Saturday Sprouting Reads (Better Life Farming, ONDC, BL Agro Strategic Investment, Caste in Smallholding Agriculture)

Dear Friends,

Greetings from Hyderabad, India! Welcome to Saturday Sprouting Reads!

About Sprouting Reads

If you've ever grown food in your kitchen garden like me, sooner than later, you would realize the importance of letting seeds germinate. As much as I would like to include sprouting as an essential process for the raw foods that my body loves to experiment with, I am keen to see how this mindful practice could be adapted to the food that my mind consumes.

You see, comprehension is as much biological as digestion is.

And so, once in a while, I want to look at a bunch of articles or reports closely and chew over them. I may or may not have a long-form narrative take on it, but I want to meditate slowly on them so that those among you who are deeply thinking about agriculture can ruminate on them as slowly as wise cows do. Who knows? Perhaps, you may end up seeing them differently.

Next ABM Townhall on 30th October: Divergent Agritech Futures with Jagadeesh Sunkad and Emmanuel Murray - How can agritech startups become stable MSME firms and brave the market uncertainties? As a follow-up to my previous ABM Townhall event, I am excited to do this ABM Townhall with my dear Yoda mentor friends of the agricultural world, Emmanuel Murray and Jagadeesh Sunkad. Together they bring 80 years of deep immersion into the complexity of Indian Agriculture while working closely on technological possibilities. Members can RSVP here

{Subscriber-Only}: Bayer’s Better Life Farming for Smallholders

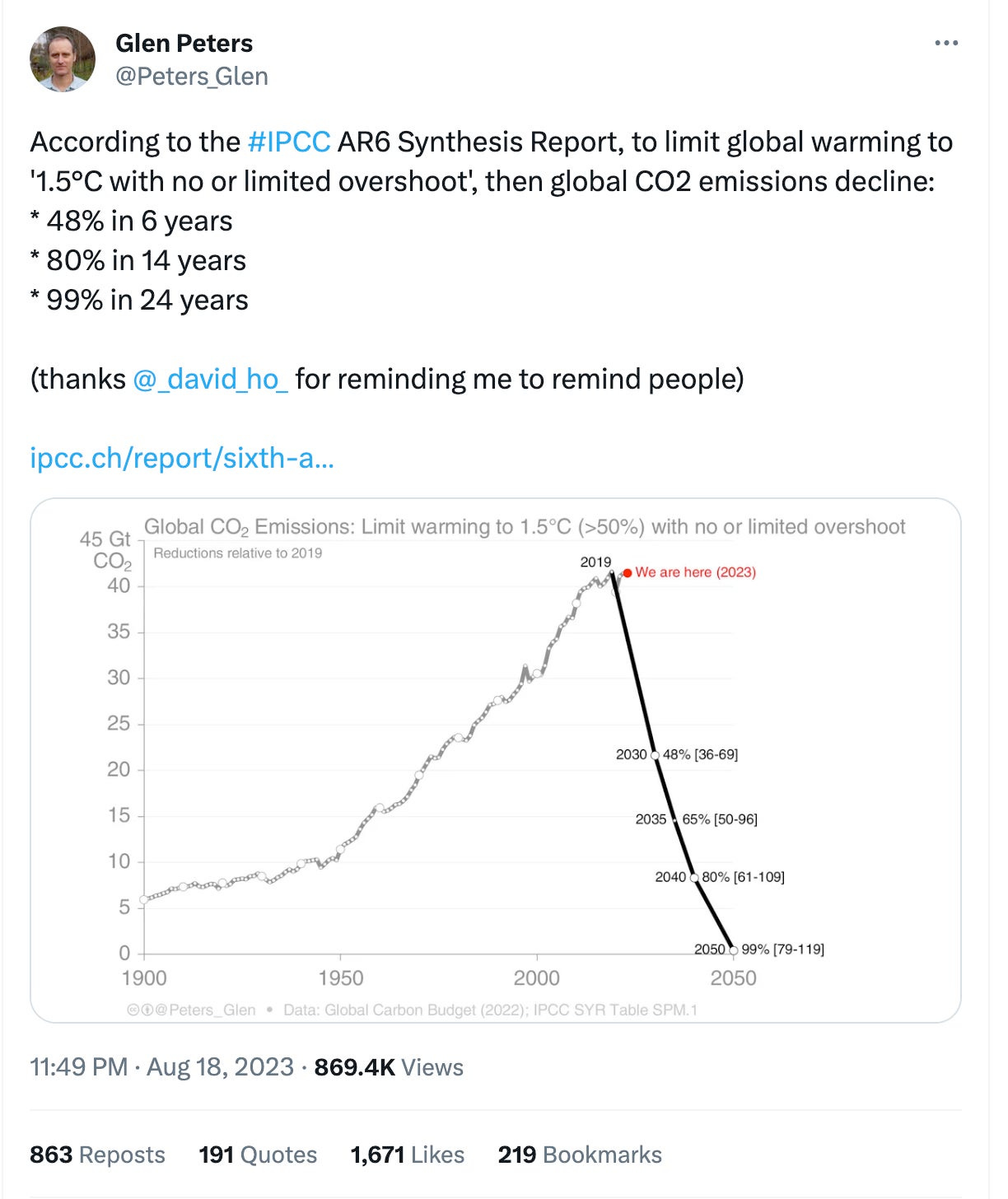

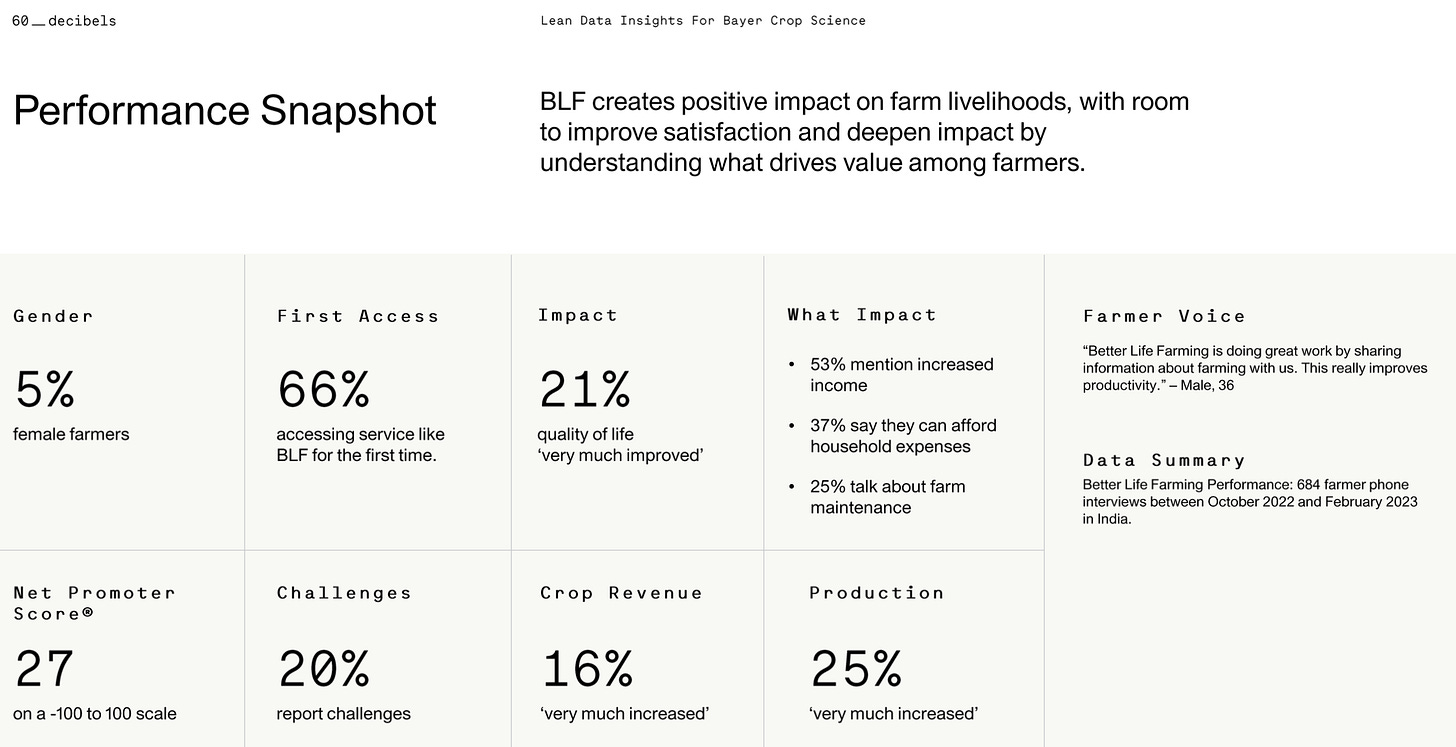

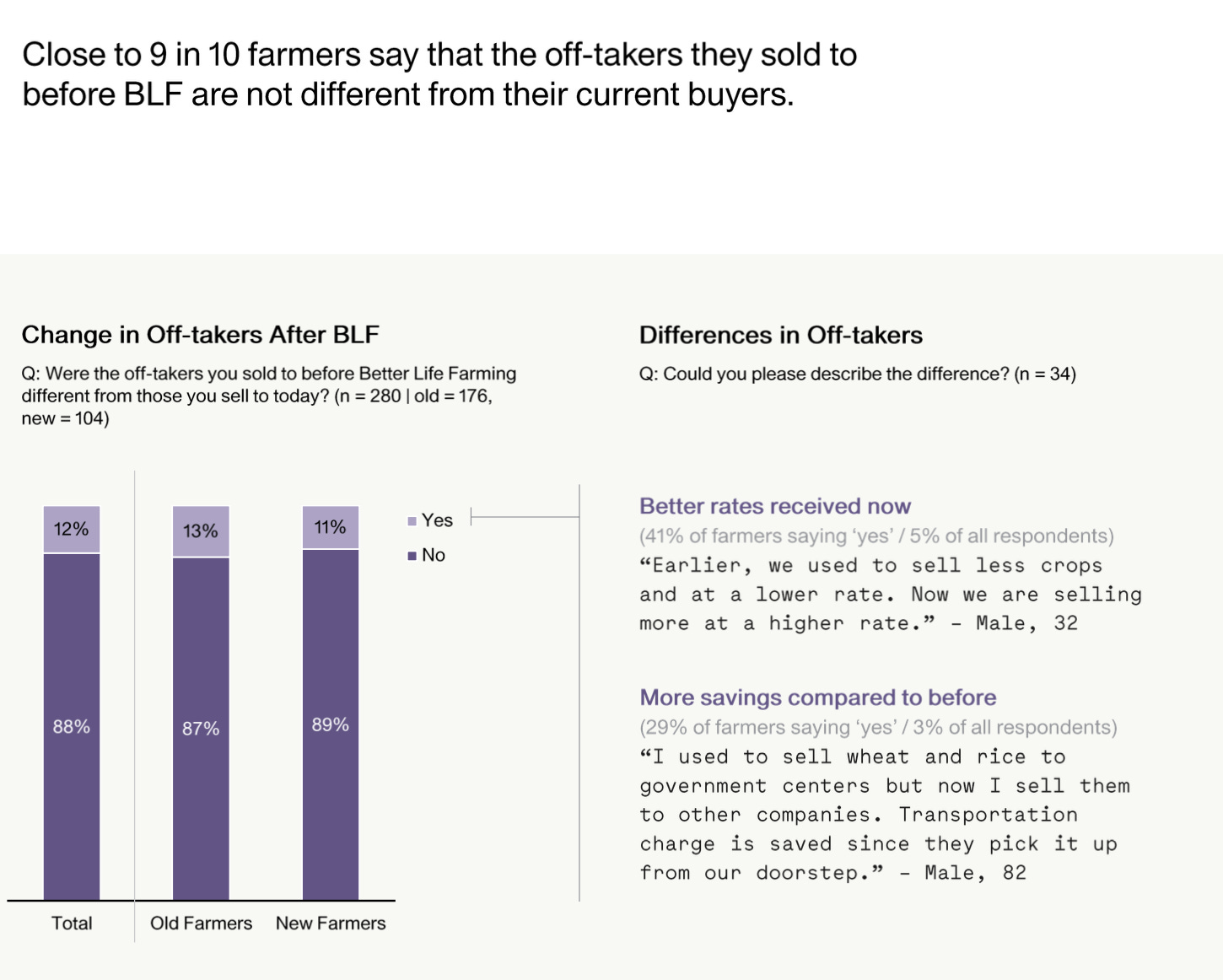

How has Bayer fared in their focus towards smallholders through their Better Life farming program? Bayer presented their results recently in a sponsored study that was conducted by 60DB.

What caught my eye was this research insight: 9 in 10 farmers say that the ‘off-takers they sold to before BLF are not different from their current buyers’

Therein lies the challenge my friend.

The longevity and durability of smallholder intervention lie in finding the right buyers who value such production interventions. If the buyers remain the same, they are not going to offer better price returns to smallholder farmers in the long run.

In my March’23 analysis of Big 6 agri-input firms’ platform-ecosystem approaches, I had written,

“Bayer is in a position of weakness as it still doesn’t have an integrated digital platform in contrast to Syngenta which is building Centrigo farming ecosystem via its Cropwise Grower platform (white-labeled plantix)”

Although Bayer has made progress with Farmrise, capability and product roadmap-wise, it still lags behind Centrigo, when it comes to expanding the platform’s scope to include partners and other ecosystem enablers. Conversely, there are enough reasons to be cynical about Syngenta’s ecosystem efforts, especially in the context of Davidian agritech startups and Goliath behemoths like Syngenta.

Although these are very early days for ecosystems to move beyond high-sounding vision statements to reality, when I look at what is being attempted, I see the evolution of middlemen unfolding from monolithic to collective ecosystem-driven structures.

In this subscriber-only post, I look at the evolution of middlemen using the examples of Bayer’s Better Life Farming and Syngenta’s Centrigo Farming ecosystem

{Subscriber-Only}: Will ONDC raise the bar?

While it is heartwarming to see the progress in the non-perishables segment, ONDC seems too stuck with its technological prowess to raise the bar and address deeper challenges in the perishable segment.

“Now the network is looking to bring the fringe to the centre—a small beginning has been made by onboarding as many as 597 FPOs with 601 products. Complementing this is the presence of the National Seeds Corporation (NSC) on the platform. Those that have also joined include Addble, which is bringing 250 organic FPOs from the northeast to the network. Others on board are DforD (Data for decision), which deals in agricultural inputs, and seller app Farmer Mandi, which deals in fruits and vegetables.

Be it local varieties of rice, millet, honey, or mushrooms, ONDC is giving nationwide visibility to local treasures. On the other hand, FPOs give small and marginal farmers better bargaining power as they are able to aggregate their produce.” (Source: Economic Times)

Maybe my expectations are too high.

If ONDC is serious about improving its bargaining power for farmers, why not start prediction markets to make sure that price discovery of ONDC's perishable produce offerings unfolds?

If ONDC is serious about raising the bar, why not bundle up its marketplace offerings for small retailers with agrifintech credit offerings based on retailers’ UPI cash flows?

RBI has approved credit lines for UPI- Pre-Sanctioned Credit Lines at Banks through the Unified Payments Interface (UPI). The possibilities are huge, especially for small MSME players who don’t get access to low-cost, timely credit.

{Subscriber-Only}: Making Sense of Leads Connect Rs. 500 Crore Strategic Investment from FMCG Player BL Agro

I wanted to highlight this here as, after the PayAgri-Suumaya Industries deal that I can remember on top of my head, it is an interesting strategic investment deal (with a controlling stake for BL Agro). If you ask me, we need more strategic investment deals in this ecosystem with agritech players collaborating with FMCG players.

Such deals could build collaboration synergies for full-stack agritech players and FMCG players who are now learning to build economies of scope with FPOs traders.

Agritech GTM models require you to understand the difference between economies of scale and scope: With the former, you focus on repeatable processes for identical products or service instances, and with the latter, you focus on similar processes for distinct products or services.In 2018, BL Agro launched their e-commerce store and this partnership should build muscle to strengthen backward linkages that could build a 365-day supply chain with dependable sourcing strategies from FPOs, farmers and cooperatives.

“Food processing firm BL Agro Industries has set a target of ₹4,500 crore turnover this fiscal — an increase of 27 per cent from nearly ₹3,540 crore last year, said Ashish Khandelwal, Managing Director of the company. The business grew 56 per cent in FY22.

“We want a slow and steady growth. Though the target is ₹5,000 crore, we are confident of achieving ₹4,500 crore. Our core business is edible oil, which contributed over 80 per cent in the turnover last year.”(Business Line)

“Bail Kolhu kachi ghani mustard oil is the flagship brand of BL Agro, which is known for its supreme taste and consistent quality. The brand’s focus is to provide customers with the highest-quality mustard oil.” (BL Agro Website)

When you are dealing with edible oil, the model worth building is circular economy gameplay with the agricultural waste contributing towards feed, while the sourcing strengthens the edible oil supply chain. It should be worthwhile to watch this circular economy gameplay intersecting with farm-to-kitchen super-full stackers.

Unpacking Caste in Smallholding Agriculture

Should smallholding farming be equated with feudalism and caste inequalities? Why do anti-caste activists in India encourage Indian smallholding farmers to exit agriculture?

Recently, I wrote about the need to bring caste into our conversations about agriculture & development and today, I want to talk about a nuance that often jumps out of the window when you start to understand agriculture from the lens of caste.

Recently, an anti-caste activist I follow on Twitter wrote an interesting thread on Twitter on how we need to celebrate the fact that 4,000 Indian farmers leave agriculture on a daily basis. This number, which I couldn't verify, apparently had been shared by Prof. Ashwani Pareek, Director of the National Agri-Food Biotechnology Institute (NABI).

He wrote the following: "Just like the United States in the early 20th century, India requires a significant farm-to-factory transition"

It's important to review the facts before we make such a recommendation. Let's take the case of Western Europe. How did Western Europe manage to remove so many people from its agricultural lands?

1) Around 40 million West Europeans emigrated to the Americas from 1850 to WWI, which today would represent around 360 million people if the same phenomenon were to occur in India from 2015 to 2078. (Data Courtesy: Bruno Dorin)

2) Two World Wars had happened which killed a lot of poor peasants.

3) Labour-intensive growth in nonfarm activities when manufacturing and other big industries were not automatized or robotized as today.

4) Massive access to Oil & Chemistry which provided cheap agrochemicals.

Sure, 'developed countries' have expelled farmers from the land. What were the consequences?

1) High-farm specialisation led to low resilience to economic, climate and biotic shocks.

2) High dependence on fossil energy

3) Erosion of biodiversity, soil water and air

Should we aspire for the 'Industrial and consolidated food systems' we see in the US when it has the highest ecological footprint among other food systems and there is enough evidence of a high prevalence of obesity for those living in these food systems?

Can you imagine the staggering ecological implications when ‘nearly one-third of the global population [that] lives in a country characterized as having a traditional and rural food system’ aspires towards an industrial and consolidated food system?

If we have to examine the question of whether it is desirable for Indian farmers to leave agriculture, we have to ask another question: How many farmers does a country need? In one of his papers, Amit Basole estimated that based on per capita GDP levels, India’s farm sector should be employing 33-34% of the total workforce ideally.

This question is complicated as hell. How many farmers does a country really need?

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.