Saturday Sprouting Reads (Westfalia, Irrigation Tech, Demand Driven Ag Myth, Age-Old Feudal Chokepoints)

Dear Friends,

Greetings from Hyderabad, India! Welcome to Saturday Sprouting Reads

About Sprouting Reads

If you've ever grown food in your kitchen garden like me, sooner than later, you would realize the importance of letting seeds germinate. As much as I would like to include sprouting as an essential process for the raw foods my body loves to experiment with, I am keen to see how this mindful practice could be adapted to the food my mind consumes.

You see, comprehension is as much biological as digestion is.

And so, occasionally, I want to look at several articles or reports closely and chew over them. I may or may not have a long-form narrative take on it, but I want to meditate slowly on them so that those who are deeply thinking about agriculture can ruminate on them as slowly as wise cows do. Who knows? Perhaps, you may end up seeing them differently.

Next Members-Only ABM Townhall Event on 9th October: “Is Agritech Party Over?” - Dialogue with distinguished ABM Members Mark Kahn, Managing Partner, Omnivore and Shubhang Shankar, Managing Director, Syngenta Ventures and other Agritech Founders, Investors and Executives. Members can RSVP here.

(Subscriber-Only Podcast}: ABM Townhall Conversations with Ajay TG, General Manager, Westfalia Fruit India

“Sometimes we get carried away by what can be done or what is something new, but not looking at it from a consumer perspective. The point is how is the consumer going to have it? How are you going to present it to them? What are your post-harvest handling problems? What kind of processing can you get into? So these are things that you can [explore]. If it's just a competition to grow or get a crop which is better than the other, then that's not where it ends. It needs to be something that a consumer will pay for at the end of the day. So that's something that needs to be considered.

Yeah, when you get into any product and I said so for any of the startups looking at it, each product is 1000 crore opportunity minimum, which I don't think there is any fresh produce company doing that 1000 plus crores in fresh produce.

There are companies that are doing multiple products. So which means that no one has gone to that potential doing a horizontal set of things as well. So there are still opportunities in each crop and getting deep into it.” -

, ABM Townhall Dialogues{Subscriber-only Post}: Bye, Bye Irrigation Tech! Hello Precision Agriculture! (courtesy Fyllo)

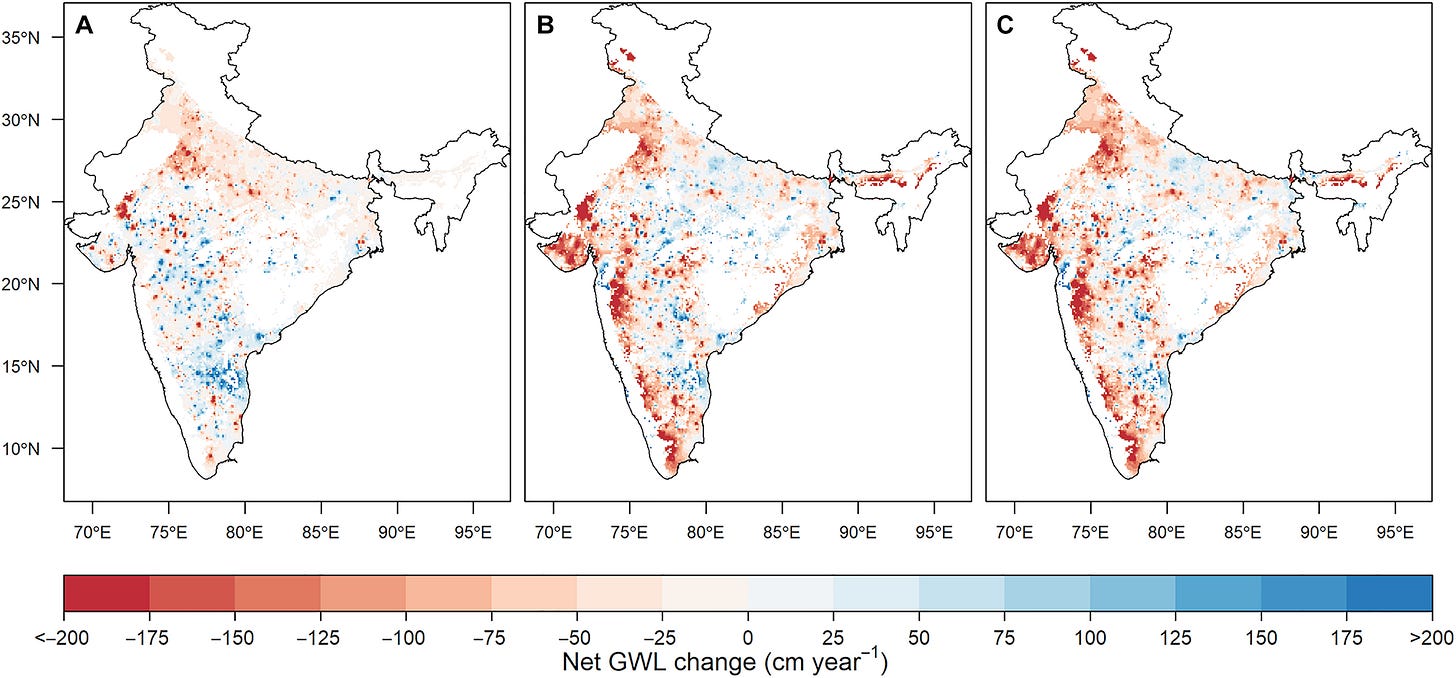

If you take a systems view, you would understand that Irrigation Tech is a hard nut to crack. Especially in smallholding contexts, where groundwater remains the last, desperate private irrigation source to tap into.

Why did this happen? Governments failed to invest in public infrastructure and markets rushed in to fill the gradient.

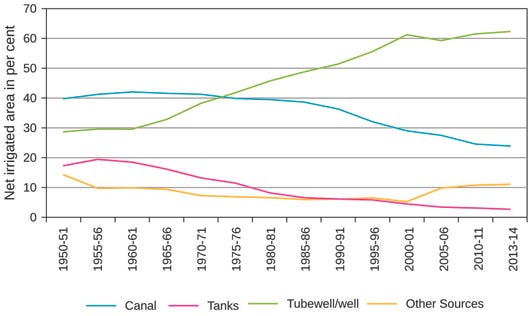

“Surface water irrigation (canal and tank) accounted for 57 per cent of total net area irrigated in 1950–51, but declined to 27 per cent in 2013–14. In the same period, the share of groundwater irrigation in the total net area irrigated increased rapidly, from 28.7 per cent in 1950 to 62.3 per cent in 2013”

With enough data clues pointing out that India will run out of groundwater by 2030, there are now newer pieces of evidence that point out that not just central India, but also northwest and southwest will face the same scenario soon.

No wonder farmers from the northwest and southwest parts of the country are starting to embrace B2C+/B2B irrigation tech players like Fyllo, which has been claiming profitability with growth in revenues.

More about Fyllo in a recent edition of Agribusiness Matters

Demand-Driven Agriculture Myth

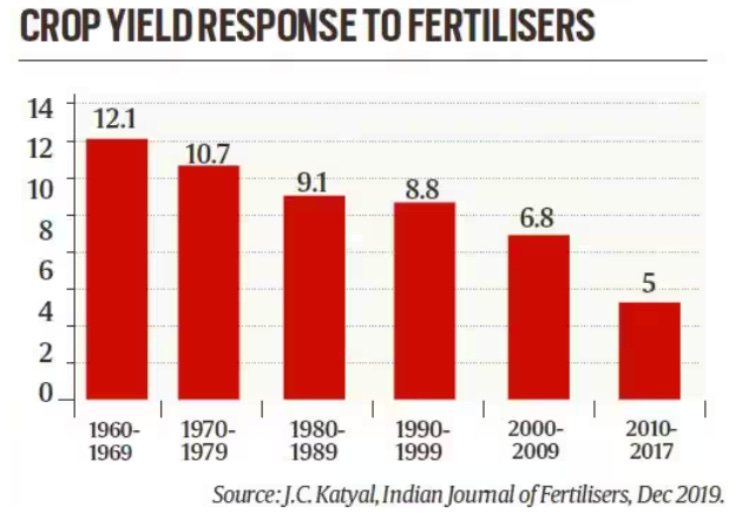

Whether you look at fertiliser subsidies or palm oil demand signals, there is enough evidence to point out an uncomfortable fact: A silver bullet called demand-driven agriculture is a manufactured myth.

Why do farmers continue to use urea when crop yield response to fertilisers has witnessed diminishing returns?

Because Urea for Indian farmers is available more cheaply than their neighbouring counterparts.

Why do Indian farmers continue to grow paddy and wheat, when the the threat of being Punjab desertified looms large with every passing day? Because the government continues to create perverse incentives where farmers prefer the government to own the production risk.

More in a recent free edition of Agribusiness Matters @ LinkedIn

Feudal Choke Points

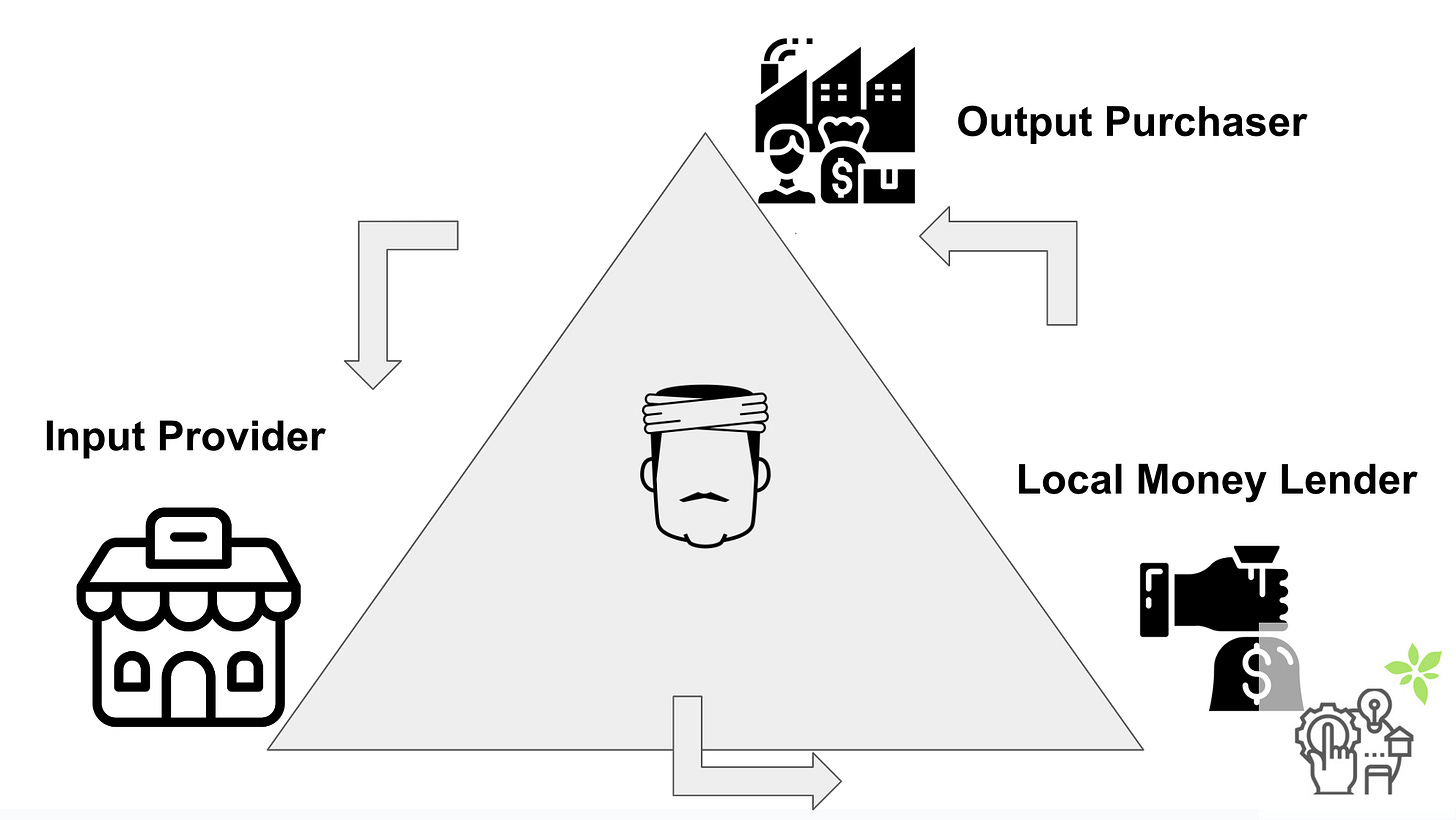

When you start excavating the fundamental predicament of a smallholding farmer stuck in sustainable poverty, (yes, sustainable…poverty) you will realise that the farmers are stuck in triangular chokepoints that control their social and economic lives.

During the recent Charcha’23 event in Hyderabad, India, Lalitesh presented this framework and I have been mulling over it ever since. The actors might vary across smallholding contexts. In some cases, output purchasers could be the government. Sometimes, all three chokepoints could be one party. Sometimes, these three parties could be two persons. But the fact remains that the average smallholding farmer is trapped.

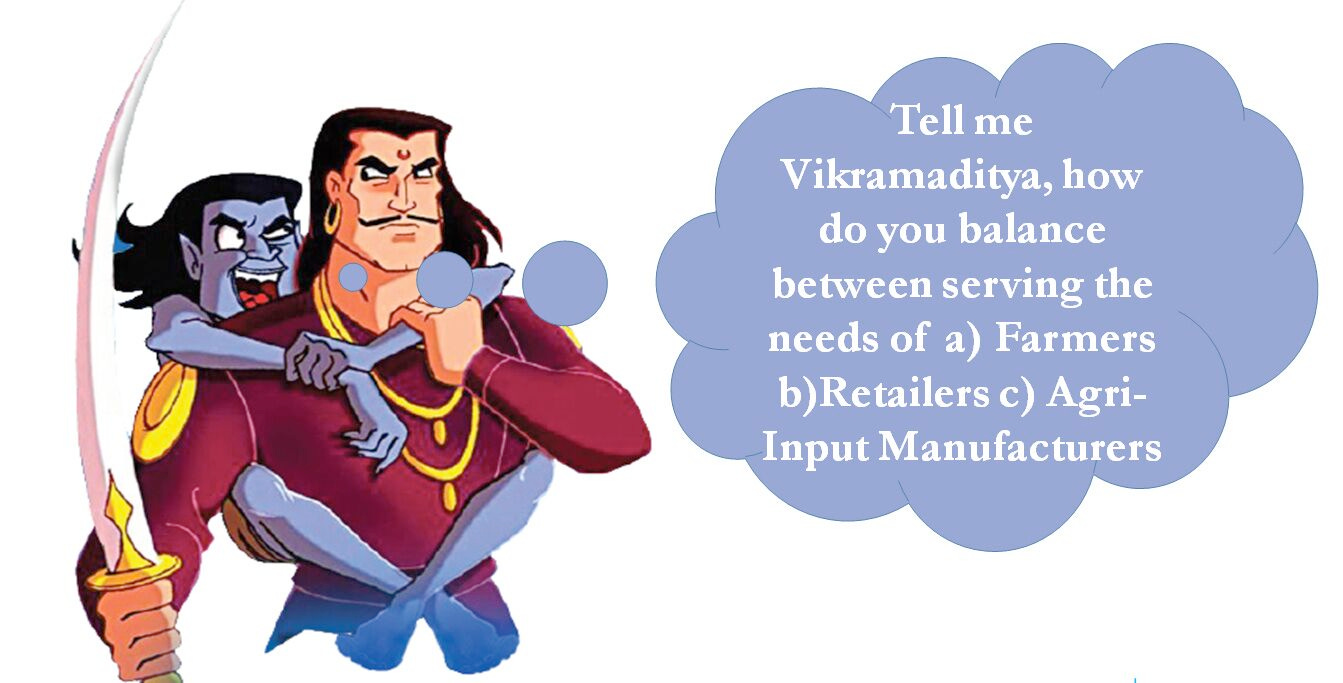

Interestingly, many years ago, when I was invited to speak on Digital Agriculture at the prestigious Institute of Rural Management, Anand, Gujarat, India, I presented a similar framework in an agri-input context through an old parable that leaves you with a modern riddle.

There are no easy answers to this riddle.

Over the last six to seven years, in my extensive travels at work, every stakeholder who is invested in the future and potential of Agritech in the agri-input supply chain is betting on technology to serve the needs of each of these three stakeholders (farmer, retailer, agri-input manufacturer), at the cost of the other.

Here is the tricky thing: You can't serve the needs of all three stakeholders. You have a choice to pick 2 out of 3. Whom will you pick? In 2020, I wrote Udaanisation of Agri-Input retail to see if this riddle could be solved and in 2023, it is evident that it is yet to be solved.

What makes the triangular feudal trap insidious is the fact that each of the three chokepoints influences each other. If a farmer gets a better-realized price in one season, the input provider would have dynamically updated the prices and the working capital loan provided to the farmer would also see a sharp increase in the cost of lending.

What does it take to break this feudal trap?

Could it lie in breaking the caste-feudal nexus through nuanced agrifintech gameplays that squarely address intergenerational caste-driven poverty?

Could it lie in decoupling agricultural expenditure from input finance?

Could it lie in decolonising agriculture?

Could it lie in group buying, financing and selling of commodities through marketplace modalities?

Could it lie in bundling inputs and financing without lock-in arrangements?

Could it lie in regulatory-arbitrage-driven corporate farming where the farmer receives a fixed monthly salary?

Could it lie in the farmer creating their own brands and owning every component of the value chain?

We will explore this further.

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.