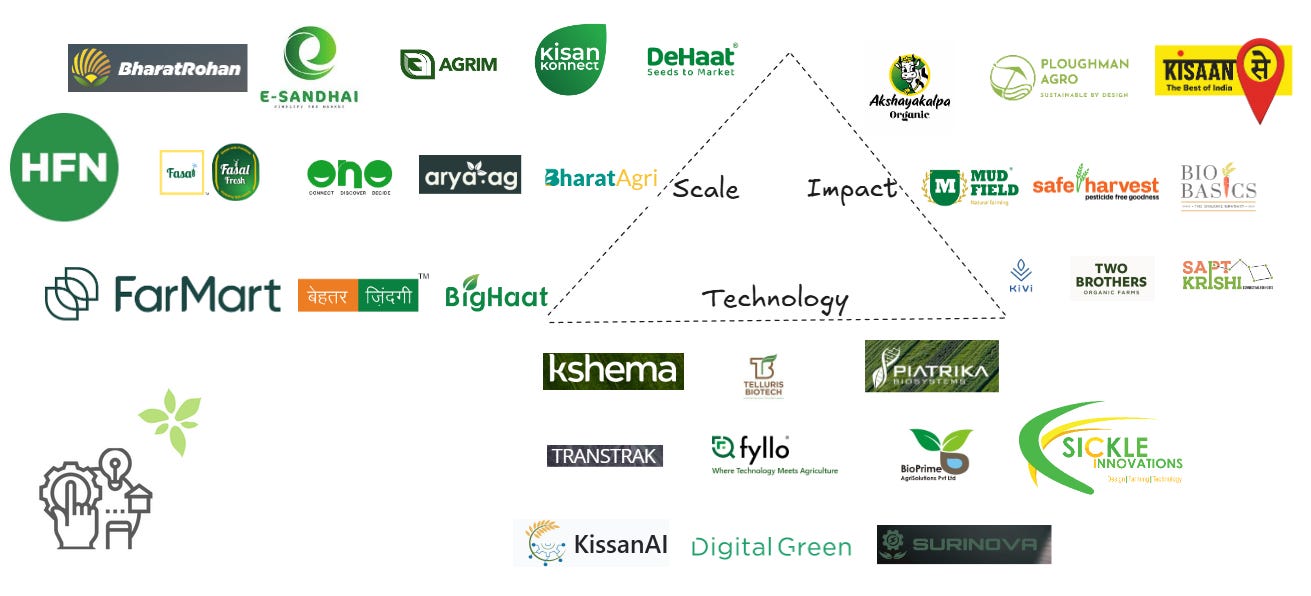

The Three Types of Agritech Startups

In smallholding agritech contexts, there are only three types of agritech startups: a) Impact DNA Kind b) Scale DNA Kind c) Technology DNA Kind

Whenever I read the likes of Inc42 making generic listicles about Indian agritech startups, I am left with a strange dilemma: Should I laugh or cry at their naivete and zero situational awareness of the ground reality?

How can anyone list down agritech startups without any criterion of what constitutes a disruption in the first place? And what disruption are we talking about? The one which leads to the enshittification of agritech?

Of course, my बीभत्स (read as emotional triggers) with Inc42 has a long chequered history. In the past, it has evoked just enough irritation to trigger my creative juices.

Truth be told, I've resisted doing generic agritech listicle pieces with every fibre of my being because I deeply care about the agritech ecosystem and it would be unfair to showcase only a handful of startups.

How can you showcase a few promising pearls when you have fallen in love with the ocean?

The list isn’t important, especially when we refer to startups who may or may not survive the vicissitudes of time and uncertainty. But the framework that builds the bird's-eye view of the landscape IS.

TLDR: If you are short on time, download the image and meditate on the triangle that categorizes the three types of Indian agritech startups. And then come back with any question on why I included each of the company in the appropriate side of triangle.

The framework shapes who will appear on the list and what problems they will pursue. And that’s what I want to leave you with.

In the ocean of Indian agriculture, agritech is a droplet with great potential. However, it still needs to discover its moorings to create the kind of Impact that deserves the word “disrupt”.

Let’s talk numbers. How do we contextualize the role of agritech in Indian Agriculture? Time for a fourteen-pointer short data thread.

1/ Indian Agriculture has 40 million full-time middle-class farmers who derive their income solely from Agriculture and 100 million part-time farmers who do circular migration: They migrate to various cities for construction and other informal work while relying on their family’s (women, children and elders) agricultural labour during off-seasons. They migrate temporarily during village festivals and harvest seasons to help their families and return to cities to continue with their informal sector jobs while sending money back in regular intervals.

2/ Most 100 million part-time farmers consider agriculture a low-risk, minimum-return occupation (the equivalent of LIC in the Indian financial world). They grow field crops such as rice and wheat, which are largely supported by the MSP regime and the supportive ecosystem that continues to exploit groundwater.

3/ In a country like India, it is a mephistophelian challenge to get accurate data that can be trusted. If you look at the current data on paddy and wheat cultivation, based on back-of-the-envelope calculations, it comes to around 23-25 million rice farmers and 15-16 million wheat farmers.

4/ Barring a few agritechs that are helping paddy growers curtail NO3 emissions (from overuse of fertilizers) and Methane emissions (from anaerobic rice cultivation), providing mechanisation products/services and selling grade-conscious wheat to dry commodity aggregators, Indian agritech is largely not focused on rice-and-wheat crop growers. However, this could change as more people discover that India extracts more groundwater than China and the US combined and could run out of groundwater by 2030 if the status quo persists.

In 2020, India's annual groundwater extraction was approximately 244.92 billion cubic meters, exceeding the combined usage of the U.S. and China. 5/ You can categorize Indian Agriculture into four buckets a) Field Crops (Cereals, Oil Seeds, Pulses, Cotton, and Sugarcane) b) Horticulture Segment c) Livestock Segment d) Fisheries.

6/ Between 2011-2023-24, a) Field Crops have grown at 1.5 % b) Horticulture has grown at 4% c) Livestock Segment has grown at 6-7% d) Fisheries have grown at 9-10%. (Data Source: Ramesh Chand, Niti Aayog at the recent NABARD Post-Budget Webinar).

7/ Barring the field crops segment, the agritech ecosystem (whether it is the formal kind or the informal) has significantly contributed to the growth of each of these three buckets.

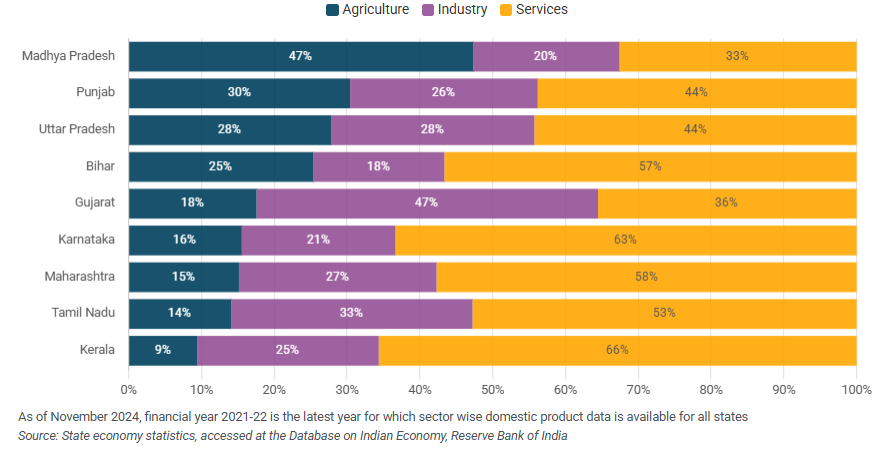

Output of ‘fruits & vegetables’ has increased from ₹287.4 thousand crore in 2011-12 to ₹434.7 thousand crore in 2022-23 at constant (2011-12) prices (Data Sources: MOSPI 2023-24 data)8/ Let’s now contextualize the role of agritech from the vantage point of Indian states. As I’ve written earlier and substantiated at greater length, the Indian Agritech ecosystem is currently limited to those states which have liberalized agricultural trade to a certain extent or remained indifferent to the diverse agricultural transactions that are happening in farm gates and other trade sites.

9/ While the states of Bihar, Madhya Pradesh and Gujarat fit the former category, the states of Maharashtra, Rajasthan, Karnataka, Tamil Nadu, and Telangana, in my opinion, fit the latter category. Note the operative nuance here: To a certain extent.

10/ While states like Kerala (Probable Cause: Gulf money has disrupted agriculture), Punjab, Haryana (Terminally stuck in Cereal Hamster Wheel and unable to diversify) and Uttarakhand (where agriculture is increasingly getting abandoned for reasons I am yet to find out) have had almost zero growth over the last decade, states like Madhya Pradesh, Karnataka, and Telangana have seen good growth due to diversification from rice, wheat and moved towards horticulture and livestock. (Data Source: Ramesh Chand, Niti Aayog at the recent NABARD Post-Budget Webinar).

11/ Telangana, Madhya Pradesh, Chhatisgarh and Tamil Nadu have shown significant growth in field crops due to the expansion of irrigation lands. (Data Source: Ramesh Chand, Niti Aayog at the recent NABARD Post-Budget Webinar)

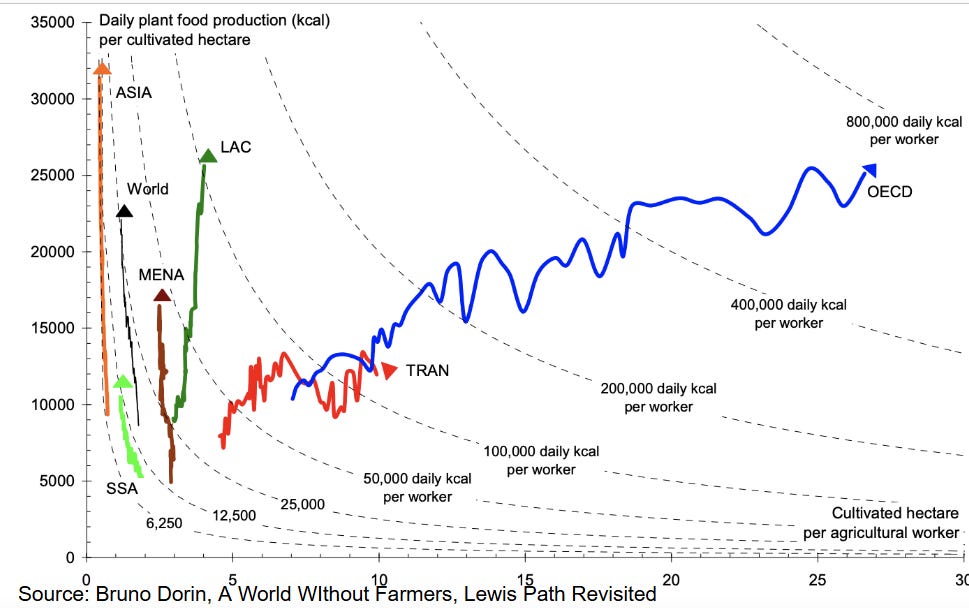

12/ The real challenge facing Indian Agriculture is this: How do we improve the productivity of per-unit workers in Indian Agriculture? As I’ve elaborated in “What is the future of agriculture”,

“..while the gap in land productivity between Asia and the rich countries has more than closed, this is not true of the gap in labour productivity, which has continued to widen tremendously.”

13/ At the end of the day, if we want to improve farm labour productivity, there are only two ways:

Intensification: (with irrigation, fertilizers, HYV, pesticides, etc) to get higher yields per hectare

Motorization (with tractors, combine harvesters, drones) to crop more land per farmer

14/ The fundamental question when dealing with smallholding agricultural technologies is this: When the yield gaps between Asia and OECD countries are closing down, can we subsidize intensification and mechanisation technologies that increase labour productivity per farm worker?

The Smallholding Agritech Trilemma

If you want to do a Harry Potter-style sorting hat exercise for the smallholding agritech ecosystem, you could categorize startups, based on their strategic vectors, into three buckets viz., a) Scale b) Technology c) Impact.

What do I mean by strategic vectors? Let’s wear the hat of an Indian agritech founder.

If you are a founder wanting to leverage agritech to solve your customer’s problems in smallholding contexts, your fundamental strategic trade-offs could be essentialized thus: Pick 2 of 3 - Technology, Scale and Impact. You CANNOT pick all the three unless you want to delude yourself.

In other words, Every agritech startup has one of the three: a) Technology DNA b) Scale DNA c)Impact DNA.

If you have Technology DNA, you strive towards making hard tradeoffs between Scale and Impact. If you have Scale DNA, you strive towards making hard tradeoffs between Technology and Impact. If you have Impact DNA, you strive towards making hard tradeoffs between Technology and Scale.

The Definition of Impact here is agnostic of “scale”. It is NOT a downstream property that is an outcome of scale or data. If you are working directly with smallholding farmers, bearing the first-mile costs without any farm intermediaries or local aggregators, you have Impact DNA.

When most of the funded players in the Indian agritech ecosystem have scale-based DNA, you have dared to walk the road less travelled! I have a soft-spot for Impact-DNA agritech startups precisely for this reason.

If you are a founder with Impact DNA, your definition of scale will be vastly different.

Impact-focused non-profits are typically bound to a particular geography and focus on creating Impact in their localised ecosystem. Their business model cannot be scaled outside that terrain as their solution has been deeply customized for their bioregional landscape.

Impact-focused for-profits have been able to build their business model modular enough to transport it across different bioregions. Akshayakalpa is a classic case in point.

Impact-DNA is the rarest species and going by its nature, it largely requires patient and donor capital. Most of the impact-based DNA players are location-bound, chasing illegible problems such as soil health, farmer empowerment and wellness that are not easily measured in definite terms to attract follow-on funding.

Few Impact-DNA agritech startups hope to find their footing in Carbon and Biodiversity land. The blueprint for native Impact-DNA players is not there yet and companies are scrambling to find the right path.

If you are going to be truly Impact-DNA company, you would be wary of selling anything to farmers. You would largely bridge farmers and consumers and walk through the precarious risk chasm between the two parties.

What about Scale-DNA agritech startups?

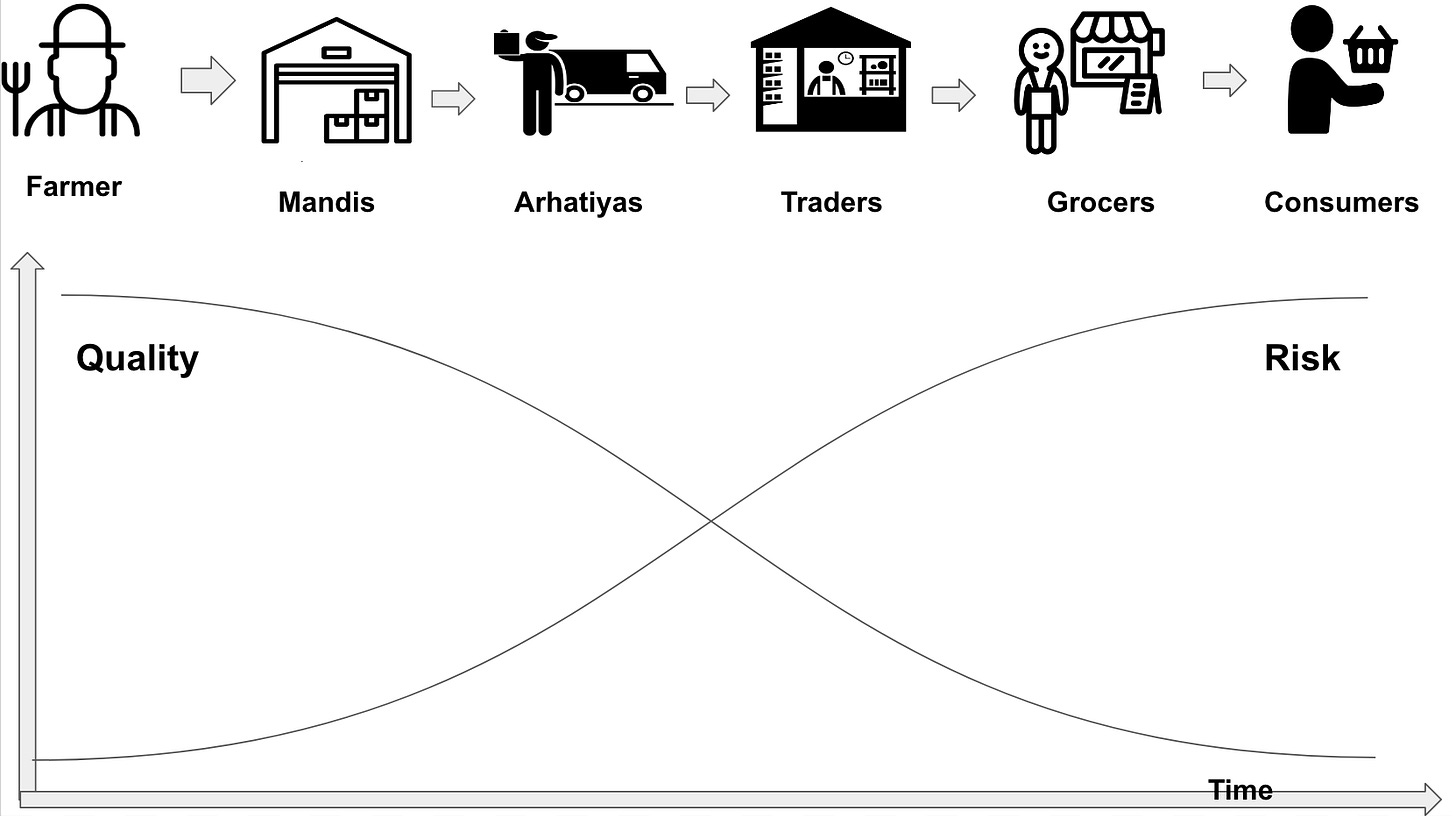

If you are a scale DNA company, you will be working with aggregators that share your risk of walking through the precarious chasm between farmers and consumers.

Scale-DNA startups start working with intermediaries before they learn to work directly with farmers. Impact-DNA startups start working with farmers before they learn to work with intermediaries.

Scale-based DNA agritech players have found their sweet spot in the middle of the value chain where value aggregates under current suboptimal market conditions between Davidian farmers and Goliathan large agribusinesses where traders, wholesalers, arhtiyas (commission agents), dealers, distributors sit.

Currently, most of the scale-based DNA players are in a race to show their stakeholders and investors that they can be profitable businesses, secure further funding, and aim for a bigger scale. Scale-DNA needs stronger flywheels of data and distribution and commerce and credit to keep the scale of ambition growing.

Let’s be clear.

Scale is the primary mover that can unlock newer forms of aggregated value creation with the help of technology through emerging models such as managed farming and farming-as-a-service models.

What about technology-DNA agritech startups?

They are as rare as Impact-DNA agritech startups in the Indian context. I have written at length about the challenges AgBiotech companies face in undertaking their arduous journey from lab to market in India’s market environment.

The lack of native agribiotech companies in India has paved opportunities for several global players to make ambitious JV/collaboration plans and enter the complex Indian market, whether it is Mosaic for value-added products fertilisers or Ricetec for hybrid rice seeds or OCP Nutricrops for Triple Super Phosphate.

Internet-Tech and SaaS players can ride the DPI +/ AI wave to adapt themselves to the evolutionary pressures of technology commoditizing rapidly than they can catch up.

At the end of the day, it’s a hard game for agritech companies to discover their moorings in the challenging world of Indian Agriculture to survive and make the hard-trade-offs navigating Impact, Scale and Technology.

No matter what DNA you choose, you have to survive long enough to play a twenty-year game and build your legacy! And that’s why I focus my energies on agritech ecosystem engineering because it’s quite brutal out there.

Let’s hope the current crop of Indian agritech startups gather enough strength to play this long game and create a dent in the challenging universe of Indian Agriculture.!

That’s the best we can do for our children dreaming of better food and agriculture systems in an age of Climate Crisis! I am doing my best. What about you? Does this framework make sense? I am all ears.

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.

Interesting bucking of agritech startups. Great read