Dear Friends 👋 ,

Greetings from Hyderabad! I write Sunday Reflections in pursuit of one question - In doing what I am doing, what am I really doing?

This free edition goes out to 27508 subscribers in Substack and LinkedIn, up by 214 last week.

Orientation: My name is Venky, I write Agribusiness Matters to find a way out of the central conundrum that characterizes Agriculture today in the nick of technological transformation: Sustainable Agriculture isn’t profitable. And Profitable Agriculture isn’t sustainable. Feel free to dig around the archives, if you want to get a flavor of my previous agribusiness writings.

In this edition:

Short and hopefully sweet edition of my subscriber-only essay, Making Sense of Jai Kisan’s $30 Mn Raise.

Making Sense of Jai Kisan's 💰30Mn Raise

On Monday, I published my long-form, subscriber-only essay, Making Sense of Jai Kisan's 💰30Mn Raise. It was a follow-up piece to my earlier subscriber-only essay, Indian Agri-fintech comes of age (which I summarized here for those who haven’t yet joined the Agribusiness Matters community).

To make sense of Jai Kisan’s fund-raise, you need to be aware of two key developments happening in the background.

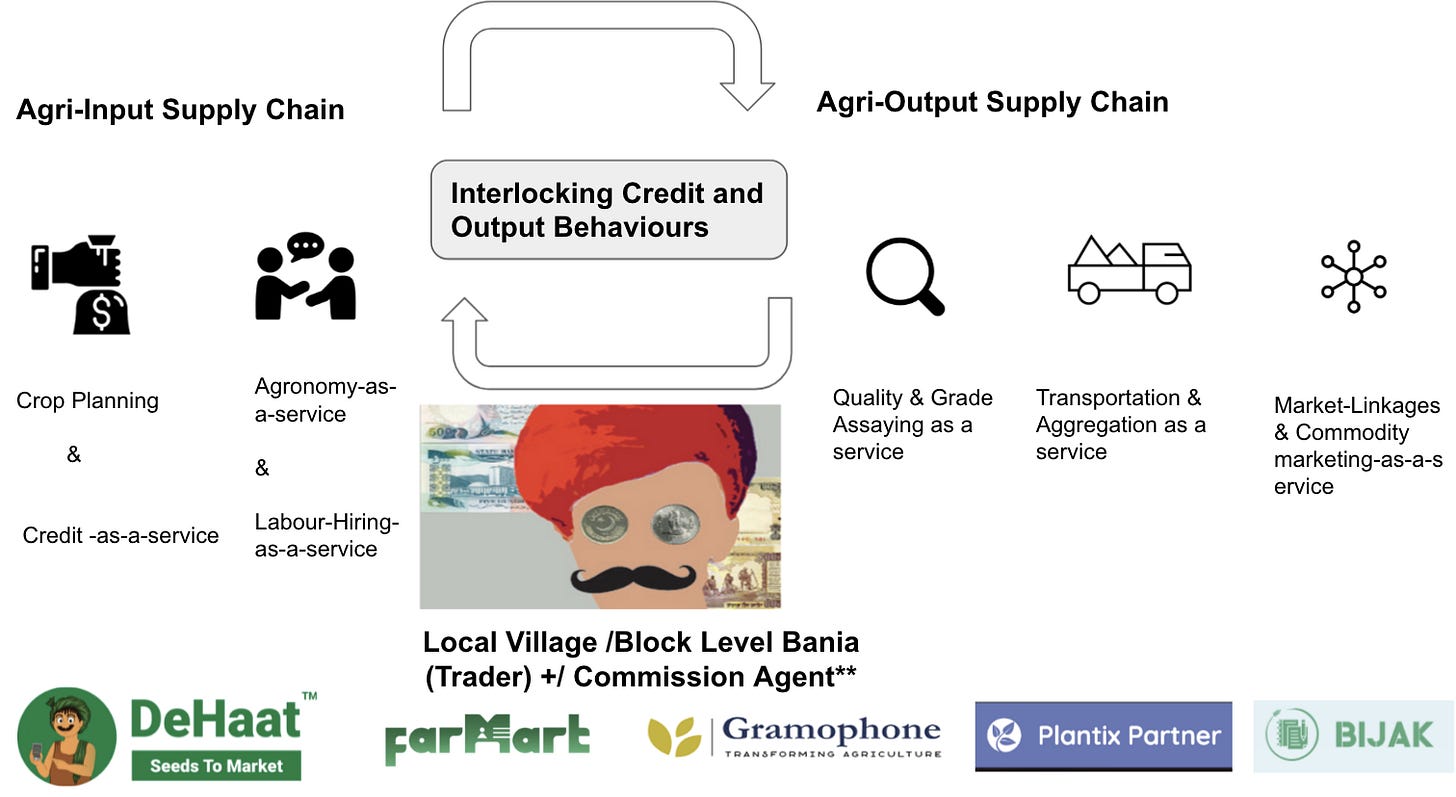

1) Most Indian Agritech models are converging towards the B2B2C model, with the agri-input trader in the center.

I wrote about the evolution of agri-tech business models, from aggregator to integrator models, here and mused about its implications here, while outlining the need to make sense of agribusiness from the lens of complexity theory. 2) Credit is evolving from ‘Credit in Agriculture’ to ‘Credit for Agriculture. If you put numbers in perspective, direct credit is declining, while Indirect credit has been increasing.

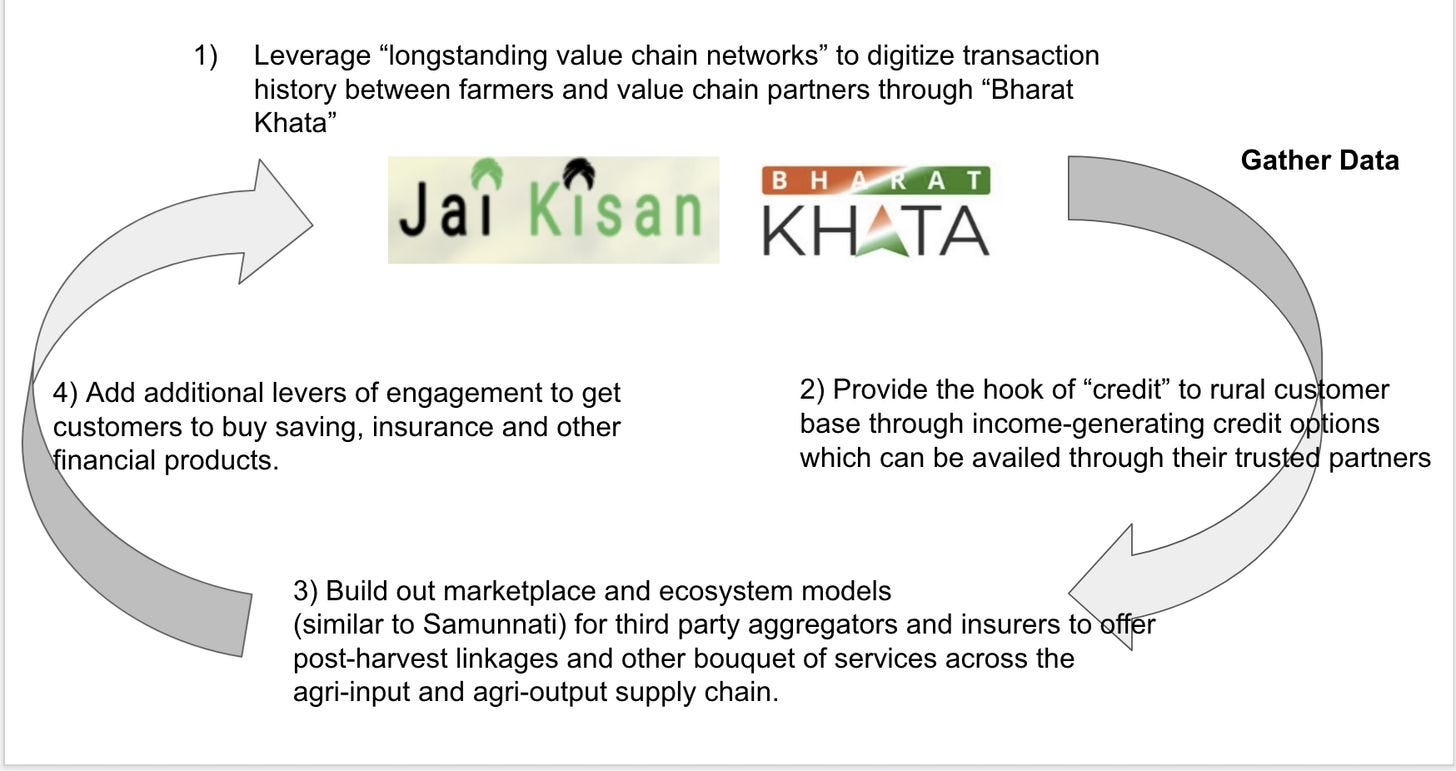

When you overlay these two facts with Jai Kisan’s flywheel, you start coming closer with the glimmer of truth.

For starters, you start to realize the wisdom behind this meme.

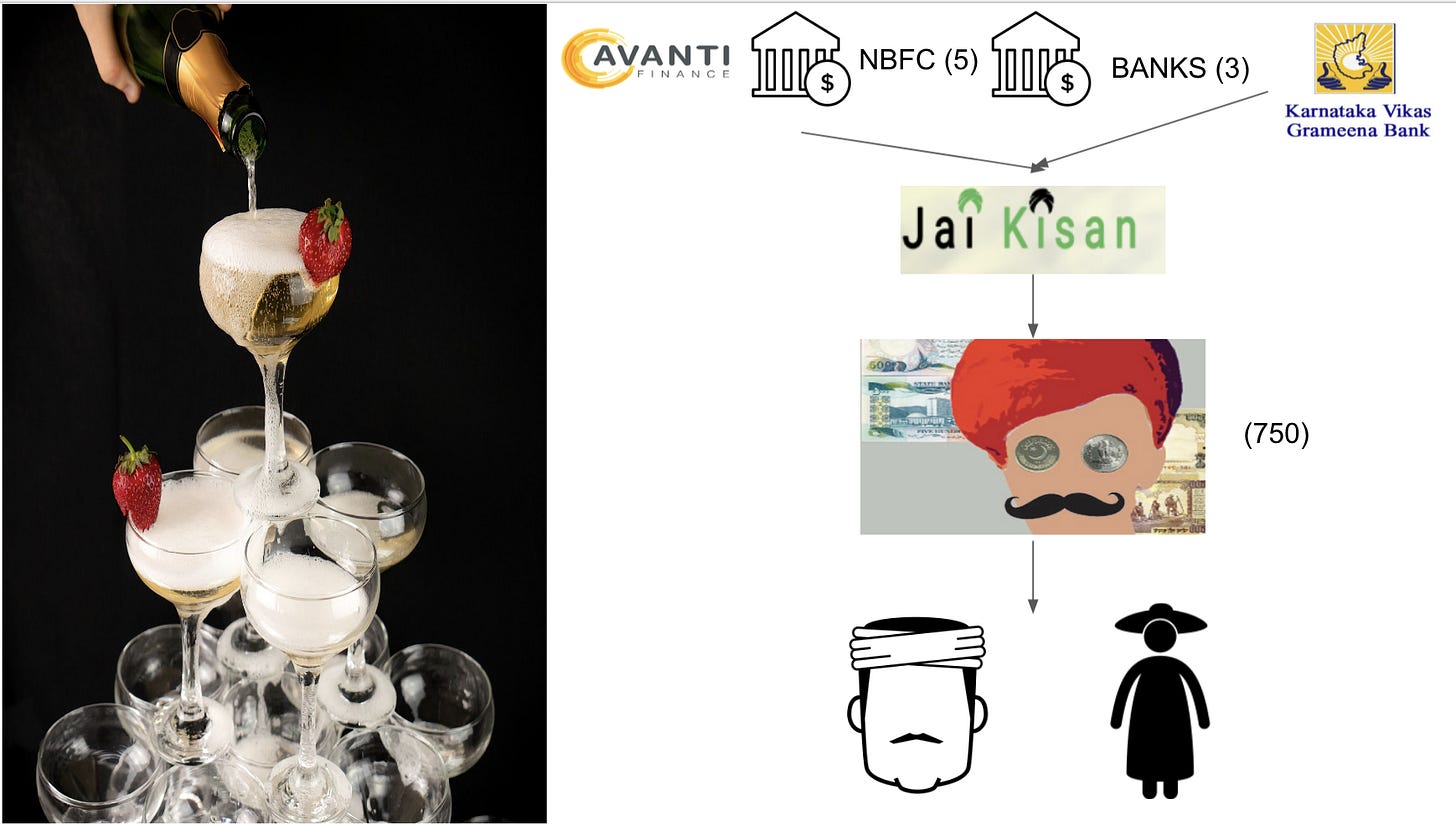

Lest you dismiss my childishness for serious matters pertaining to agricultural credit, here is the full picture from the essay, shared here without the 1000 words, that shows exactly how sippers are sipping ‘lending’ credit while adding their costs of serving the credit.

Of course, these costs are going to get competitive, when further players jump onto the agri-fintech wave. Like this one, for instance.

The key implication to watch out for in this metaphorical agri-fintech game of champagne and sippers is what it does to address the beer game problems that are endemic in the agri-input supply chain.

Sadly, not many people are familiar with and understand the real consequences of beer game problems in the agri-input supply chain and its downstream effects in the way it plays havoc with the lives of farmers.

And when you absorb the costs of serving credit with margins from the sale of agri-inputs, the implications of beer games are even more profound.

In response to my two-part essays, I received one important piece of feedback from a friend:

While the first part of the essay touched on the agricultural credit scene at 50K feet level, the second part rapidly came down to the ground at 50 feel level, without explaining to the readers what is happening in between.

It’s a fair criticism, and I realize there are so many other angles to be covered if we have to make sense of the emerging agri-fintech scene. I will be covering them in the coming weeks. Stay tuned.

Enjoy your Sunday!

Cheers

Venky