Fox Vs Hedgehog Revisited: Who Will Win the Indian Dairy D2C Market?

Country Delight/Sid's Farm/ Akshayakalpa: Who will win the Indian Dairy D2C Market?

In Today’s Edition:

State of Agitech - 18th August 2024

Ministry of the Future

1/ Fox Vs Hedgehog Revisited: Akshayakalpa/Sid’s Farm/Country Delight - Who will win the Indian Dairy D2C Market?

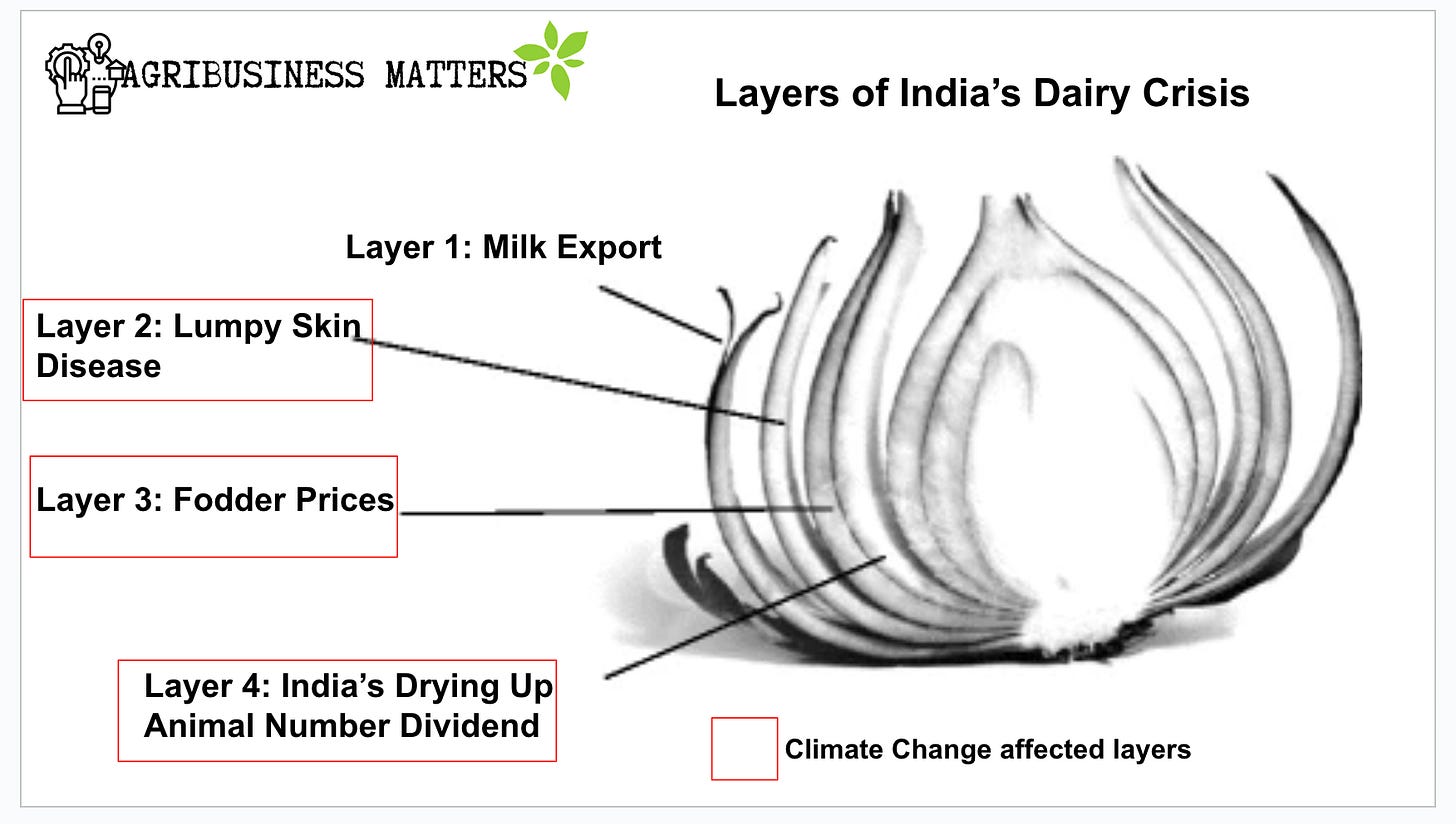

When you understand the impact of Climate Change on the Indian Dairy ecosystem, amidst clarion calls to curb methane emissions, you might, perhaps, acknowledge the complexity at play and belt out that cliched chorus line, often sung in viral, oral cultures - Indian Dairy Sector is not for beginners!

In 2016, emissions reported from enteric fermentation - natural process in ruminants where microorganisms called methanogenic archaea present in the rumen of the animals ferment food and fibre into simple sugars that the animal can use for energy - were 222.6 mtCO2e, amounting to 73.5% of total methane from all agricultural sources and about 7.8% of total emissions from India. (Data Source: Down to Earth: State Of India’s Environment 2024)

Should the world’s largest milk producer (221 Million tonnes in 2021-22), employing 80 million rural households, with the bulk being small, marginal and landless farmers, contributing 5 % to the country’s GDP, worry about methane emissions?

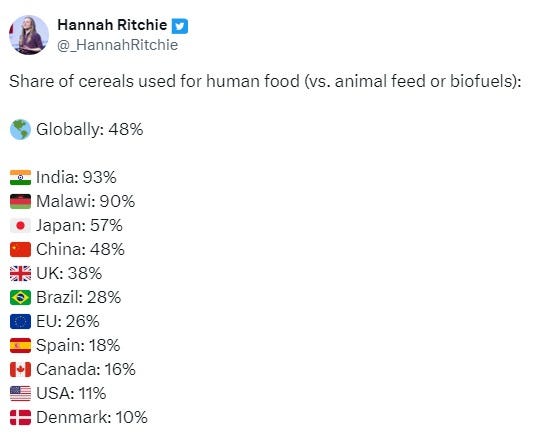

Should India worry about methane emissions when the share of cereals used for human food vs animal feed is the highest at 93 % in India, in comparison with the global average of 48%?

Of course, you are most welcome to argue with me that the carbon price per litre of milk in India is the highest in the world, save sub-Saharan Africa.

Nevertheless, the fact of the matter is this: The Indian Dairy sector is in throes of transition. The growth rate in milk production has dropped to 3.8% in 2022-23, in sharp contrast to historic CAGR of 8.2% from 2014-15 to 2021-22 1

What led to this sudden rise and fall?

Professor Rajeshwaran Selvarajan who recently published an excellent report on “Changing Scenario of Dairy Sector in India”, attributes it to “a higher proportion of the adult female population which are in milk”

Rajeshwaran corroborates the sudden drop thus:

“their growth rate has considerably come down in this 16-year period, as revealed in this graph; from 7.7% to 5.0% for crossbred cows, from 2.3% to 0.3% for indigenous cows and from 1.9% to 0.3% in the case of buffalos. In other words, the growth in capex is clearly on the decline in all the three types of bovines.”

If this is the case, these must be challenging times for dairy D2C entrepreneurs to manage the productivity of these 73-odd bovine varieties (comprising cross-bred cows, Indigenous cows and buffaloes) of this country while managing customer expectations.

If you want to sketch the metaphoric map of the Indian dairy market, you could draw a Janus face with quantity and quality on either side.

The former (Quantity) occupies the better part of the organized and unorganised market share, thriving on inherited government monopoly - Amul being the classic case of a government-monopoly-backed marketing company with a dairy back-end- and is largely on focusing on providing a cheap source of protein.

“As per the household consumption expenditure survey 2022-23, the monthly per capita on milk and milk products is the 2nd largest component of expenditure on food.” - Rajeshwaran Selvarajan

The latter (Quality) tries hard to compete on urban characteristics with high margins and higher anxieties about health, adulteration and quality concerns.

No prizes for guessing which side of the face the D2C market is focused on.

Why is the D2C market not going deep on product positioning, creating a differentiation premium between crossbred cows and indigenous cows? Sure, the customer doesn’t care as long as the milk looks pure. But why not educate and upgrade the customer?

Today, as Rajeshwaran rightly points out in his paper, milk produced by each of the 73 recognized Indian varieties is sold as undifferentiated MILK to consumers. How to win this quality-conscious urban customer?

When I look at the trifecta of venture-funded D2C dairy players whose operations I have been personally able to observe in Hyderabad- Country Delight, Akshayakalpa, and Sid’s Farm, each of them is playing as per their strengths. How do we evaluate these strengths, given how the dairy sector is expected to evolve towards the future?

If you want to win this highly competitive D2C Indian dairy market, would you prefer to be a fox or a hedgehog? This might seem like a weird question to ask.

But here is the thing: If you want to find the player with the right strategic instincts to win the Indian Dairy D2C Market, this might be the crucial archetype worth paying attention to.

Perhaps you may not be familiar with the popularity of this timeless metaphor.The fox/hedgehog archetype emerged when the Greek philosopher Archilocus observed that "the fox knows many things, but the hedgehog knows one big thing."

The Fox archetype is associated with thinking in N+1 multiple models, while the hedgehog is associated with a single big N model. You could oversimplify this by stating that hedgehogs wear generalist hats and swear by execution focus, while foxes wear specialist hats and swear by better situation awareness and agility.

Foxes are good at asking the right questions. Hedgehogs are good at providing the right answers.

When I look at the leading trifecta of the next generation of the Indian Dairy segment, at the risk of oversimplifying, Sid’s Farm and Country Delight stand out as Hedgehog to me, while AkshayaKalpa stands out as Lone Fox.