Saturday Sprouting Reads (What Agri-Input Retailers Want in 2022, Indonesian Agritech, Chinese Agritech)

Hi Friends,

Greetings from Hyderabad! Welcome to the March edition of Saturday Sprouting Reads!

Hi! My name is Venky. I write Agribusiness Matters every week to help us make sense of vexing questions of food, agribusiness, and digital transformation in an era of Climate change. Feel free to dig around the archives if you are new here.

About Sprouting Reads

If you've ever grown food in your kitchen garden like me, sooner than later, you would realize the importance of letting seeds germinate. As much as I would like to include sprouting as an essential process for the raw foods that my body loves to experiment with, I am keen to see how this mindful practice could be adapted for the food that my mind consumes.

You see, comprehension is as much biological as digestion is.

And so, once in a while, I want to look at one or two articles closely and chew over them. I may or may not have a long-form narrative take on it, but I want to meditate slowly on them so that those among you who are deeply thinking about agriculture could ruminate on them as slowly as wise cows do. Who knows? Perhaps, you may end up seeing them differently.

Saturday Sprouting Reads goes out to 28.5 K+ curious agribusiness readers across the globe.I am accepting requests for unconventional content sponsorship experiments from contrarian agritech startups chasing the holy grail of sustainable impact. Do write to me if you want to collaborate. What do Agri-Input Retailers Want [in 2022] from Agritech?

When I was a product manager in my earlier life, I learned about the concept of invisible asymptote from Eugene Wei, based on his experiences in Amazon.

In his words,

What is the ceiling that agri-input retailers are observing in their growth curve if they continue down their current path?

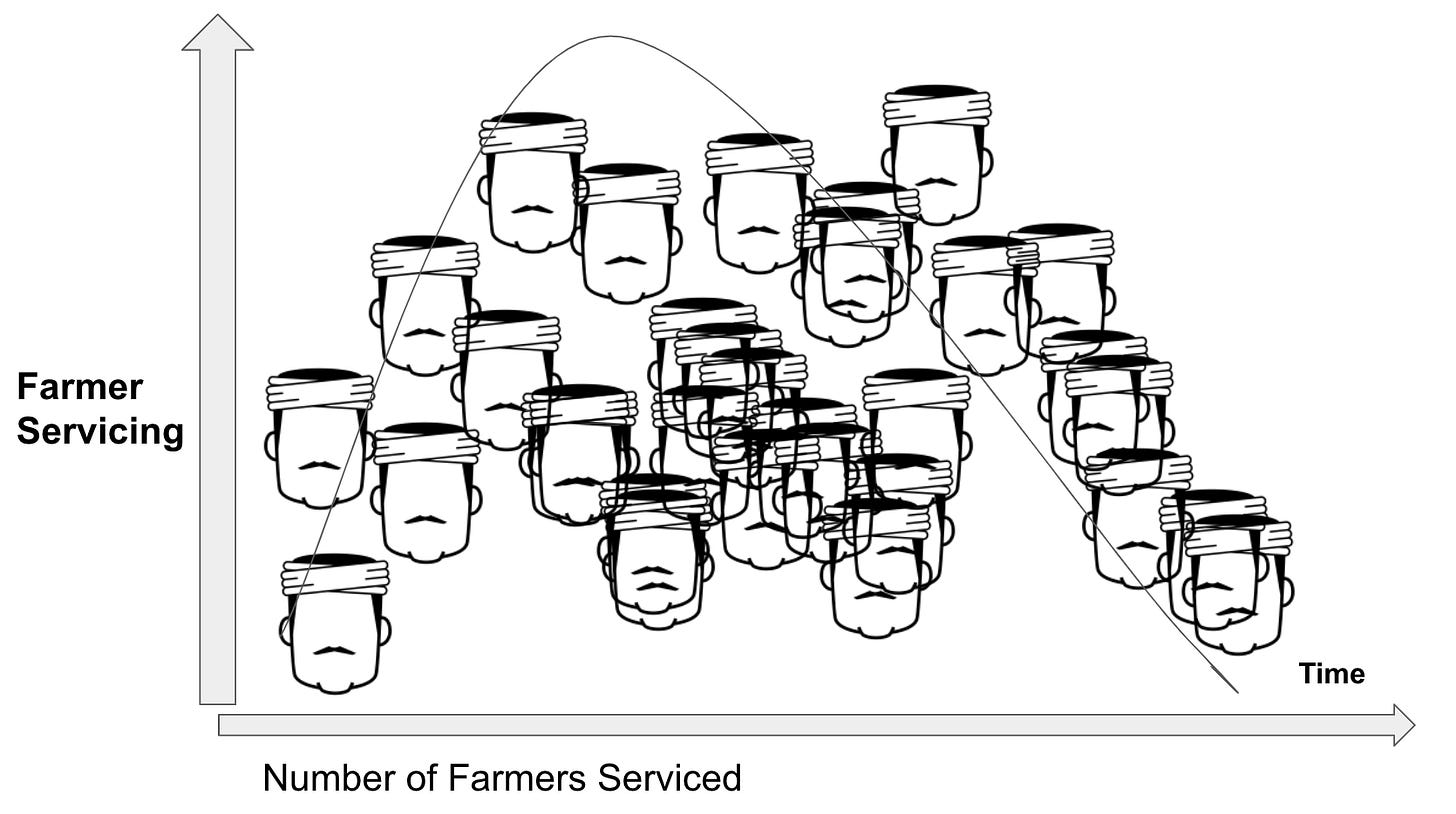

If you observe the life of an agri-input retailer in India, they meet farmers in the mornings between 6 AM - 10 AM and then open their shop to start their sales operations. They receive goods from agri-input manufacturers, track and help farmers with their queries while taking care of their margins and running their operations.

Naturally, with their human energies, there is a certain limit in the number of farmers they would be able to service over their day, week and year span.

In this subscriber-only article, I look at the third wave of agri-input retailing which seeks to overcome this invisible asymptote through platforms.

How can technology enable agri-input retailers to service a bigger radius of farmers?

Today, most digital agricultural systems are designed with farmers as paying customers.

Is there room for digital agricultural systems that are designed with farmers as consumers and retailers as paying customers for those services undertaken by farmers in their catchment areas?

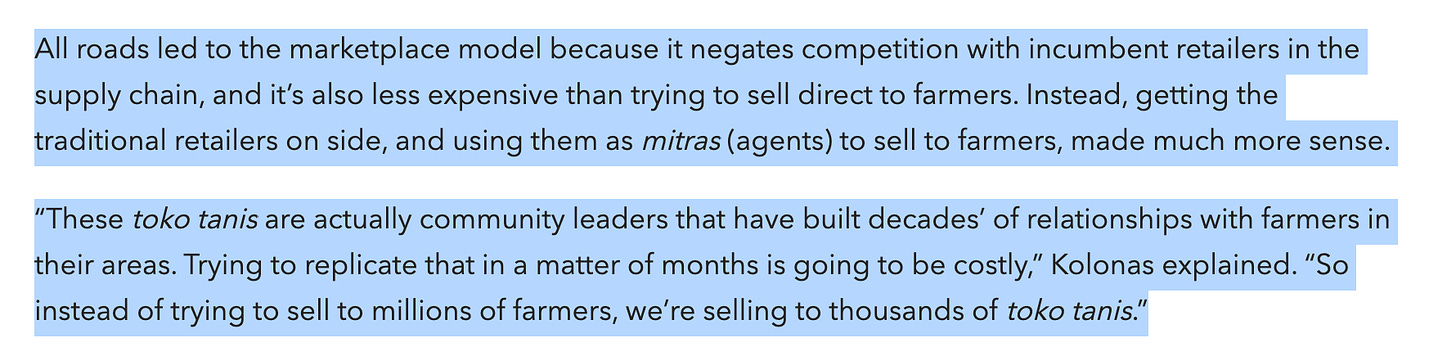

Indonesian ag marketplace AgriAku raises $6m to democratize farmer access to inputs

I came across AgriAku’s funding announcement recently which further added weight to my larger trendspotting of how Agritech 1.0 is shaping up in smallholding countries.

In countries with larger smallholding populations (and that includes China and Indonesia for the purposes of this email), we are seeing sublinear (with the fragmentation of landholdings) and superlinear (with the consolidation of landholdings) trajectories of digitalization that could be summed up in succeeding waves that strive to move the constraints of digitalization from the last mile towards the first-mile.

In the same breath of this article about Indonesia’s agrifood tech, you could very well write in the same vein about the second wave of Indian agrifood tech in which the likes of Ninjacart, Zomato hyper pure dreamed of being the farm-to-fork partners for e-commerce delivery players before “Third Wave” brought together B2B2C players like Udaan, Dehaat, Agrim, Unnati.

In 2020, going by their numbers in their IPO prospectus, Zomato spent $16.1 Mn in its hyperpure division, procuring vegetables and other supplies for restaurants, and earned $16.8 Mn, thereby indicating Hyperpure's insignificance in the larger scheme of things, in terms of net margins earned from this business. Of course, I am at risk of stretching too far, extrapolating what I have read in this single article to draw parallels with India agrifood tech.

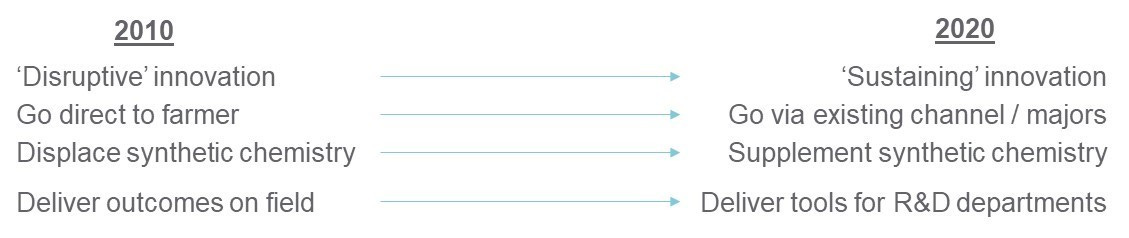

Sometime back, investor and subscriber of Agribusiness Matters, Shubhang Shankar wrote a fascinating piece that looked retrospectively at why agritech failed to create the disruption it promised in the 2010s.

Shubhang and I further discussed the promise of disruption in a long Youtube dialogue

In AgriAku’s announcement, you hear the same echoes of going via existing channels, instead of going direct to farmers.

If you’ve been following what I’ve attempted to do in contextualizing Web 1.0 with Agritech 1.0 in smallholding countries, the follow-up question has to be this: Will Agritech 2.0 follow the patterns of centralization we saw in Web 2.0 (more unlikely, if you ask me) or will we directly move from Agritech 1.0 to Agritech 3.0? (more likely, if you ask me)

Frankly, I don’t know. But I have my bets and biases. Will wait and watch.

Putting Chinese Agritech in Perspective

For a while, I’ve been trying to see Chinese Agritech outside the focal lens of the 800 pound gorilla called Pinduoduo

In making my grand theory about the Studio Era of Agriculture, I wrote about them briefly

China acknowledged in their 14th Annual Year Plan (2021-2025) that “the foundation of agriculture is not yet solid” while putting a clear plan for the same, much evident in the pivot of vertically integrated platforms like Pinduoduo, echoing the same with slogans like ‘不忘初心 (“Not forgetting your original intent”), shifting their agritech play from an asset-light third-party model to an asset-heavy model with clear aspirations to become the world’s biggest grocer.

Pinduoduo’s Business Model - Image Source: Turner Novak

In this interview with Cheng Biao, I found a sufficiently interesting answer that scopes superlinear and sublinear digitalization happening in China. Cheng segments four types of customer bases, the first of which seems to resonate with what Pinduoduo is attempting to do.

The second tier and third tiers are fascinating sandboxes for precision agriculture to bring down costs, increase value without necessarily leveraging the economics of scale. As expected, Cheng expects boutique-level customers to replace scale-level customers as production becomes more specialized.

You could very well draw parallels between the fourth tier in China as Cheng describes it here and smallholding farmers in India.

Considering the amount of communication that has gone into talking about artificial intelligence for this segment of farmer customers, Cheng’s advice will never work for India.

It would be fascinating to look at these tiers and observe how sublinear and superlinear trajectories create sufficient variety for Ashby’s Law to be contextualized for agriculture.

That is going to be a deep-dive for some other time.

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.