Saturday Sprouting Reads (IndigoAg <>Zero Interest Regime Phenomenon, Jai Kisan's B4R Labs, Agritech <> Venture Sector)

Dear Friends,

Greetings from Hyderabad, India! Welcome to Saturday Sprouting Reads!

About Sprouting Reads

If you've ever grown food in your kitchen garden like me, sooner than later, you would realize the importance of letting seeds germinate. As much as I would like to include sprouting as an essential process for the raw foods that my body loves to experiment with, I am keen to see how this mindful practice could be adapted to the food that my mind consumes.

You see, comprehension is as much biological as digestion is.

And so, once in a while, I want to look at a bunch of articles or reports closely and chew over them. I may or may not have a long-form narrative take on it, but I want to meditate slowly on them so that those among you who are deeply thinking about agriculture can ruminate on them as slowly as wise cows do. Who knows? Perhaps, you may end up seeing them differently.

{Subscriber-Only}Indignant Ruminations on Indigo (the startup, not the natural dye)

I read my fellow Agritech colleague-in-trade Shane’s comments on Indigo’s valuation nose-dive return to normalcy in valuation.

Is this a trend beyond the macroeconomics environment? If you ask me, this is a precise trend that squarely belongs to the macroeconomics environment. Why did Indigo announce in its heady days that they were “five startups in one place”?

Hello Zero Interest Rate Phenomenon!

Why is Indigo a classic candidate to explain the Zero Interest Rate phenomenon? Why is the “factory system” of venture capital giving way to a quid-pro-quo funding regime?

In my recent subscriber-only edition of Agribusiness, I delve into why it is important to understand ZIRP and peer into the Chinese Geopolitical Hunger Games.

{Subscriber-Only}Making Sense of Jai Kisan’s B4R (Build for Rural) Labs

Almost a year ago, I wrote about how VC financing feedback loops affect rural financing workflows. When I look at the recent developments, I see this trend further accelerating.

“Financing workflows which successfully go through the VC financing funnel quickly spread like wildfire. When that happens, vertical agritech platforms, alongside horizontal rural tech platforms start replicating those VC fundable workflows while building newer and differentiating capabilities on top of them.”

When I look at horizontal embedded fintech players like Rupifi and Saral CF partnering with Gramophone; when I look at the growth of Of Business (and its debt offspring Oxyzo) goading agrifintech players to include supply chain financing in their portfolio of offerings; when I look at Mannjal taking a shot at the debt discovery jigsaw puzzle for agritech firms’ working capital needs (and eventually become Yubi for Priority Sector Lending); when I look at Jai Kisan quietly announcing B4R labs, I see this trend in full throttle.

More on Jai Kisan’s B4R Las (Part1, Part 2) in a recent subscriber-only edition of Agribusiness Matters

Is Agritech a Venture Sector?

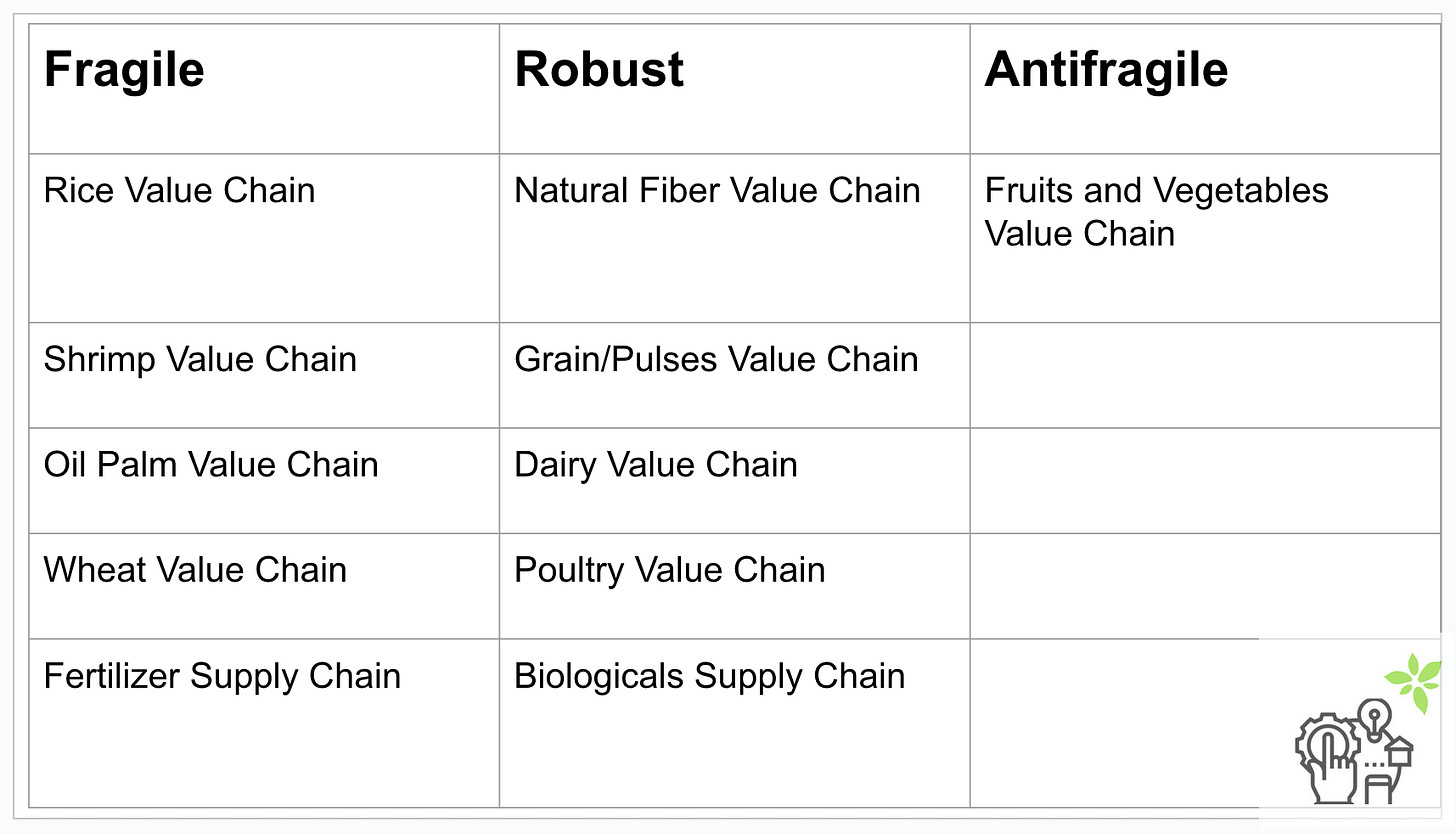

Few days ago, Sarah Nolet from Tenacious Ventures, in the fallout of Indigo’s valuation, wrote an article titled, “Is Silicon Valley still killing agtech?”

While I have looked at Indigo Ag from the lens of the Zero Interest Rate Regime, Sarah frames it more broadly as the Silicon Valley playbook:” Throw huge amounts of money at adoption and promise investors outside returns via IPO.”

In her article, she asks two important questions 1) “Is agtech a venture sector?” 2) “Will there be venture returns in agritech?”. Answering the two questions requires deeper second-order thinking.

Sarah writes,

“Our answer to these questions is still an emphatic yes. In fact, agtech is uniquely positioned in that it can be uncorrelated to macroeconomic cycles, and has a massive opportunity to tackle climate change while also unlocking returns.”

I have been thinking about these two questions ever since I wrote about zero-interest regime agritech business models. Thankfully, I discovered a vital clue while revisiting Nassim Taleb’s Antifragile.

If the American theologian Reinhold Niebuhr were alive today to write a Serenity Prayer for the future of Agriculture, he perhaps might have written

God, grant me the serenity to accept the agricultural markets that I cannot change,

courage to design the agritech marketplaces that can change those markets,

and wisdom to know the difference between markets and marketplaces.

Few years ago, I spelt the difference between markets and marketplaces through the concept of pace layers.

Marketplaces learn, Markets remembers. Marketplaces proposes, Markets disposes. Marketplaces are discontinuous, Markets are continuous. Markets control marketplaces by constraint and constancy. Marketplaces get all our attention, markets has all the power.

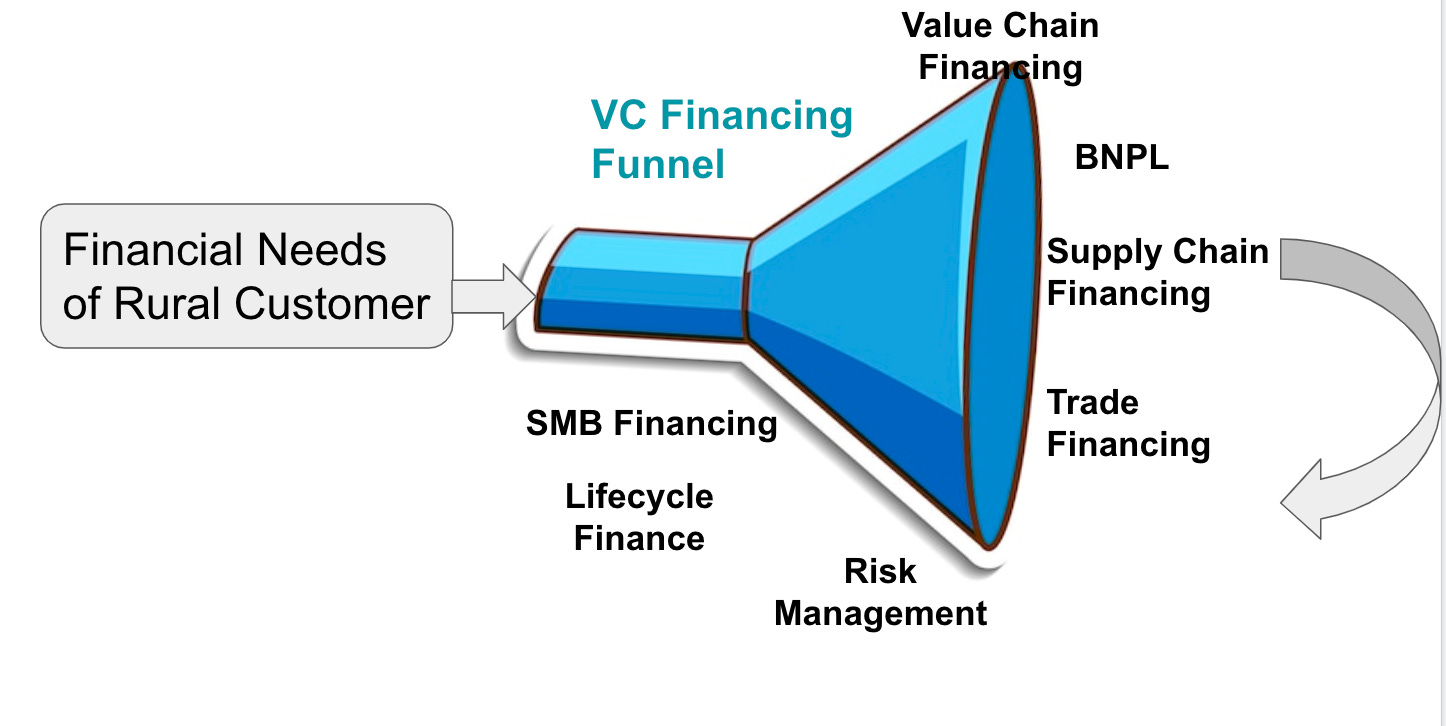

Beyond this prosaic delineation, what determines which marketplace will end up transforming the market lies in categorizing agricultural market structures as fragile-robust-antifragile.

In his fascinating book, Nassim Nicholas Taleb sums up the central insight: “The fragile wants tranquillity, the antifragile grows from disorder, and the robust doesn’t care much”

From Antifragile: Things That Gain from Disorder:

How would this triad classification for agricultural value chains look like? At a 30,000-feet snapshot level, this is how I would categorize the different agricultural value chains, albeit with plenty of disclaimers.

Sectors which resist top-down financialization of their value chains are antifragile. Agritech is a venture sector in agricultural market structures that are robust and fragile and can help the value chain (which may or may not help weakest link farmers) move towards antifragile and robust domains respectively.

For now, the only antifragile value chain I see belongs to F&V as a category. Because the entry barrier is too low for fruits and vegetables in smallholding contexts, it is extremely difficult for them to achieve economies of scale and I don’t see outsized venture returns happening in fruits and vegetables anytime in the near future.

Of course, I am simplifying things a bit here and there are plenty of nuances yet to be spelt out. Time is the crucial element here. Of course, if you are patient enough for a longer time horizon and willing to do the groundwork in any of the value chains, you can achieve outsized returns, provided you stay alive.

Of course, this is a static snapshot 2023 view. Developments in each of these value chains are happening at a breakneck pace to transform value chains from fragile to robust to antifragile.

We are currently doing decarbonisation of the rice value chain because it is way too important for it to be fragile. Or take the case of the fertilizer supply chain. A few weeks ago, phosphate deposits were found in Norway and it could change the dynamics of fertilizer supply chains. And the same could be said with polyhalite and the attempt to industrialize polyhalite for green fertiliser production.

Let us not forget the central fact that conventional agriculture, the way we are practising it is destroying the entire planet and sowing seeds for self-destruction of agriculture.

We have extracted so much groundwater for drinking and irrigation that we have ended up shifting the Earth’s axis of rotation.

A recent study titled ‘Drift of Earth’s Pole Confirms Groundwater Depletion as a Significant Contributor to Global Sea Level Rise 1993–2010’ spells out our rapacious appetite to the point of self-destruction: We have pumped out around 2,150 gigatons of groundwater between 1993 and 2010, owing to which, as per the study, the planet’s axis has drifted at the rate of 4.36 cm per year towards the east.

Agriculture, in its current unsustainable design, is destroying itself and the planet. There is a small window of opportunity for venture capital to do its bit and avert the destruction and help niche value chains (that can withstand rocket fuel) transition from left to right in the fragile-robust-antifragile spectrum.

Will develop this framework deeper and add more nuance in the upcoming editions.

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.