Sunday Reflections (Agri Fintech, Farmer Protests)

In doing what I am doing, what am I really doing?

Dear Friends,

Greetings from Hyderabad! I write Sunday Reflections in pursuit of one question - In doing what I am doing, what am I really doing?

This free edition goes out to 27294 subscribers in Substack and LinkedIn, up by 234 last week.

Orientation: My name is Venky, I write Agribusiness Matters to find a way out of the central conundrum that characterizes Agriculture today in the nick of technological transformation: Sustainable Agriculture isn’t profitable. And Profitable Agriculture isn’t sustainable. Feel free to dig around the archives, if you want to get a flavor of my previous agribusiness writings.

In this edition

Short and hopefully sweet version of my subscriber-only essay, “Indian Agri-fintech Comes of Age”.

My Podcast Episode with Mekhala Krishnamurthy on Farmer Protests

A Favour to Ask

Indian Agri-Fintech Comes of Age

On Friday, I published my long-form subscriber-only essay: “Indian Agri-fintech Comes of Age”.

It’s a fairly long and dense piece with tons of hyperlinks and numbers substantiating every adjective I used in the essay. Here is the compressed version.

After a few cold starts, Indian Agri-fintech has finally come of age, thanks in part to NABARD signaling “skin in the game” to LPs queuing to join the agri-fintech party. How do we make sense of the emerging Indian agri-fintech story? How about we start by understanding the evolution of agricultural credit?

The historical arc of Agricultural Credit in India, at a broad helicopter-view, can be divided into three phases:

A) ‘Social and Development’ Led Phase (1969-1990)

B) ‘Profitability and Rationalisation’ Led Phase (1991-2005)

C) ‘Debt-Relief and Debt Waiver’ Led Phase (2005-Present)

At a directional level, credit is morphing, as one RBI internal report put it, from ‘credit in agriculture’ to ‘credit for agriculture’. Beyond semantics, what that means is that, if you put the numbers in perspective, while direct credit is declining, indirect credit has been increasing.

Now, when you are talking of the evolution of agricultural credit, at some point, we have to grapple with a question that often gets glossed over - Which Indian farmer are we really talking about?

Harish Damodaran’s insightful commentary on the missing agricultural middle class gave me a perfect springboard to explore the contours of this question, especially in context with the evolution of agricultural credit.

Essentially, I framed the evolution of the agricultural credit scene in India as a fulcrum to place under inquiry the following question: Can agrifintech startups like Jai Kisan fulfill their promise to “serve un/under-served rural Indian?”

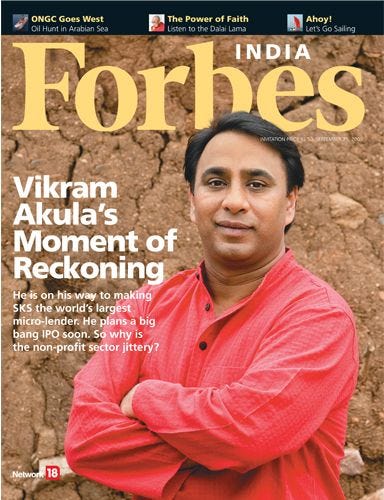

If you believe in history rhyming itself, you might perhaps recollect this image.

Let me get this straight. This isn’t about pouring cold water of pessimism (after all, we know what happened to SKS Microfinance) on a question that brims with promise.

Going by their announcements, Jai Kisan has been “disbursing close to Rs 8 -12 crore (US$ 1.13-1.70 million) in credit monthly, with average ticket sizes ranging from Rs 50,000 to Rs 1 lakh (US$ 709.32 to 1,418.64)” and want to do more.

“It expects to expand its services to eastern and north-eastern parts of India in next six months and take the total loan book size to Rs 150 crore (US$ 21.28 million)”

Perhaps, going by the iterations they have done on their business model, they have come a long way. But, can it really resolve the complexity required to serve multi-term and multi-purpose credit requirements of rural Indians? What can go wrong?

You will hear more from me on this question when I release the concluding part of my subscriber-only analysis on Jai Kisan. I am also planning to do an Ask-Me-Anything session with subscribers on my Jai Kisan analysis and take questions. If you are a subscriber, you will be notified about it. I am excited to see how that will turn out.

My Podcast Episode with Mekhala Krishnamurthy on Farmer Protests

I don’t know about you.

As a part-time musician and an occasional oral storyteller, I cannot help but hate to hear my own voice. When I learned that the team at Tenacious Ventures has done a great job in editing my 120 min long chat/rant with them to 30 minutes, I was relieved that whosoever listens to this will only have to tolerate me briefly.

Thankfully, I have been hearing nice things about the podcast. The podcast personally helped me delve deeper into a few of the recurring pet themes I have been exploring in this newsletter.

1) Market Infrastructure comes before Technology 2) Middlemen hedge farmers against inefficient market infrastructure. 3) Agribusiness is Wicked and needs to be understood from the lens of Complexity Theory.

What made this podcast episode an honour for me was a chance to get featured alongside the wondrous Mekhala Krishnamurthy, an agrarian scholar whom I hold with deep respect for her body of work.

Do give it a listen if you can spare 30 minutes and give me your feedback.

A Favour to Ask

I posted this tweet shamelessly the other day.

along with this.

I want to fill up my “What Subscribers Are Saying” page with all kinds of feedback, not just from subscribers, but from everyone reading this newsletter. I don’t want to feature only the good ones. If you have anything to say about my newsletter, good or bad, I invite you to click on the tweet above and share your 2 cents.

I promise you that I will feature them no matter how critical your feedback is.

That’s all for today. Enjoy your Sunday.

Cheers

Venky