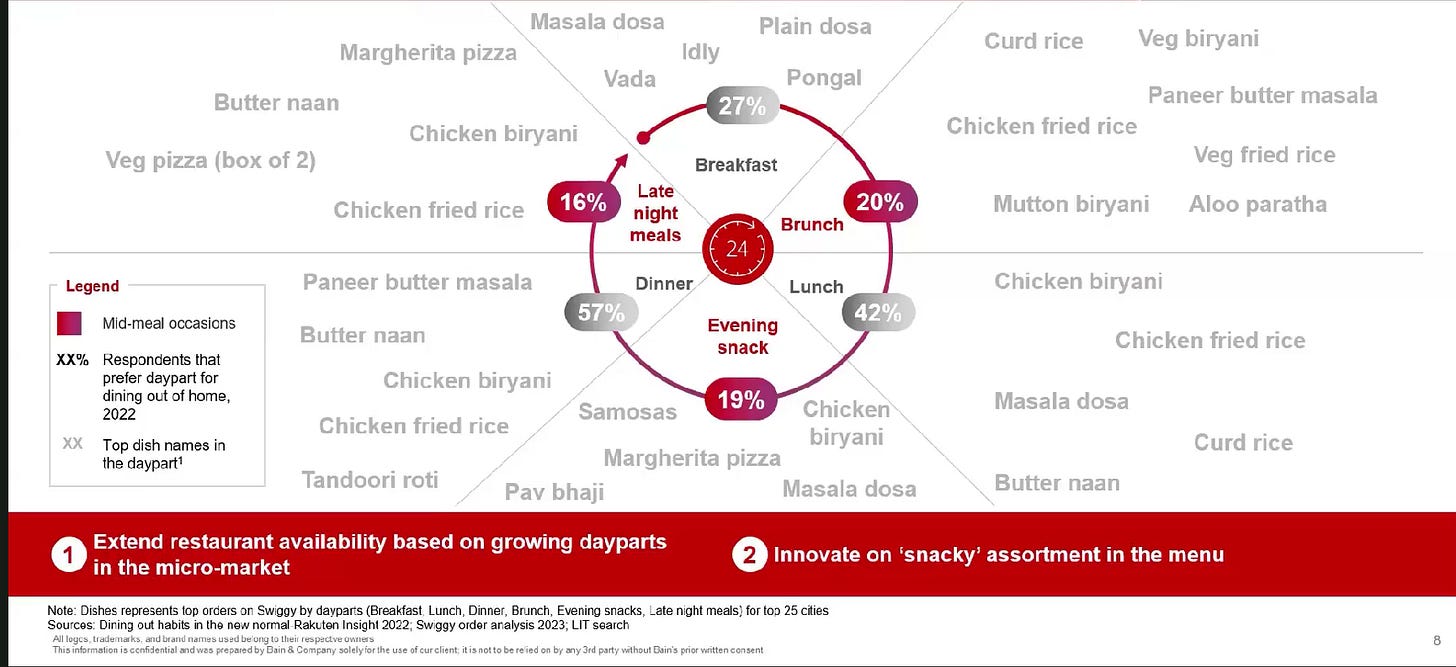

The food services market (with 105 consumption occasions in a month, as the study points out) received a turbo-boost demand from India’s upper-middle and higher-income segments, residing in the top 50 cities, predominantly dominated by GenZ and the younger population. If you want to understand the economics of variety at play in the food services market, look no further.

Online food delivery has triggered this massive behavioural change, and if we benchmark this growth against global peers, it clearly shows the headroom left when these markets mature.

Number of non-home-cooked meals consumed monthly per addressable consumer as of Oct’2023? China:33 // India 5

Why is food services much more exciting than food delivery?

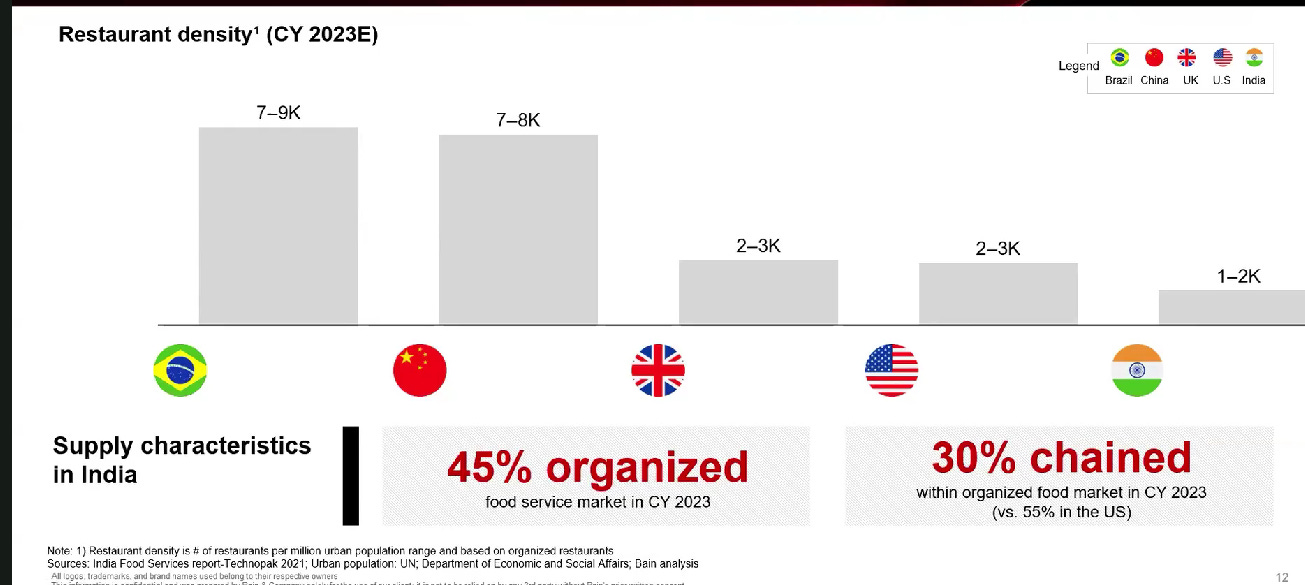

An increase in food services could lead to exponential growth in restaurant supply, which could further lead to exponential growth in compositional food service players like WynBrands

I recently spoke to WynBrands Founder and realised that we don’t talk as much about food services, leaving aside, compositional food-service players, as opposed to D2C food brands.

What does Wynbrands do?

“Wynbrands enables Q commerce for food operators applying Mise-En-Place (putting in place) principles across traceable sourcing, bakery and food products preparation, shelf life alignment using packaging & temperature, storage, mid and last-mile delivery to outlets, cloud kitchen, commissaries and warehouses.”

As you can see, this compositional food services play is one layer below cloud kitchens and is expected to grow as cloud kitchens grow.

When the food services market grows by 10-12% over the next six to seven years, what kind of unintentional consequences would we be dealing with?

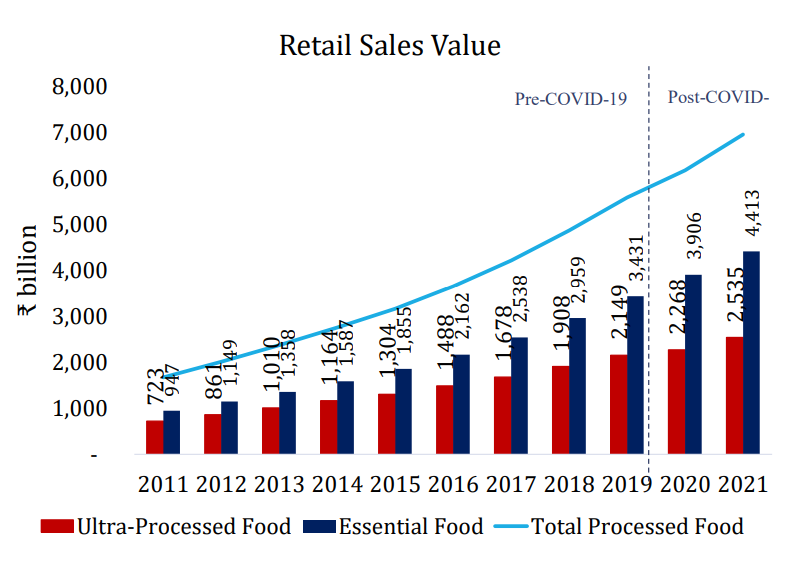

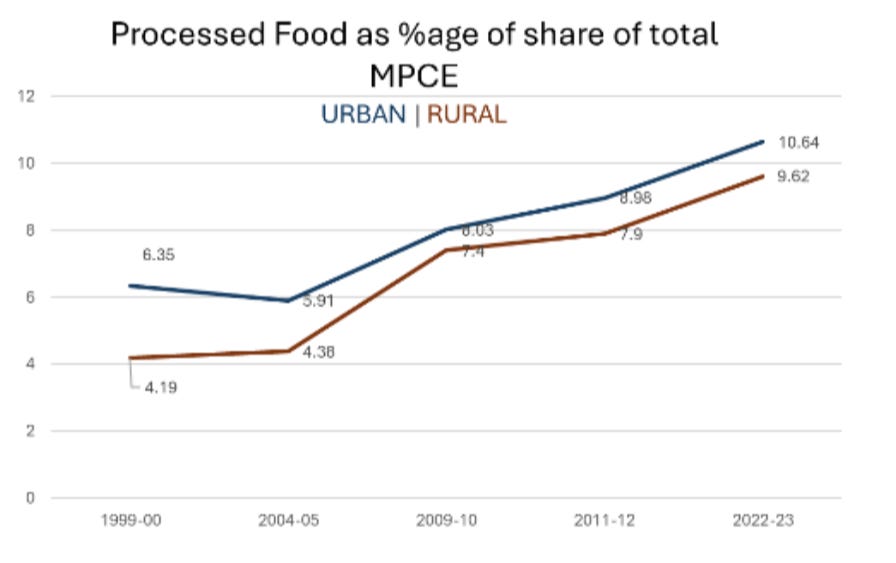

Did the burgeoning growth of the Food Services Market accelerate the sale of ultra-processed foods, which grew at a CAGR of 13.37% in retail sales value between 2011 and 2021?

Changing restaurant behaviours could have a strong correlation with ultra-processed foods’ growth. Both in the case of food services and ultra-processed foods, you could see the post-covid behaviour shift drastically from pre-covid.

So what have been the broader unintended consequences of the way India Eats

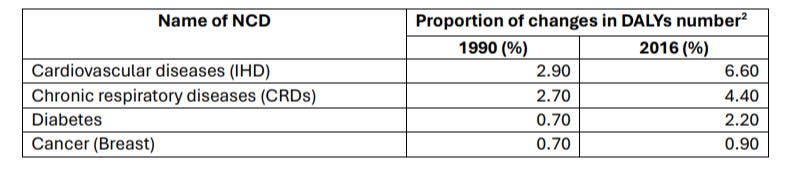

Between 1990 and 2016, the death rate due to non-communicable diseases has grown from 37.9% to 61.8%

The rise in Ultra-processed foods has resulted in the weakening of the essential staples food market, leaving “the producers and conventional traders..squeezed out of the markets.”

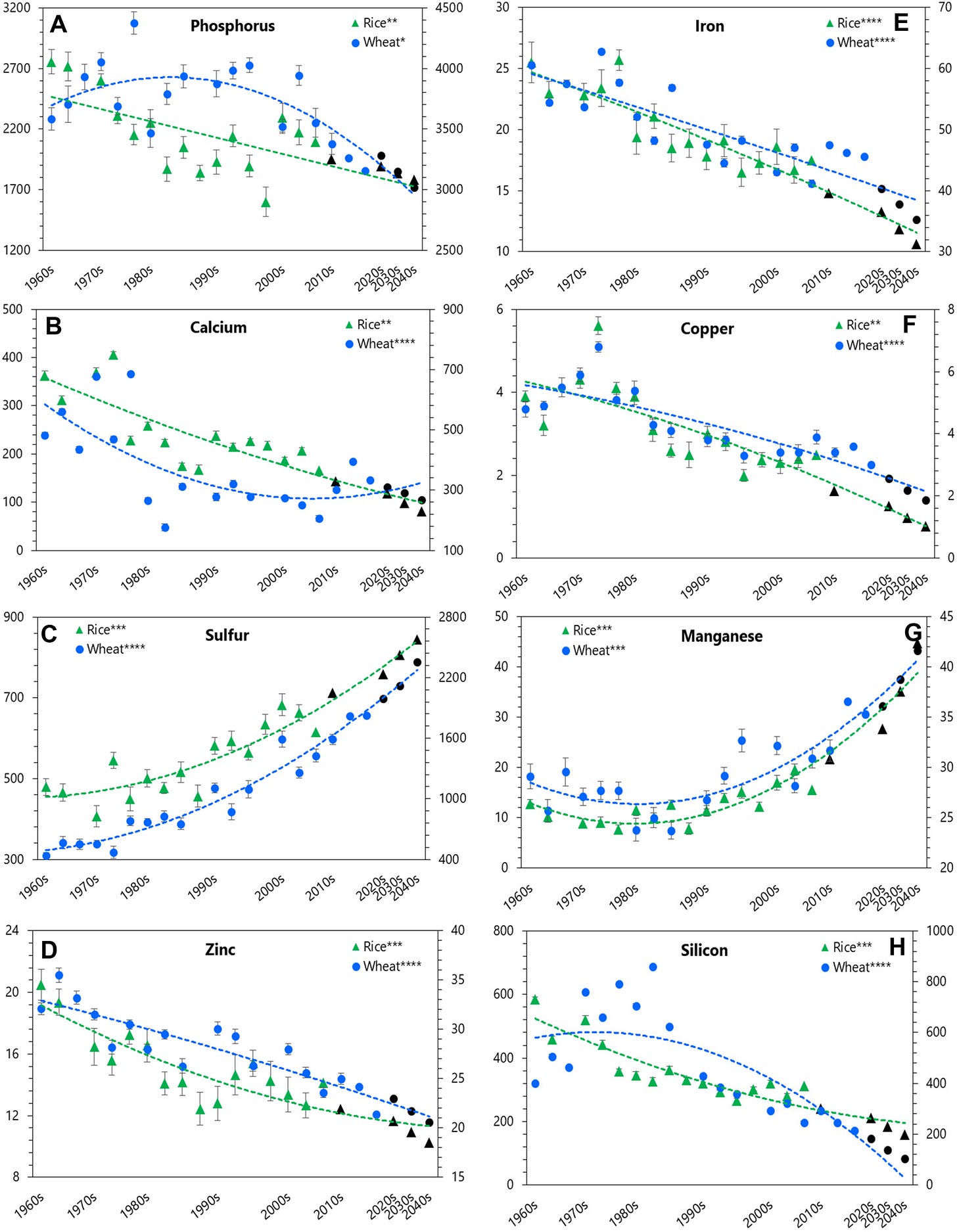

Essential Staples have lost their nutrient profiles, leading “to a downward trend in concentrations of essential and beneficial elements, but an upward in toxic elements in past 50 years in both rice and wheat”.

Following Europe, Singapore has already placed restrictions on Ultra-Processed Foods. India is the last country to follow this top-down diktat approach and even if it does, it is guaranteed to fail.

How else would India regulate ultra-processed foods? How about culture?

5/ South Indian Farmers Embrace Tobacco

Few weeks ago, the Tobacco board organised an important conference for tobacco farmers in the southern city of Hyderabad, India. The meeting was chaired by the Union Minister for Commerce and Industry, Piyush Goyal

“Addressing the gathering, he expressed satisfaction for realisation of record high price for the flue cured Virginia tobacco by the farmers as well as record high export performance for the Indian tobacco for FY 2023-24. He shared that as on June 27, an average price of Rs 269.91 per kg has been realized by the farmers for the sale of 112.35 million kg of FCV tobacco in electronic auctions conducted by the Tobacco Board. He also informed that the export value of unmanufactured tobacco and its products surpassed all the earlier records at Rs 120,05.80 crore (USD 1449.50 million). This is higher by 11.3 per cent in rupee terms and 19.5 per cent in dollar terms.” (Source)

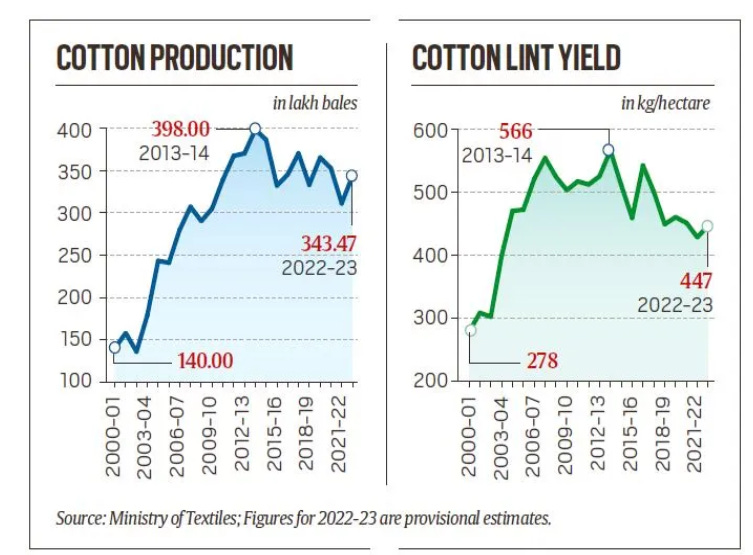

The fundamental question driving these developments is this: Is the large-scale failure of cotton production in India forcing farmers to shift towards paddy in the north and tobacco towards the south?

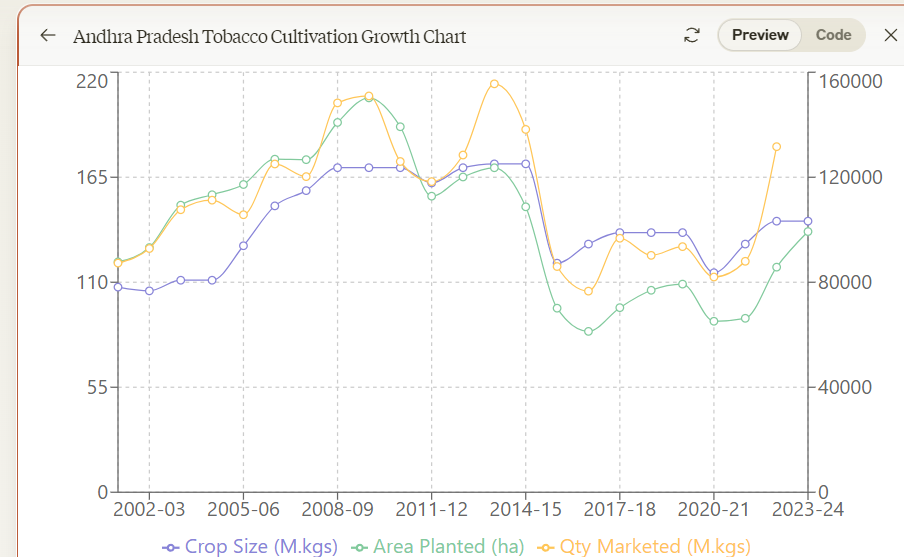

The data from the Tobacco Board seems to validate this anecdotal ground-level observation

Crop Size: There was a general upward trend from 2001-02 to 2013-14, with the crop size increasing from around 107 million kg to 172 million kg. After 2014-15, there was a significant drop, followed by fluctuations, with the most recent years showing a recovery to 142 million kg.

Area Planted: The area planted shows more variability. It peaked around 2009-10 at about 150,000 hectares, then experienced a sharp decline until 2016-17. Recent years show a recovery trend, with 2023-24 reaching about 99,000 hectares.

Quantity Marketed: This metric closely follows the crop size trend but with more pronounced peaks and valleys. The highest point was in 2013-14 at about 214 million kg, followed by a significant drop. Recent years show a recovery, with 2022-23 reaching about 181 million kg.

Much like other value chains, the market is ready for premiums with residue-free tobacco leaves of the highest quality and the export market is such that companies like ITC are willing to get into forward contracts with farmers.

I also don’t have a framework to evaluate tobacco farming. How to make sense of tobacco farming? Will dig further into this in the coming weeks.

6/ Glimpses from the recent Coimbatore Agripreneurs Meet

Wherever my work takes me, I have gotten into the habit of organizing agripreneue meetups. The Coimbatore Agripreneurs meet was a blast. So much so that I forgot to click pictures, save this incomplete one with many outside the frame.

We had around 16 folks who showed up from places as far as Tanjore and IIT Palakkad.

Senthil Kumar, Santhosh Murthi and Kaarthik S 🌴🥥 gave a master class on the coconut supply chain. Given how much coconut plays a vital role in this ecosystem, it was fascinating to hear so many field stories and how this ecosystem is evolving. Karthik and Santhosh shared fascinating local gossip and it was wonderful to hear Karthik share his Instagram success story in building 60k followers with content focused on the coconut supply chain. Senthil shared a nuanced take on the evolution of the coconut from his rich journey in the agribusiness world.

Selva Kumar A brought the investor perspective and shared his rich experiences from his portfolio and also in building the papaya supply chain and hear more on the complexity in building the papaya supply chain. I also got to visit his coconut farm in Pollachi and hope to do more agripreneur events with the support of agripreneurs in this fascinating Kongunaadu ecosystem.

Venu Gopal shared his work in building solarisation infrastructure for improving the livelihoods of tribal regions of tamizh Nadu. There is tremendous potential in scaling sun-dried processing infrastructure in tribal regions across the country.

Balaji A shared his perspectives on volunteering for agribusiness Tamil and traceability work happening in SourceTrace.

Pavalan A.A shared the challenges in growing traditional rice varieties in natural farming methods and shared his experiments in growing coconut in the delta belts.

Sreehari V shared the fascinating work happening in IIT Palakkad in building a dedicated agritech centre and it became a good ground for synergy building, given the institute's focus on building agritech infrastructure that could scale in collaboration with agribusinesses.

Vasanth Murugesan gave a fascinating peek into how they are integrating tech and crop biology and the conversation helped me catch up with some of the fascinating developments in this realm. It was fascinating to hear Vasanth's story in agripreneurship starting from natural farming all the way up to indoor farming.

Sathes Kumar Kanagaraj shared a researcher's perspective in addressing the evidence gap of natural farming and the data he is collecting for Indian policy contexts that are now inclining more towards natural farming.

For an event announced at the last minute, I was amazed by how this group came together and hope to do more such events on a larger scale in the wondrous Kongunaadu ecosystem.

7/ Pondering Over the Vision of Agribusiness Matters

A friend shared this video and it deeply moved me. Strange as it may sound, this 32-sec video could largely sum up my vision in building Agribusiness Matters

Can the undistorted, pure perception of the changes happening in the world of food and agriculture transform the food and agriculture systems in the wake of runaway Climate change?

Yes, it's a grand vision, perhaps.

But I don't think anything lesser than this is worth the effort, given the urgency we are in transitioning from a broken food and agriculture system that neither serves us, farmers and consumers nor, the planet.

How happy are you with today’s edition?

I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.

As always, super insightful stuff, Venky.. Thanks for sharing..