Dear Friends,

Greetings from Hyderabad, India! Welcome to Saturday Sprouting Reads!

About Sprouting Reads

If you've ever grown food in your kitchen garden like me, sooner than later, you would realize the importance of letting seeds germinate. As much as I would like to include sprouting as an essential process for the raw foods that my body loves to experiment with, I am keen to see how this mindful practice could be adapted to the food that my mind consumes.

You see, comprehension is as much biological as digestion is.

And so, once in a while, I want to look at a bunch of articles or reports closely and chew over them. I may or may not have a long-form narrative take on it, but I want to meditate slowly on them so that those among you who are deeply thinking about agriculture can ruminate on them as slowly as wise cows do. Who knows? Perhaps, you may end up seeing them differently.

You can join Agribusiness Matters with 20% off over the next seven days.

{Subscriber-Only}: BharatAgri’s Horizontal Agri-Input e-Commerce gameplay)

When I tracked BharatAgri’s last fundraise in Sep’21 I wrote,

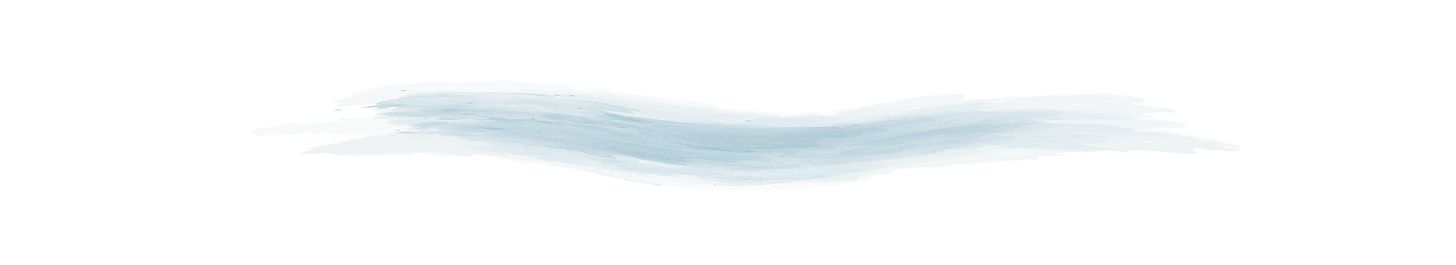

“If you are asking farmers to pay and trust your agronomy services, where is your skin in the game if you offer cashback and direct-to-farmer agri input supply to farmers? ln states like Madhya Pradesh and Maharashtra where they have their active subscriber base, ‘farmers tend to use unbranded pesticides or very limited volumes (c.1% of operating cost).’ Can they build a sufficient moat against agri-input retailers who offer free advice and agri-input sales?”

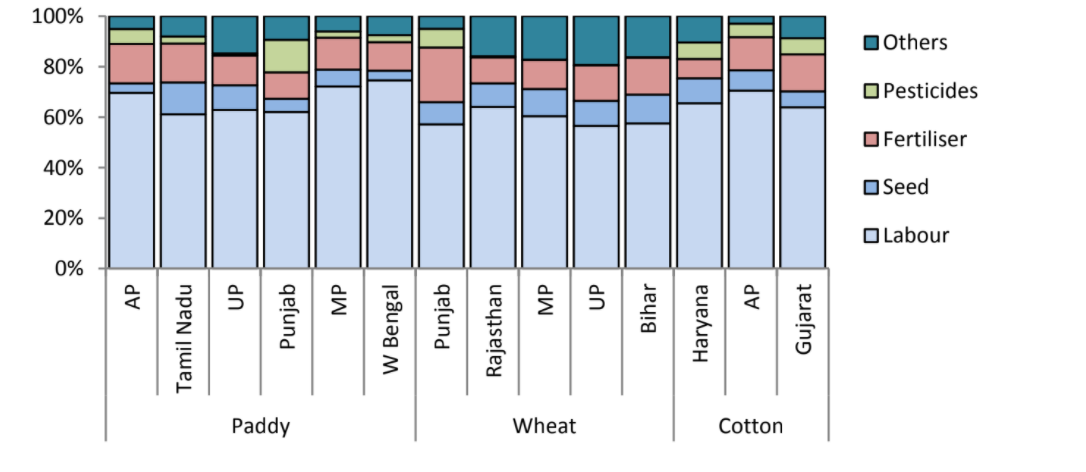

As it turns out, When you offer horizontal e-commerce solving for a wide selection in a native agri-input context spanning fertilizers and bundled agri-inputs (‘with original GST Bill On all Order’, as their app assures me) alongside premium services, it seems a good enough combination to build a sufficient moat against agri-input retailers.

“With 10L+ unique monthly users, 10k+ SKUs, 100+ marketplace partners and 20k+ serviceable pin codes, BharatAgri is making a significant impact on farmers' lives. With this investment, BharatAgri aims to further strengthen its rural supply chain, expand the user base and become the largest and the de facto e-commerce platform for farmers.” - Siddharth Dialani CEO, BharatAgri

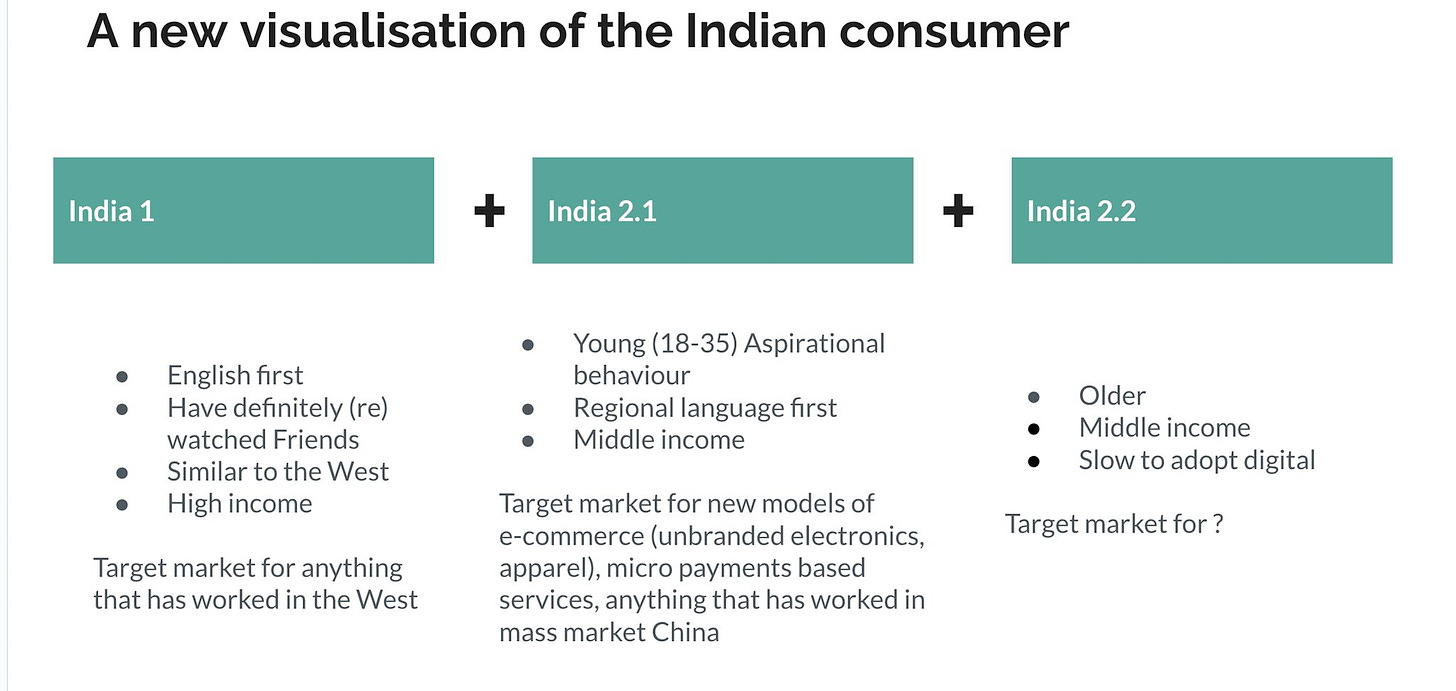

What is important to note is that they are serving an aspirational India 2.1 farmer base (‘medium sized’ covering easily more than 2 acres, ‘modern farmer’, with adequate knowledge on micro-nutrients and advanced pesticide+/biologicals applications, as their investor Rahul Chandra spelt their target customer base while detailing his investment rationale), concentrated probably in the states of Maharashtra, Gujarat and Madhya Pradesh where they have good ground base.

More on BharatAgri and their Series-A fundraising while tracking the evolution of agri-input e-commerce in India in a recent edition of Agribusiness Matters.

{Subscriber-Only}: Making Sense of Bull Agritech’s Fundraise

At a time when the agritech investor community is expressing its aversion towards output linkages (‘They skipped the GMV enhancing high burn causing output side of the problem” ++ Gramophone’s Protifability), it is interesting to see how newer players that seek to digitize the primary transaction between farmers and processors are now coming to the fore.

Farm-Factory model is best suited to grow in the state of Gujarat, which has seen better industrialisation metrics than any other Indian state

“Nearly 24% of its workforce – more than twice the national average – is employed in manufacturing, which is almost as much as in services. Gujarat is the only state that seems to confirm closer to the Lewis model of labour shifting from farms to factories. Yet, the proportion of its workers in agriculture is much higher than for Punjab, Haryana, Kerala, Tamil Nadu or even West Bengal. Less services sector-dependent would be a more appropriate description for Gujarat” - Harish Damodaran

What is interesting to see in the case of Bull Agritech’s gameplay is a combination of online + offline with dedicated warehouses (collection centres)

{Subscriber-Only}: Making Sense of Ninjacart’s Reboot

Ninjacart rises once again to the fore as a phoenix from the ashes of their agritech pivots. How to understand their constellation-of-trades agritech gameplay this time?

“We realised it makes sense to expand our offerings to stakeholders across the value chain, for example, farm aggregators, traders, and larger wholesalers. Earlier we used to bypass them, but now we have started co-creating along with them,” - Kartheeswaran K K in ET Prime Interview

Last year, when I wrote about the potential of Studio agriculture, I wrote

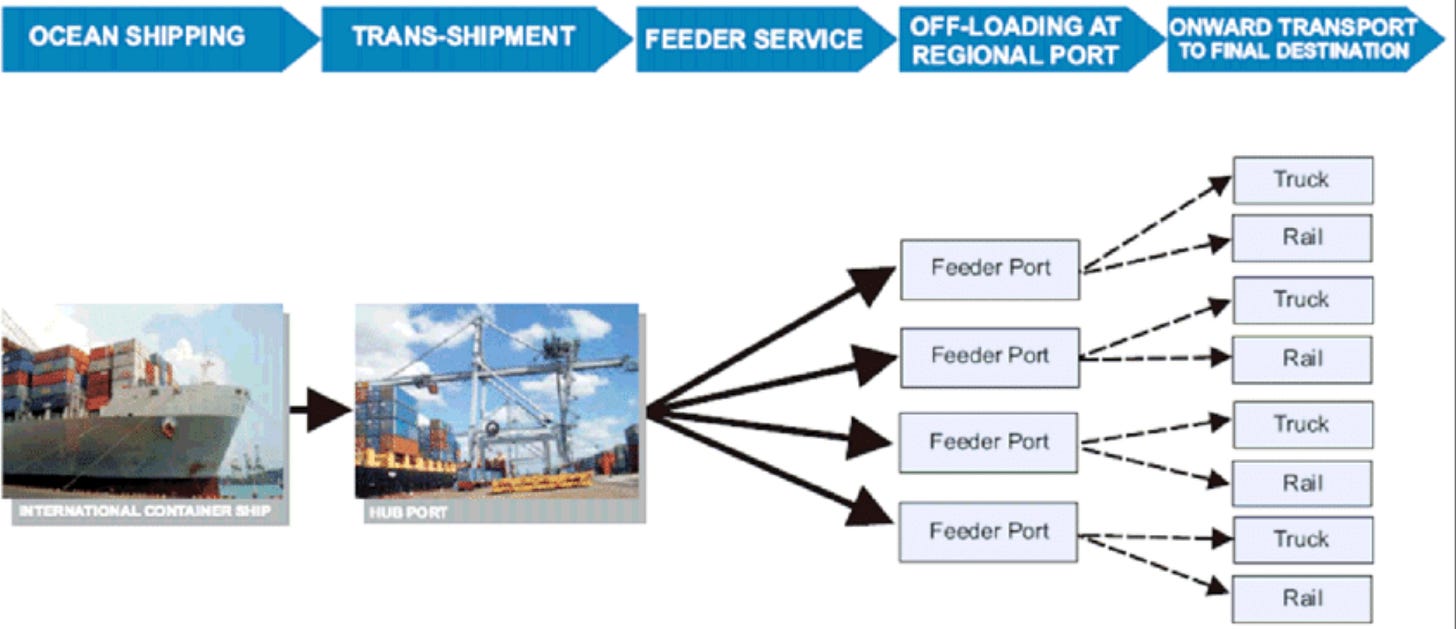

What do you see in this diagram from an agritech operations perspective?

What is common between this containerized ocean freight model and this operating model of Ninjacart?

The answer is simple: Hub and spoke model

What if the Hub and Spoke Model were the WRONG way of organizing the agritech supply chain in unorganized agri markets with a larger smallholding farmer population?

When I look at the refreshed portfolio of agritech offerings of Ninjacart and contrast it with their old About Us page, it seems likely that they have realized that the hub and spoke model ought to be replaced by a constellation of farmer-grocer-trader-exporter trades approach.

More about Ninjacart and their constellation of trades approach in a recent edition of Agribusiness Matters

The Changing Agricultural Trade Landscape in India

Few months ago, a journalist friend reached out wondering if I could write an essay on the theme, “Why should you care about Indian Agriculture?”. After a few rounds of mediocre hand-wringing attempts, I gave up.

Even though the work I do in Agribusiness Matters seems ‘journalisty’ from the outside, the operating system that churns out what you read in Agribusiness Matters could very well be harshly characterized as an evil twin of a journalist.

My writings don’t carry the whiff of objectivity of an imagined spectator. My writings contain wrong-but-useful models that are weakly held to make sense of the disparate live data points I come across in my consulting work, interviews with agritech founders and field travels. My writings are never conclusive - they are replete with footnotes to counter my arguments with data points available at my disposal. My writings are a spaghetti mess with references to older perspectives so that I track how my opinions are evolving.

In doing what I am doing, what am I really doing?

Food Historians of the future will closely study this nick of time starting from 1971 when we started playing around with financializing our food and agriculture system and look for clues on how the food systems slowly started transforming over the next thirty-forty years.

In writing subscriber-only ‘State of Agritech’ pieces with a date, I strive to connect disparate weak data points with a larger commentary so that we can predict the future. As I enter the fourth year of my solopreneurship journey, this has been the most fascinating discovery, trudging through a new lens of my work as a geopolitical strategist making calculated predictions about the global future of food and agriculture systems.

Recently, Gaurav Singh wrote a small note on a historic shift happening in the agricultural trade dynamics in the political economy of Onion.

“The decision of onion growers in Maharashtra to exclusively sell their produce in their own markets, bypassing APMCs and private mandis, marks a significant shift in agricultural trade dynamics. The move aims to address the perceived exploitation of farmers at APMCs and facilitate direct sales to consumers.

The Maharashtra State Onion Producer Farmer Organisation's initiative to establish these markets in major cities like Mumbai, Pune, and Nagpur reflects a concerted effort to empower farmers and reshape the traditional supply chain.”

Now why this is a big deal?

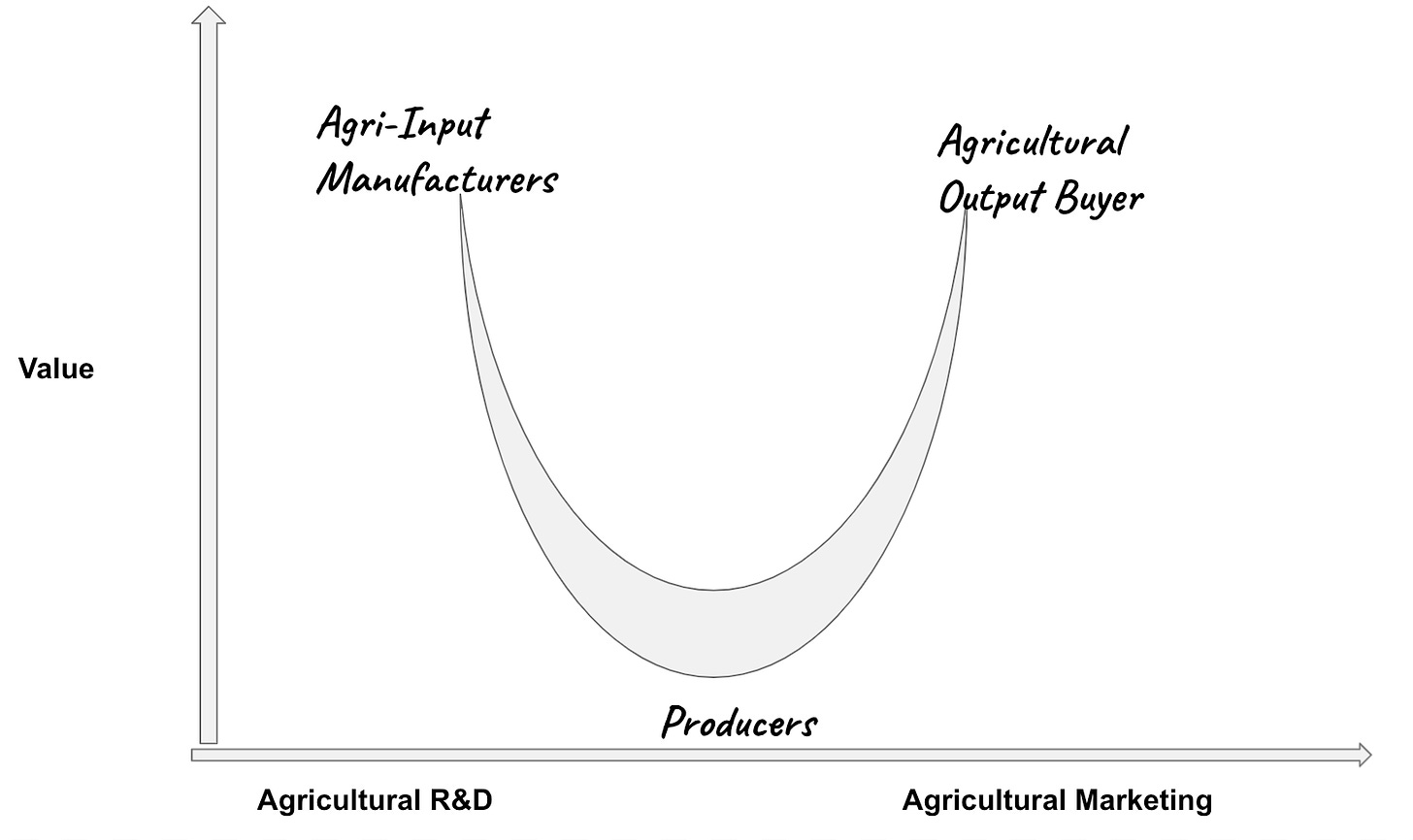

Few years back, when I sketched out Ben Thompson’s Aggregation Theory in context with agritech, I sketched the Agritech Smiling Curve to explain a core facet of the Industrial Agriculture paradigm.

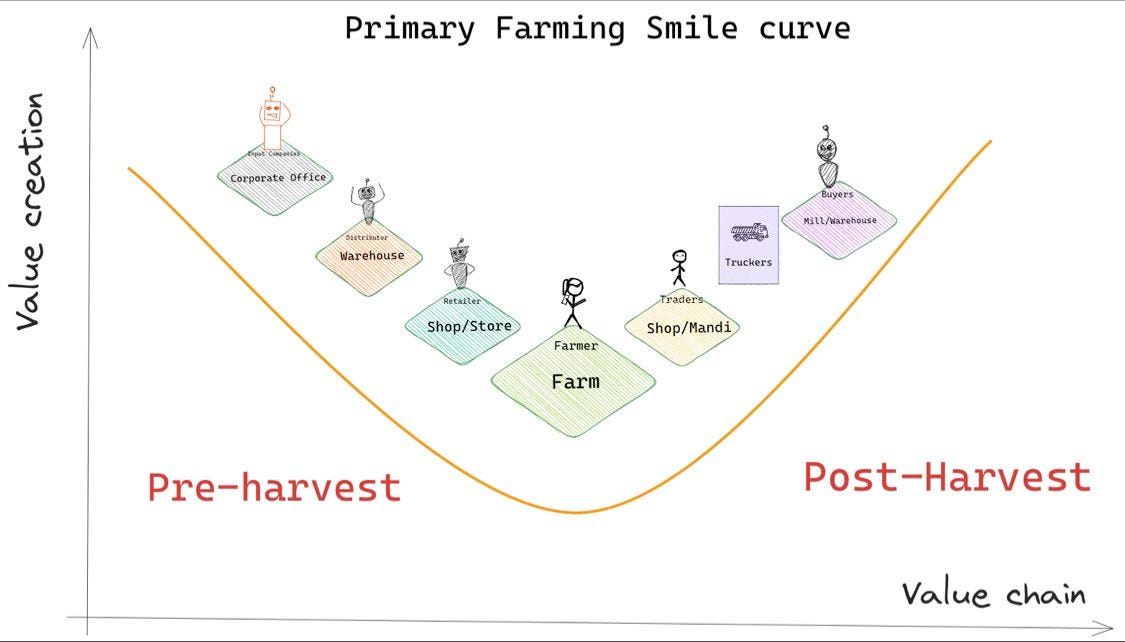

My friend Vivek sketched another variant of the same curve with more details in a smallholding context.

“If you are launching an advisory service to farmers. The value you create is very minimum compared to launching a new input product suite as a startup. Similarly, aggregation from farmers create lower value compared to providing transportation in agri-value chain.

If the value we are creating is pegged to the impact on the stakeholders. This curve puts its in relative terms to the value chain. Unless you flip the way market works. The value realised by the solution is proportional to smile curve.”

When farmers can organize themselves in the political economy through technology AND (that is a big AND) flip the way the market works, we see interesting possibilities.

Let’s see.:)

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.