Saturday Sprouting Reads (Agrifintech Patterns, Growpital, Agritech - Development Death Cycle)

Dear Friends,

Greetings from Hyderabad, India! Welcome to Saturday Sprouting Reads!

About Sprouting Reads

If you've ever grown food in your kitchen garden like me, sooner than later, you would realize the importance of letting seeds germinate. As much as I would like to include sprouting as an essential process for the raw foods that my body loves to experiment with, I am keen to see how this mindful practice could be adapted to the food that my mind consumes.

You see, comprehension is as much biological as digestion is.

And so, once in a while, I want to look at a bunch of articles or reports closely and chew over them. I may or may not have a long-form narrative take on it, but I want to meditate slowly on them so that those among you who are deeply thinking about agriculture can ruminate on them as slowly as wise cows do. Who knows? Perhaps, you may end up seeing them differently.

{Subscriber-Only}How to Map Agrifintech Patterns?

There are two ways to map patterns of agrifintech and categorize agri-fintech players

1) Categorize agrifintech players based on a linear process of A) Discovery enablement (both from the buyer and seller perspective) followed by B) Transaction Flow (Escrow Service, Credit Profile Generation) followed by C) Financial Services (Rolling Credit Line, Credit Integration with Payments)

2) Categorize agrifintech players based on lending structures

Doing 1 is a hair-splitting exercise as today most of the players either start one of the three (among A, B, C) and attempt to complete the remaining dots.

To wrap my head around each of these various agritech players’ agrifintech gameplay, I started mapping them around their lending structures, alongside Marketplace and Embedded Finance approaches.

Of course, this list is not exhaustive and I will soon realize how limited this framework this:)

More details about the implications of the agrifintech gameplay and the emerging agrifintech ecosystem in a recent edition of Agribusiness Matters.

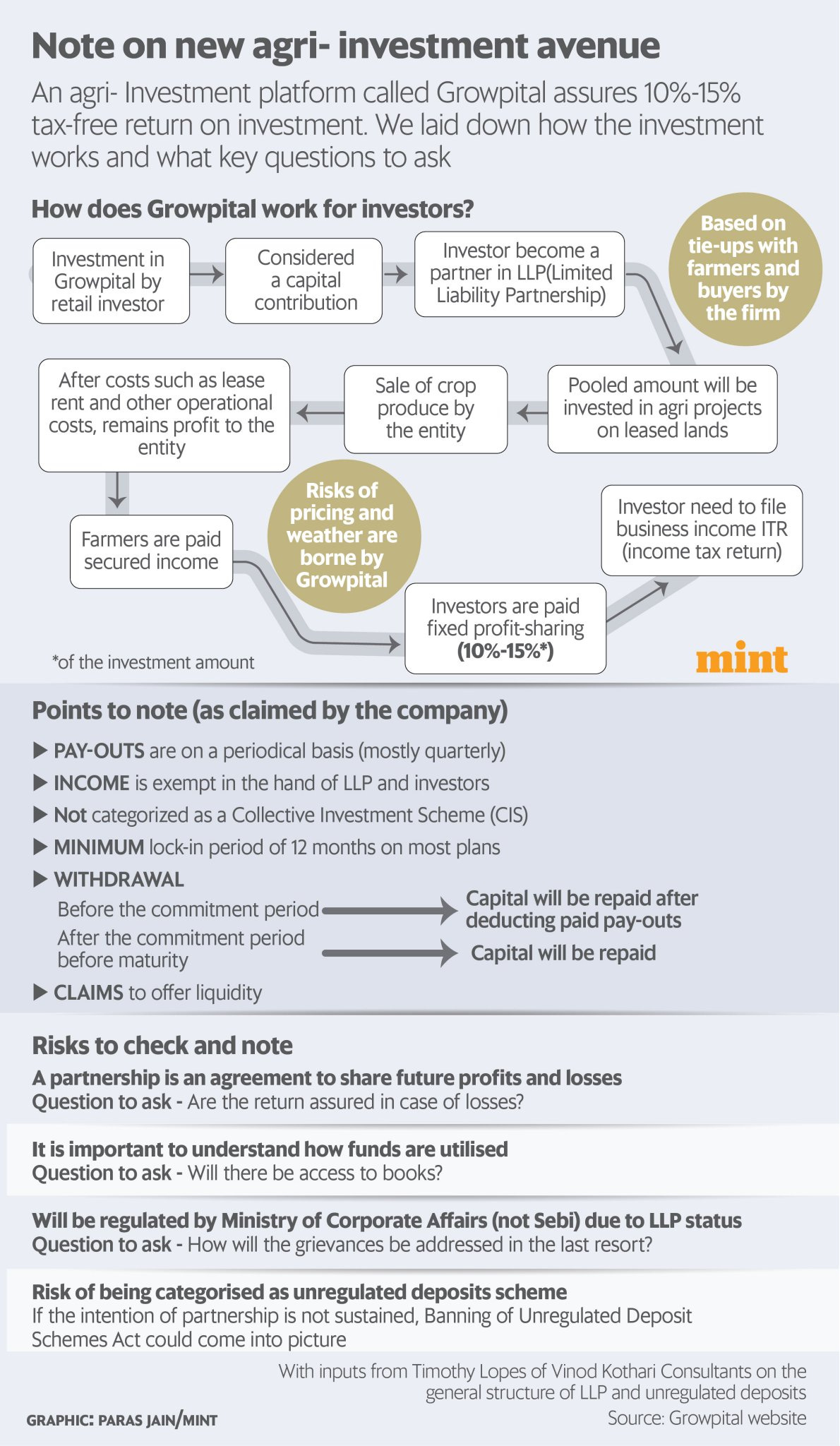

{Subscriber-Only Post}Will Growpital move past its regulatory arbitrage model?

In light of the recent LiveMint media spotlight on Growpital’s agri-investment model, will Growpital move past its regulatory arbitrage model? Or would the regulatory climate eventually evolve to regulate the emerging agri-investment tech players? How is Growpital different from other agri-investment tech players in Africa?

When you connect the dots between agri-investment tech players like Growpital leasing lands to run their corporate farming operations and the policy need for taxation of agricultural income in India (Non-Indian readers must be rolling their heads in disbelief, I suppose:)), you will discover the power of second-order effects in a complex domain like agriculture.

If you think about it, agri-investment tech is based on an audacious premise: Can we create a native mutual funds approach in agriculture with digital farming systems helping us keep track of how our investments are faring and braving the volatility of the climate?

Thanks to astute readers of this blog, what is fascinating to observe is how this agri-investment model is similar to emerging investment models in real estate. Much like REIT, we are talking of fractional property ownership and how the company will build the asset with the money of the investors and pay dividends in the form of shares of profits and capital appreciation.

The crucial distinction here is that while REIT is regulated by SEBI, in the case of tax-free return agri-investment tech players, their approach is not regulated yet.

More on changes in land leasing norms, comparison with agri-investment tech players of Africa in a recent edition of Agribusiness Matters

Postscript: In response to my article, Growpital CEO Rituraj’s comments are deeply insightful.

"Growpital is eagerly looking forward to levelling up from the regulatory arbitrage. The first mover, in our case, we take on the heat as well as the benefits through this arbitrage and when the right scale kick in, the regulation will evolve and we firmly believe that it will be favourable for all the stakeholders involved - Growpital, Farmers, Investors, Zetta Farms projects and land owners. The models at the global level mostly involve the land to be kept as collateral, but in our we like to keep it at a very low capex, just to keep the cash flow churn at the right rate.”

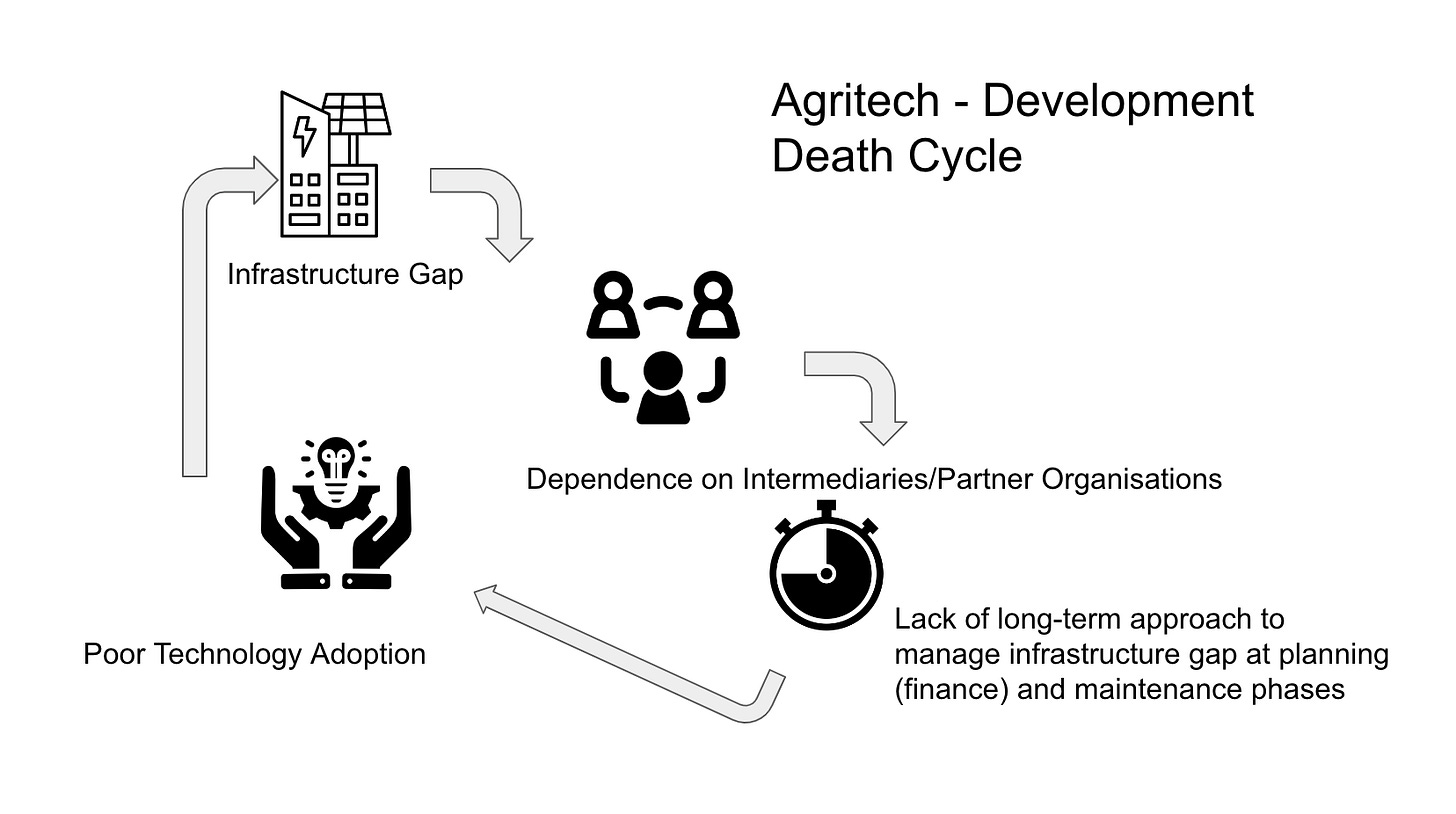

Agritech - Development Death Cycle

Last week, Washington Post wrote a scathing commentary on India’s rural solar systems and the Rockefeller Foundation, who had supplied some of these mini-solar grids profiled in the story, published a rebuttal on Twitter.

If you go beyond the narrative agendas (which could be attributed to colonial hangover) and implementation blame games, and for a change, take a deeper look at what is happening, you will eventually realize the importance of understanding the Agritech-Development Death Cycle.

In my recent Agribusiness Matters subscriber-only edition when I examined Bayer<>Cargil partnership from the context of smallholding farmers, I sketched this and illustrated it with Bayer’s Better Life Farming as the case study protagonist.

When you are trying to improve the adoption of agritech in smallholding contexts, you are bound to discover an underlying Infrastructure gap, which results in more dependence on intermediaries, which further incapacitates long-term approaches to infrastructure creation and maintenance thereby fueling this vicious trap forward.

Let’s now examine this through rural solar grid adoption.

Few weeks back, in my rural field travels, I stumbled upon this non-functioning solar cold storage in the eastern part of the country.

When I inquired with the local implementation agencies, it was evident that this implementation failed because of the underlying infrastructure.

Solar Cold storage fails when there is no three-phase power supply. Storage fails at night and with temperatures soaring at 45 degrees in this part of the country, farmers lose their produce due to heat. The alternative is a diesel generator which is unaffordable. I was told that farmers paid 25 paise (0.0030 USD) per kg to leverage solar cold storage as banana ripening chambers when it was functional.

The full picture emerged when I got to speak with the founder who provided this solar cold storage.

Here are a few facts I verified after talking with the founder.

1) The solar grid’s terms and conditions spell out a 1-year warranty with a recommendation to have an alternate three-phase power supply. The product was installed in July 2020, and as per their data logs, was operational until Jan' 23. The central issue seems to be the maintenance with regular cleaning of the condensing unit.

2) The farmers were paying 25 paise per kg. Was this too little incentive for maintenance? What are the right incentives for the operators to maintain this system to have a better ROI of the investment? The farmer makes an additional 10 to 12 INR/kg (0.12 USD) for selling ripened bananas by paying 0.25 INR/kg (0.0030 USD). Could this additional income for farmers be translated into improving grid phase infrastructure?

3) This system seems to be designed for 55 C ambient temperature. The question, therefore, boils down to maintenance.

4) The body is a repainted marine shipping container. Although the founder conceded that it was a bad paint job, he further added that 'repainting a marine container is not a good option. The red colour is the original paint and not rust.'

Averting Agritech -Development Death Cycle entails asking the following questions

How do we incentivize the ecosystem to maintain these technological solutions?

How do we bring more ownership to these agritech solutions, especially among the end users, instead of creating agency problems with implementation intermediaries?

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.