State of Agritech - 21st August 2023

Programming Note: A previous subscriber-only edition of this newsletter was published on Saturday and I had to unpublish the edition as the estimate numbers of Agrostar I had published from Gramophone’s investor memo were way off. Although I had published them with a disclaimer stating that I hadn’t verified those numbers, I should have not put them out in the first place without due diligence. I apologize for the error in my editorial judgment. I am opening up this edition outside the paywall and republishing it with some additional commentary.

In Today’s Edition:

0/ Gambling on Indian Development

A recent investigatory expose on India’s repealed Farm Laws illustrates Stefan Dercons’s excellent theory of development

1/ Followup on Mapping Agrifintech and Agri-Input Biologicals

Why should agrifintech gameplays be mapped by lending structures? What is the similarity between India’s Agri-Input Biological Market ecosystem and Brazil’s? Why is the Indian Agri-Input Biological Market ecosystem so unorganized when compared to its global counterpart?

2/ Zomato’s Agritech Needle in a Profitability Haystack

Zomato announced its first-ever quarterly profit and guess what I found in their profitability haystack?

3/ Gramophone’s Journey to Profitability

Gramophone recently announced that they became EBITDA positive. What does it tell us about the state of the Indian agritech ecosystem in 2023?

0/ Gambling on Indian Development

Many moons ago, Stefan Dercon wrote an excellent book titled, ‘Gambling on Development’. The book was based on Stefan’s work as a policy adviser to the UK’s Foreign Secretary. The book explores the idea of elite bargains - how elites conspire to drive their business goals alongside the nation’s development goals- and how development bargains emerge through long-term bets with pro-growth policies.

A recent investigatory expose (part-1) on farm laws (part-2) is helpful in putting Stefan’s theory in perspective: Development has always been an elite bargain.

Diva Jain recently wrote an excellent introduction to India’s political economy as a multi-player game with four sets of players: ‘politically organized large farmer lobbies, the corporate lobbies, the ‘non-farming poor’ and the income-tax paying middle class (as everyone pays GST, VAT, Excise, Customs)’.

That the farm laws were repealed, despite gradual reformist measures showed the power of farmer lobbies over corporate lobbies.

I’ve been tracking Farm Laws since their inception and have looked at their ramifications for Indian Agriculture closely.

My analysis of Farm Laws and farmer protests so far:

Part-1: Setting the Context 🔒 | Part-2: No Country for Middle-Men | Part-3: In Defense of the Government 🔒 | Part-4: Samudra Manthan in the World of Agriculture: | Part-5: "Annadata" Conundrum" And Mapping the Cultural Wars of Agriculture 🔒 | Part-6: Can I offer you a grey pill on farm laws? | Part -7: Greta Thunberg and the aftermath of Farm Law Politics in India | My TEDx Talk on the need to dialogue in context with the farm laws.

My prediction: If the ruling party BJP comes to power in 2024, we can expect reforms in taxing agricultural income and better-designed farm laws will be passed through, hopefully in a democratic manner in the parliament.

As I had argued at length in my analytical essays on Farm Laws, I am hoping that next time, when it comes to the policy drawing table, it wouldn’t pussyfoot around as if it were an RFP document.

I hope it will tackle the elephant in the room it missed last time- the price discovery complexities discussed in this podcast, especially in the crucial first transaction involving the farmer and the primary buyer of their produce.

Let’s see.:)

1/Followup on Mapping Agrifintech and Agri-Input Biologicals

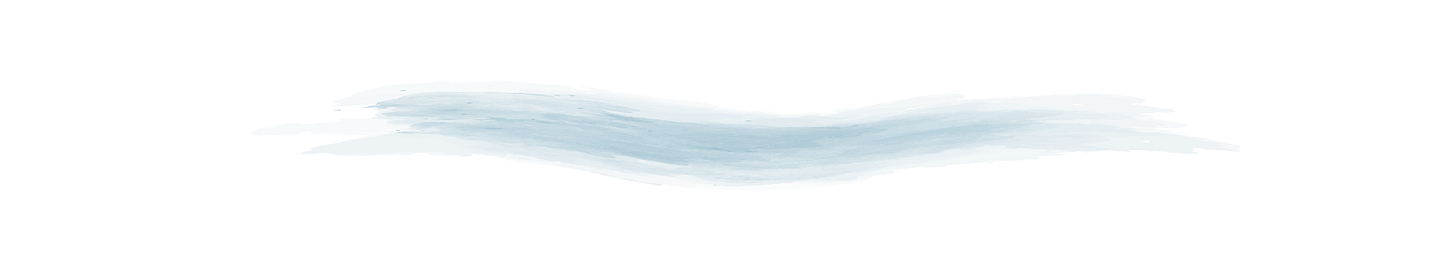

Agrifintech Analyst and long-time subscriber Niall Haughey published his comments in the Agribusiness Matters Slack channel in response to my map of agrifintech patterns.

“The discovery -> transaction flow -> financial service is actually a great framework to use and the jobs listed are quite useful (e.g. escrow, credit profile, credit, payments)

Splitting by lending structures narrows in one facet of the financial service - funding. This is super interesting as it can highlight some competitive models such as the first loss guarantees, but these can change over time with the funding cycle or guarantor requirements (e.g. 5 year term).”

Niall shared this category map in the Slack channel. My interest in mapping agrifintech patterns through lending structures is to see which model will be more amenable to regulation in the future. Would FLDG be regulated in the near future? What about the risks of co-lending? If you are an investor in a startup that leverages a particular lending structure, which one would you bet on, based on the risks of regulation?

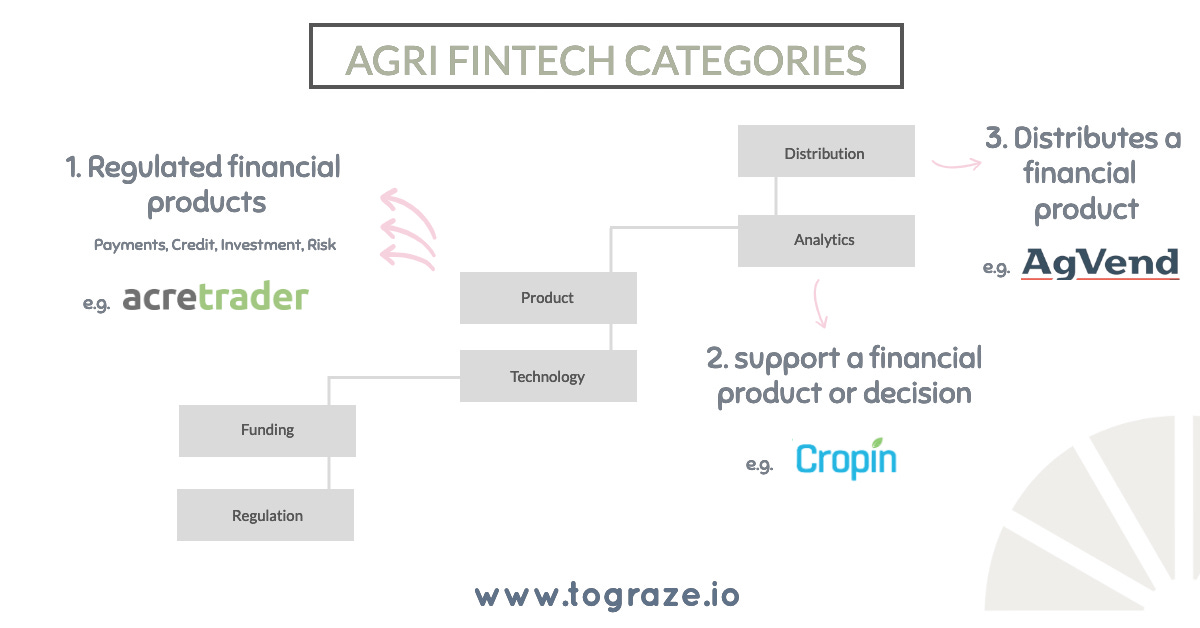

I also received an interesting comment from long-time subscriber and veteran agribusiness professional Bob Morris, in response to my mapping the competitive landscape of Indian Agri-Input Biologicals vis-a-vis the Global Agri-Input Biologicals market.

I learned that many of the larger-scale farmers are manufacturing their own biologicals in Brazil. Latam Markets, especially Brazil, have seen tremendous growth in biologicals.

“The recent success of biologicals in Brazil is due to its well-established extension system and fewer regulatory barriers to foreign companies. The need for alternative inputs in agriculture will expand the use of biologicals, and Brazil presents clients a model for scaled-growth opportunities.” - Deepesh Bishta, Lux Research

In my field travels, I have seen a similar arrangement in Guatemala and Columbia where dealers have private label arrangements to deliver specialized fertilizer to their farmer customers.

In the case of biologicals, it is very much possible to decentralize the production process near the farm gate. What is very interesting is to see how the global agri-input biologicals ecosystem is much more organized than its Indian counterpart.

Comments I received from an organic farmer and an avid reader of Agribusiness Matters, Sunu Thomas, reiterated the same. While we have the likes of Kiss The Ground (courtesy John Roulac), John Kempf, Dr elaine Ingham, Christine Jones, Matt Powers, Rodale Insitute, Whole Foods, and Patagonia who have contributed immensely in bringing awareness about the developments in the biologicals in a commercial context, we haven’t had many many pioneers in a strict commercial sense promoting biologicals in India.

Of course, awareness about natural farming/organic farming/agroecology was possible in this part of the world, thanks to pioneers who brought Masanobu Fukuoka to India and published an Indian edition of ‘One Straw Revolution’ during the nineties. Significant contributions were made by Bablu Ganguly, Debal Deb, Ramanjaneyulu GV, Bhaskar Save, Nammazhvar, Subhash Palekar, Shripad Dabholkar and many more who spread awareness as a grass-roots movement across the country with more emphasis on bottom-up livelihood regeneration rather than commercial development.

It would be interesting to see how these developments towards safe, residue-free, trait-based foods and awareness about agroecology would pan out across India, Brazil and other smallholding contexts.

2/ Zomato’s Agritech Needle in a Profitability Haystack

Searching for profitability in a heavily funded company that prioritizes growth over profitability sometimes can get as challenging as looking for a needle in a haystack.

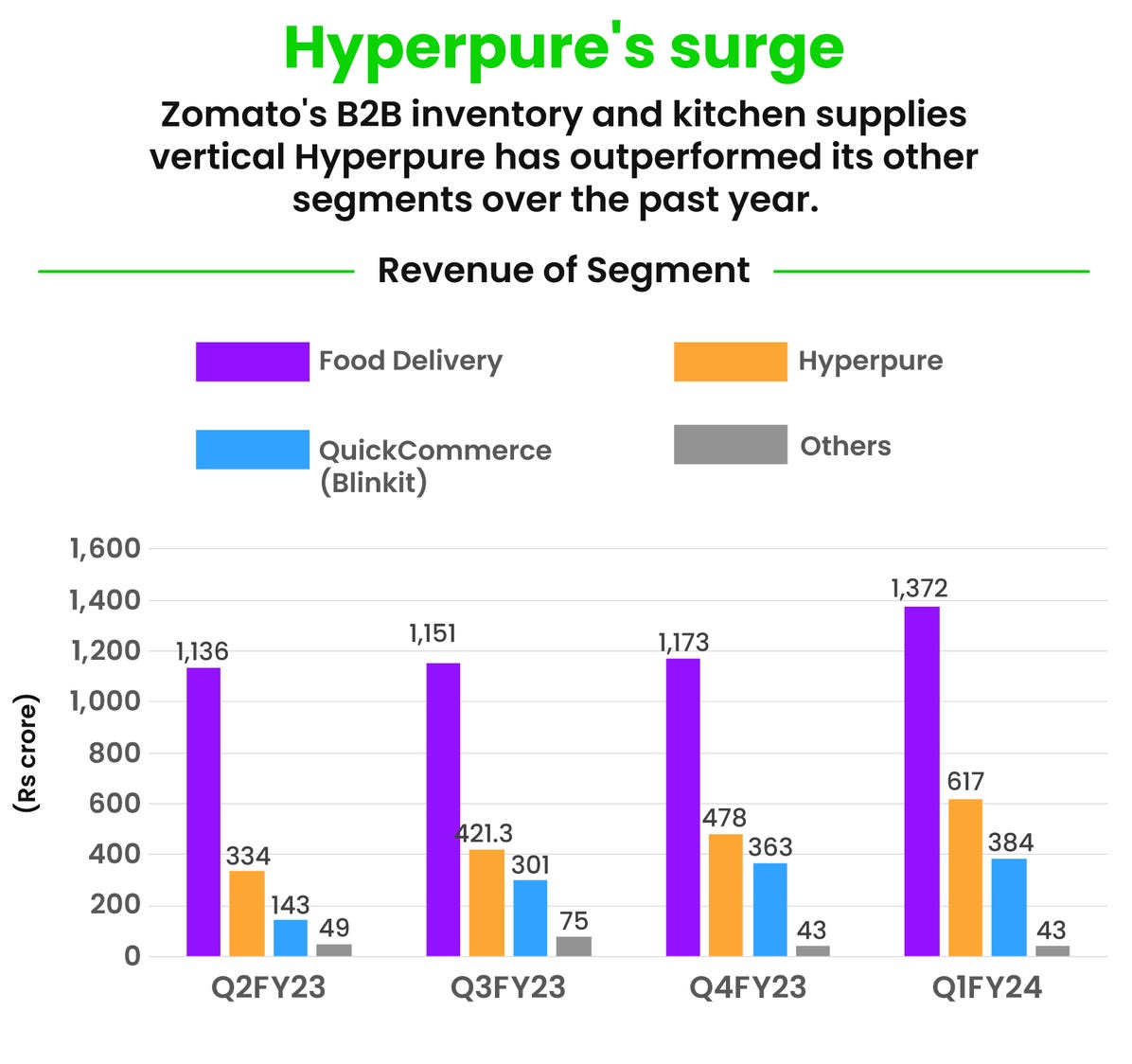

“The second biggest contributor to Zomato’s topline was its farm-to-fork inventory and kitchen supplies business Hyperpure. The company acquired this vertical back in 2018, and has grown it in the shadows of its food delivery business ever since. In the past year, however, the vertical has truly come into its own, with revenues growing 126% year-on-year (29% quarter-on-quarter) to Rs 617 crore in the quarter ended June 2023.

Zomato’s management explained that the company raised Hyperpure’s minimum order value, resulting in higher average order values (AOV). This drove the growth in overall collections and margins. During the previous quarter, the company introduced a delivery charge for orders below a certain minimum value, which saw increased collections even as the overall volume of orders dropped.

Crucially, Hyperpure’s margins have also improved significantly—from -16% to -4.7%, year-on-year. Zomato stated that the business’ margins will only improve over the next few fiscals.” - Captable Story on Zomato

In the output segment, hyperpure’s margins present an opportunity to the agri-output trader.

Cracking Farmgate infrastructure to deliver fresh produce to quality-fresh-conscious Indian consumers is no mean feat. Swiggy attempted it through 2.5L logistics player Wheelocity. Zepto is attempting through Zepto Bloom+ Dark Stores

“Zepto’s total costs were also sharply lower than the other players, it claimed. Per order, Zepto spends Rs 40-45 as last mile cost, Rs 28-30 as dark store cost, Rs 18-20 as distribution centre cost and finally Rs 9-10 of wastage per order. Those add up to a total cost of Rs 95-105 per order for Zepto, which is about 40-45 percent lesser than Swiggy Instamart’s Rs 140-145 and about 30-35 percent lesser than Rs 130-135 that Blinkit incurs as cost per order.- Source: (Money Control)

What makes these numbers depressing, despite their valiant attempts is this: Optimizing the highly-efficient-but-illegible Indian agri-output value chain is a question of tapping the human network of traders more than technological infrastructure.

Jeff Bezos famously said, “Your Margin is my opportunity” implying that by ‘removing the costs added by the middlemen in the retail supply chain’, Amazon was able to offer better prices.

In the case of the Indian agri-output supply chain, the reverse could be said with the agri-output trader having the last laugh: “Your Quick Commerce Opportunity is my margin”.

3/ Gramophone’s Journey to Profitability

That the agri-output trader will have the last laugh becomes more evident when I look at Gramophone’s recent announcement that they became EBITDA positive in July’23, after cutting down the high cash burn business in the agri-output segment.

Last week, Tauseef, CEO of Gramophone, called me to update the same and we had an interesting conversation on what it entails for the Indian agritech ecosystem.

From Tauseef’s Note and the Investor Memo shared with me:

“Gramophone’s had been an Input focused platform built on a very strong Agronomy Intelligence engine. It focused on our core and increasing the margins in the business. Gramophone has cut down the high cash burn business i.e the output segment and built capabilities in Private Labels which has enabled the company to become EBITDA positive in July 23.”

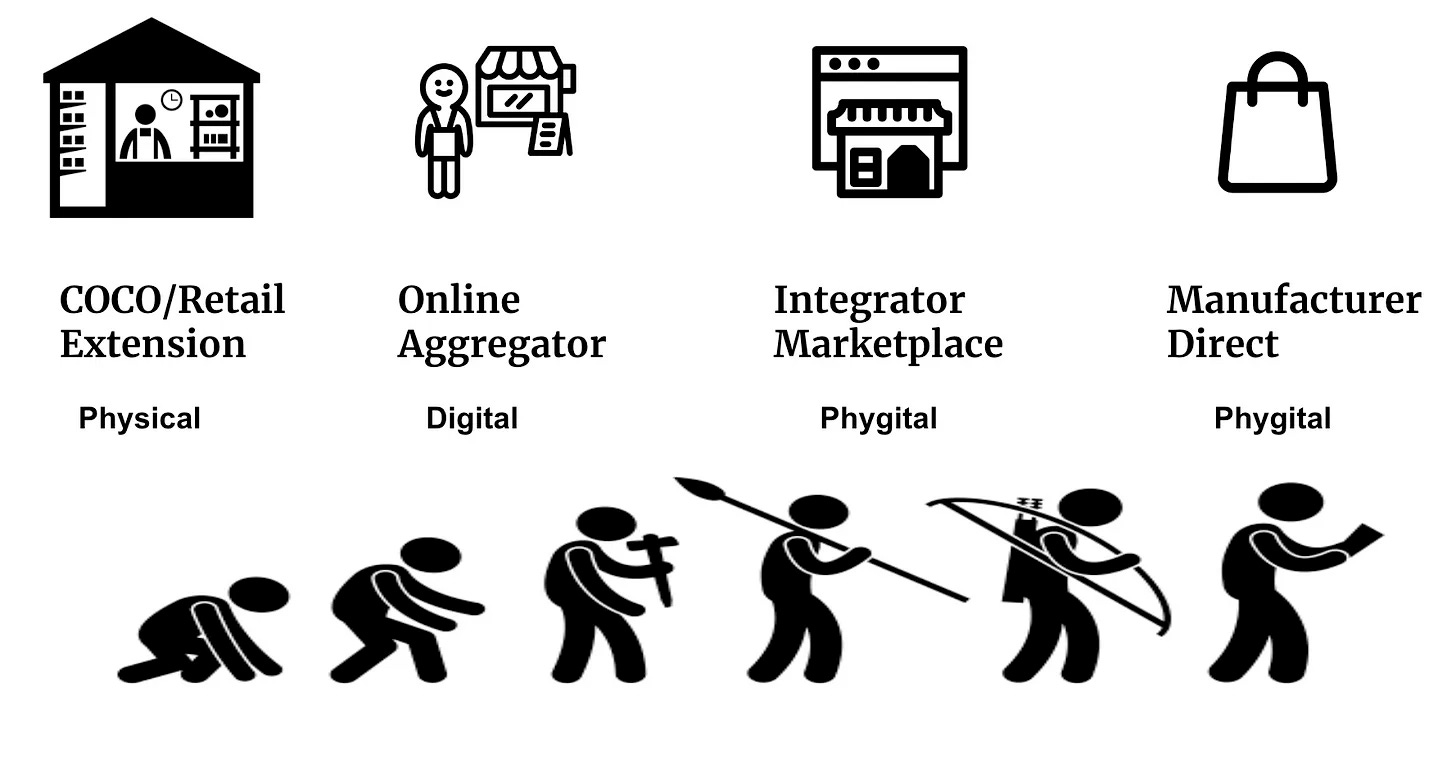

Two years ago, I compared Dehaat with Gramophone and sketched the evolutionary curve of agri-input retail. I introduced the term ‘integrator (which has now become the default vocabulary) and predicted the growth of private labels in the input business.

The agri-input agritech ecosystem in India is evolving to be a digital distributor player with a stronger digital play that will eventually build deeper relationships with farmers to help them improve their productivity.

Barring anomalies like INI Farms which received an ESG funding booster as a testament to their growth, who will bell the cat of the highly efficient (fresh F&V reaches Indian consumers faster than you think) yet informal agri-output supply chain?

With the government renewedly focusing on cooperatives (over FPOS), amidst large grain storage plans that tap into the cooperatives, the agri-output supply chain will eventually become centralized with Adanified private silos that are run in partnership with agri-output startup players acting as last-mile players across the grain, F&V and other supply chains with adequate investments in cold chains.

How far this scenario will be opposed tooth and nail by other political economy game players of farmer lobbies remains to be seen. This will perhaps be the most important political battle that will determine the future of Indian agriculture.

Let’s see:)

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.