Dear Friends,

Welcome to yet another podcast edition of Agribusiness Matters.

It has been more than 150 years since Dmitri Ivanovich Mendeleev put together the the first form of the periodic table to organize elements and predict the elements that were yet to be discovered. Although Scientists tell us that it is time to turn the table upside down with discovery of newer elements that might challenge the schematic integrity of the periodic table, the comforting familiarity of the structure is hard to resist even for scientists.

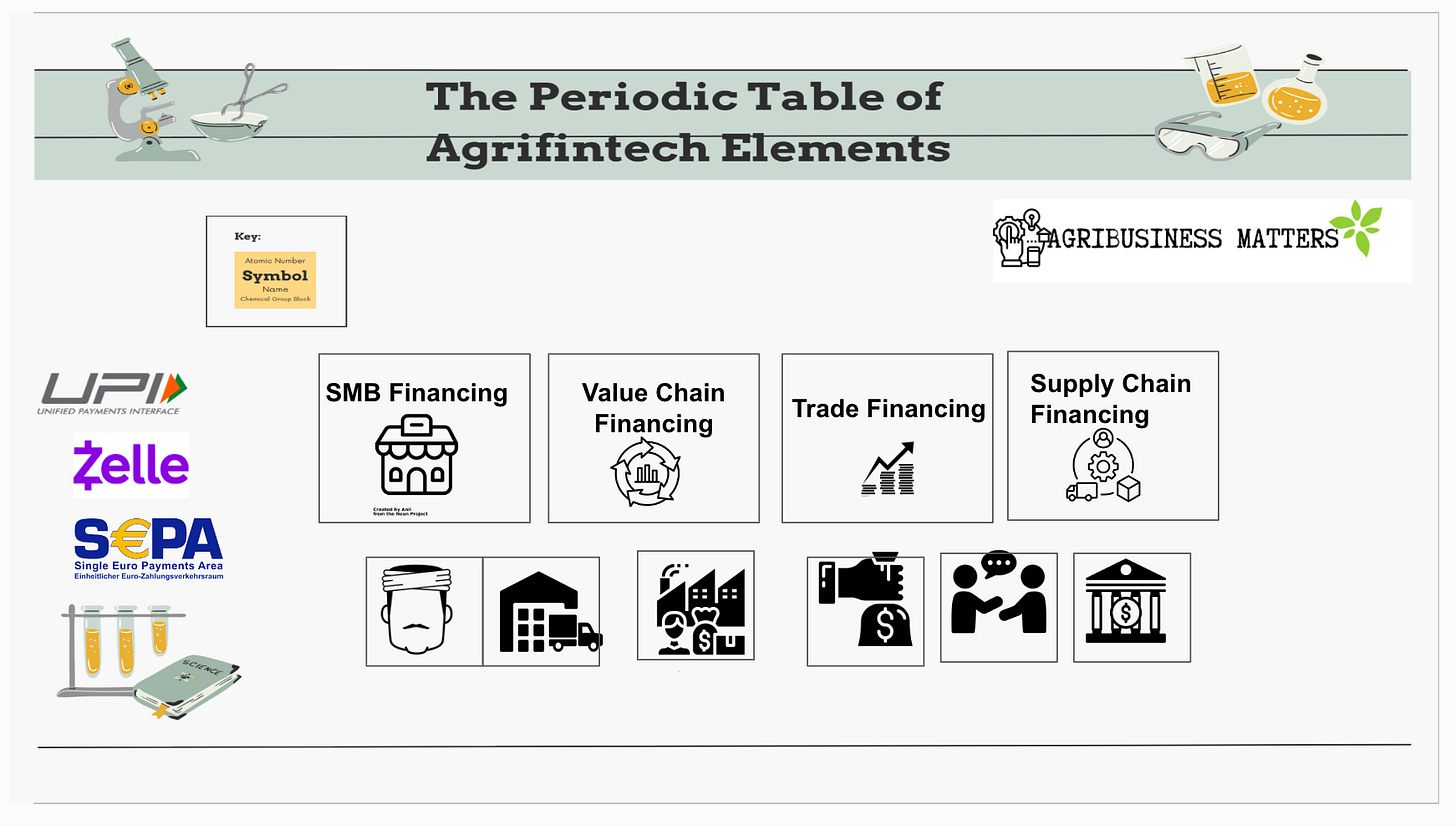

The more I talk to Niall Haughey and his work of building Financial IP in his innovation studio, The Graze, I wonder if I should go ahead and build the periodic table of agrifintech elements based on the investment and trade activities happening in our midst.

Think about it.

The problems of providing financial solutions for modern food systems have not really changed much over the last few decades. As Niall points out in this wonderful conversation, the only thing that is new and perhaps revolutionary is this: We now have better tools for data aggregation.

In this conversation we recorded few weeks ago, Niall and I probe into his latest report Agrifintech 2022 and cover the difficult trade-offs between building financial solutions and financialization of food systems. We also explore why Africa received a paltry sum of funding (640 M) as opposed to Asia ($8.6 Bn) and America (13.6 Bn USD) ; why does Europe dominate the table when it comes to Sustainability funding and finally the evolution of data business models in agrifintech ecosystem.

Timeline of the conversation:

0.04 Introduction – Who is Niall Haughey?

1.04 What does Graze do?

5.41 Why do we need modern financial solutions for modern food systems?

10.47 How do we prevent unregulated financialization of the food systems in which farmers end up facing the brunt despite taking higher risk than anyone else in the system?

13.37 Despite its vulnerability to Climate Change, what makes investors slightly more resistant to investing more in Africa?

19.17 Why is Europe attracting more sustainability deals than in America?

22.38 How are different geographies - LATAM, APAC, Africa, America - embracing agricultural finance and are there are any interesting lessons when you compare the adoption trajectories?

25.49 How the structures of financing are evolving across different markets?

27.46 In Agrifintech 2022 Report, Niall writes, “For the first time, India surpassed North America as the top region in USD investment and maintained its top spot for deal volume with 23 deals.” We explore the reasons from both perspectives-a slowdown in the US and growth in India.

31.06 What are the things that are changing in the financial system vis-à-vis what is not changing?

33.39 Evolution of data business from an agri fintech perspective

36.12 Why are agrifintechers more attracted to agriculture rather than finance?

I hope you enjoy the conversation.

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.