Hello!! My name is Venky and I thank you for reading Agribusiness Matters, an endeavour to discover systems thinking in the real world - crumbling food and agriculture systems in an age of runaway Climate Change. If you like what you see, I encourage you to subscribe and receive exclusive perks - invitations to join ABM Townhalls, special discounts on ABM Publications, Global Agritech 101, 201 cohort courses, and more.

In Today’s Edition:

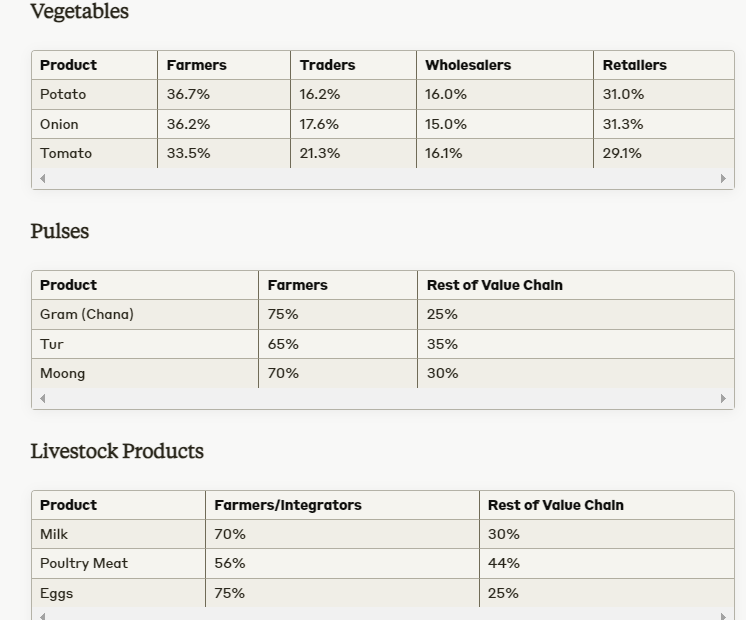

1/ RBI’s Working Reports on Tomato, Onion, Potato; Gram, Tur and Moong Pulses and Milk, Poultry, Meat and Eggs

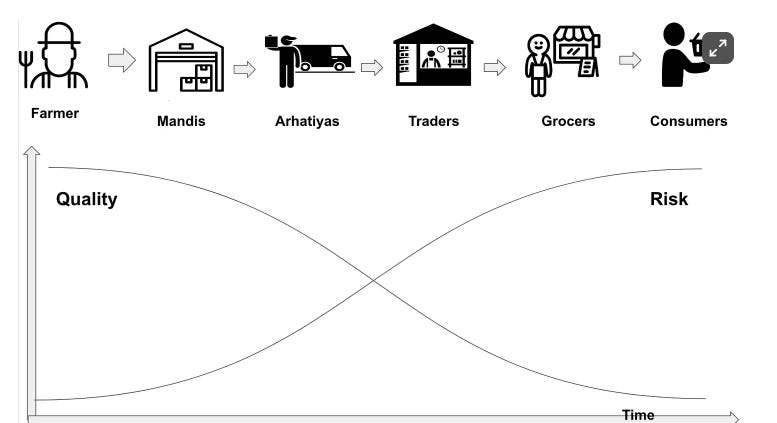

How does a zero-sum game look like in Indian Agriculture where the system chugs along with no standardisation in procurement processes, consuming unnecessary transportation costs, and hitting below purchase price by evening, benefiting the status quo with Six Sigma precision that extracts every cent efficiently?

What do you do when the operation is successful, but the patient is dead?

As long as logistics is used as the lever to control the prices of the produce, the market is never going to respect the quality of the produce and the prices are always going to be volatile.

If you can cultivate a beginner’s mind, you can read each of these reports with a fresh pair of eyes - an excellent market opportunity to create price stabilisation; create feed banks and improve fodder costs; improve productivity through R&D in varietal development and change the ground conditions for Indian Agriculture.

Among vegetables, farmers receive the smallest share for tomatoes (33.5%) and the largest for potatoes (36.7%).

In the pulses category, farmers receive a significantly larger share of the final price, with gram (chana) providing the highest return at 75%.

For livestock products, egg farmers receive the highest share (75%), while poultry meat farmers/integrators receive the lowest (56%).

Retailers generally have the highest markup in the vegetable supply chain, ranging from 29.1% to 31.3%.

The "Rest of Value Chain" for pulses and livestock products includes traders, wholesalers, and retailers combined.

2/ My Podcast on Agritech in Earthlings 2.0

In the latest episode of Earthlings 2.0, The Podcast, I spoke with Lisa Ann Pinkerton and talked all things agritech. This post by Petterson Yale is a good summary of some of the key themes I discussed in the podcast.

Do tune in and share your feedback.

3/ Jesters and the Languaging of Agritech

Jesters, since the days of Tenali Raman, have always held mirrors of conscience to the powerful. Unsurprisingly, Kunal Kamra's criticism [linked video in the link] of agritech is spot on for most parts.

Indian Agritech is going through turmoil because we are dealing with technologies that have been passed on -not built for India, in India.

When ‘most of world's climates and type of soils are available in one part or other in India’, is the criticism of technologies not built for India valid?’

When Indian consumers don't value the quality of vegetables, thanks to the cooking culture which doesnt prefer any other state of vegetables other than one which is beaten down, dunked with oil, would technologies to improve cultivation of vegetables make any difference? And so, these technologies never get embedded in the lives of farmers in meaningful ways, rarely creating businesses that are deeply aligned towards solving farmers' problems.

The root cause lies in asking a fundamental question: When does a technology empower farmers and when does it disempower them in the name of empowerment?

Soon after I shared my announcement on UAI, a wise mentor showed me how my language in that announcement carried seeds of disempowerment.

Why do we say "piloting" technologies when farmers ought to "field test" technologies? Why do we talk of farmers "supporting " technology when we meant to say that they are "validating" our technologies?

It was a powerful penny-drop moment for me. If we are serious about empowering farmers with technology, we must rethink the language we use in talking about technology.

After all, language deeply influences the microbiome of our thoughts. Have you pondered over it?

4/ India: Are the bets back on?

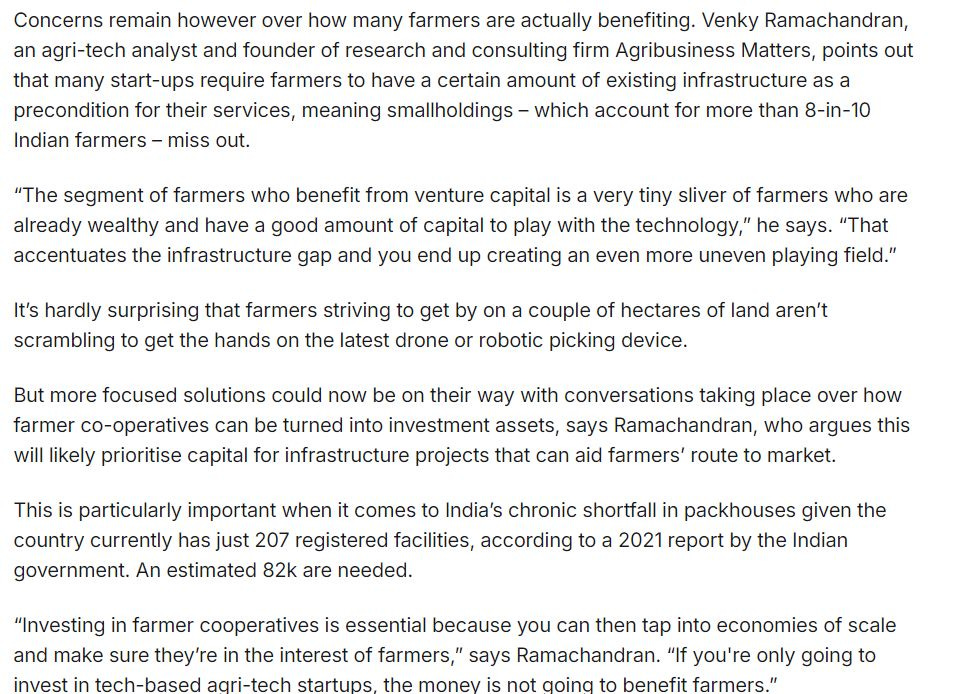

How is the Indian Agritech landscape evolving, after the last year's funding winter? Is the investment going towards the right places? I shared my 2 cents on this piece by Harry Holmes.

5/ Personal Ethics, Work Ethics and Earth Ethics

Indian thought has embedded Earth Ethics, Personal Ethics and Work Ethics in its substrate. Of course, the word "Ethics" doesn't exist as such in Indian thought.

Instead, we have a beautiful word-"Dharma" - That which enlivens myself, the other and the context is dharmic action. Unfortunately, we Indians are deeply colonised to the extent that they have created a hermetically insulated compartment between Personal Ethics and Work Ethics/Earth Ethics.

Ram from Samanvaya had shared this and I kept wondering when we would bring Earth Ethics into our board room conversations.

When those who are working on Earth Ethics are losing hope and quietly doing their bit, how do we respond to it?

I'm increasingly seeing the need to have ethics/Dharma-related conversations in the workplace as that's where they are deeply missing.

What would it take to design an Earth Ethics Action Network where key food and agribusiness players who follow Earth Ethics come together to create a strong differentiator in the marketplace, thereby setting higher standards of Earth ethics in the market?

6/ VST Tillers and Tractors Q1 FY25 Results

VST Tillers and Tractors plans to enter the US Markets. It already has a presence in 40 countries, including Europe, Asia and Africa, with international business contribution growing significantly from 4 per cent in FY20 to 13.5 per cent in FY24. From their analyst call, it is evident that they have a large landbank and could very well do managed cultivation at scale once the right collaborative partnerships are in place.

Here is a quick snapshot summary of their Q1 FY25 Results

Revenue: The company's revenue from operations decreased significantly, falling from Rs. 246.14 crore in Q1 FY24 to Rs. 190.59 crore in Q1 FY25, representing a 22.6% year-over-year decline.

Profitability:

EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization) dropped from Rs. 49.83 crore to Rs. 34.70 crore, a 30.4% decrease.

The EBITDA margin contracted slightly from 18.86% to 16.37%.

Operational EBITDA saw a steeper decline, falling from Rs. 31.71 crore to Rs. 13.38 crore, with the margin shrinking from 12.88% to 7.02%.

Bottom Line:

PBT (Profit Before Tax) decreased from Rs. 42.59 crore to Rs. 27.94 crore, a 34.4% reduction.

PAT (Profit After Tax) fell from Rs. 32.99 crore to Rs. 22.85 crore, a 30.7% decline.

The PAT margin decreased from 12.48% to 10.78%.

While we have newer Davidian players like Moonrider launching EV Tractors, Goliaths need to move faster, beyond announcing that they are ‘working on at least 10 new products including EV (electric vehicle) models.’

7/ Digicides Partnership with Truecaller

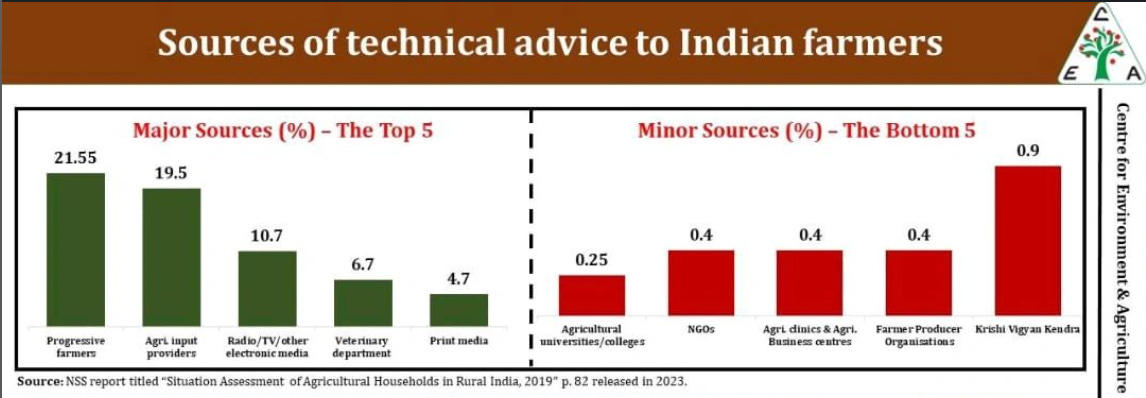

Before unpacking Digicides’ partnership with Truecaller, it is important to understand the sources of technical advice for farmers. Progressive farmers followed by private agri-input providers constitute the major sources of technical advice to farmers.

A damning indication of the institutional failure of the public role of agri-input extension services in a smallholding country abdicating its responsibility to the private sector.

-Only 2 out of 100 farmers receive agricultural advisory through government machinery.

-55 out of 100 farmers are served advisory through private enterprises in multiple ways.

The influence of agri-input providers and channels has led to the unintended consequence of agri-input marketing being infantilised as Pran powerfully put it many moons ago.

TrueCaller partnership with Digicides is interesting as it shifts the needle of the industry towards responsible and hopefully accountable agri-input marketing.

“Most of the Customers that we work with, use telephony (pre-recorded calls, call centres) at scale. These calls are sent through random, unknown numbers and therefore the calls never present themselves with an upfront context, the pickup ratio is poor and therefore the impact is poorer.

We have been speaking with the Truecaller team for quite some time. The usual pricing at which they offer their Caller identification service is often not justifiable for most agri companies + their standard package structurally is not fit for the Agri industry

We are now onboarded as an aggregator for the agri-industry by Truecaller and are given pricing which are affordable (30% lesser) and packaged for small used cases as well. This can now be passed on to all our Customers.

It automatically increases usage, the pick up ratios become better and is a win-win for all.” - Dean Dutta, CEO, Digicides

Whitelabeling any number into a branded handle throws interesting challenges. What happens when a competitor labels a company-branded call as spam? How would truecaller discern?

Dean Dutta responded to my question thus:

“The solution overrides it. In this case, you don’t have to identify spammers. You can still mark the call as spam but the offering states the name and identity of the beholder upfront.

You’re not duped into picking up a call from an unknown number and then realising that it is something that doesn’t interest you. The company also saves the picked-up pulse which gets charged to them even if they disconnect it in 2 seconds.”

Agri-Input marketing has largely been illegible. I hope such market-driven endeavours bring much-needed transparency and accountability to this sector.

How happy are you with today’s edition?

I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.