State of Agritech - 29th August 2024

In Today’s Edition:

Ministry of the Future

1/ Making Sense of Cargill’s ‘Structural Overhaul’

In a deglobalizing world undergoing energy transition, digitizing its operations, and vying for a nutrient-rich, lower-calorie future, how are goliaths in the agri-input and agri-output world adapting themselves?

2/ Making Sense of Jiva.ag

How to make sense of Jiva, the lovechild of BCGX and Olam?

1/ Making Sense of Cargill’s ‘Structural Overhaul’

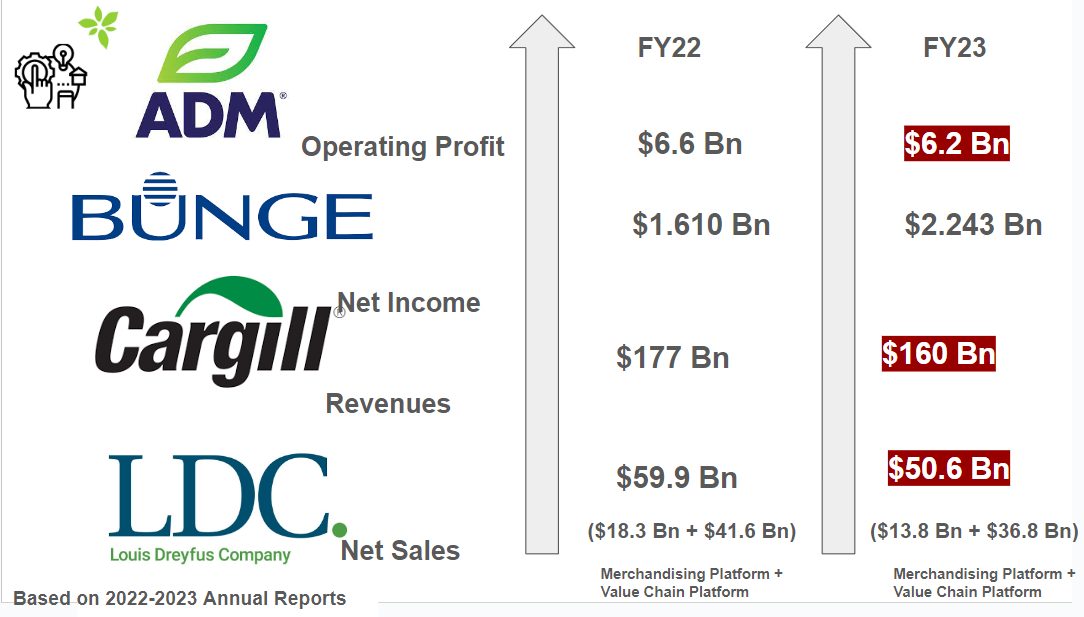

These are trying times for Goliaths in the global agribusiness ecosystem, including ABCD traders, with ACD reporting ‘shrinking profits’ in FY23 compared to FY22.

The steady rise of weight-loss drugs, the collective discomfort and regulation against highly processed foods have prompted many goliaths, including Nestle into an existential crisis.

“Mark Schneider, the company’s boss, says Nestlé is already preparing for a “lower-calorie, higher-nutrient future”. Last year the business set a target of growing sales of “more nutritious” products by 50% by the end of the decade. Other packaged-food businesses such as Conagra and General Mills also now have products targeted at users of slimming jabs.” - Economist Story

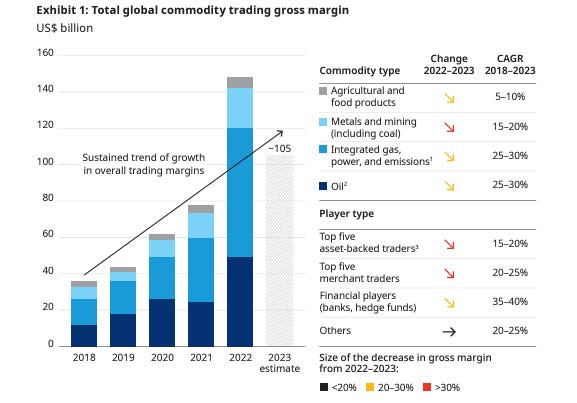

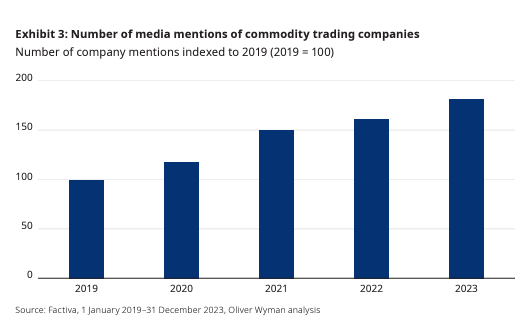

At a macro level, as per recent data by Oliver Wyman, the gross margins of global commodity trading players have “regressed to the mean” from $150 billion in 2022 (owing to war-spurred volatilities and other disruptions) to around $100 billion in 2023.

Few weeks ago, Reuters published an article claiming access to Cargill’s internal memo, revealing Cargill’s plans to overhaul their business units from five to three.

In January 2020, Olam went through a similar reorganisation to restructure its business portfolio into three distinct operating groups so that it could go for IPO for OFI and Olam Agri.

If.

If things go as planned.

Earlier this month, the European Commission approved the acquisition of Viterra by Bunge with instructions to ‘divest the entirety of Viterra's oilseed businesses in Hungary and Poland and a number of logistical assets linked to these operations’ to address competition concerns of concentration of oilseeds processing capacity in Central Europe.

The bottom line is this: The role of commodity traders is evolving.

As Jonathan Kingsman put it eloquently in a recent podcast, it is becoming more feminine, more collaborative, and more open to regulatory scrutiny, playing with much more market-shaper archetypal energies as opposed to its previous opaque, lone-wolf, market-broker archetypal energies.

In simple terms, Collaboration is not a nice platitude1 any more. It has become a norm for survival in a volatile market.

“At top trading firms in 2023, power trading desks collaborated with gas and LNG desks to optimize risk management and ensure stable performance throughout the year. That held true even in a challenging macroeconomic environment in Europe and during weatherrelated disruptions in the US. Similarly, collaboration of oil, product, and gas desks with shipping and chartering desks helped firms navigate tight freight markets across major shipping chokepoints such as Panama and the Strait of Hormuz. Implementing such collaborations requires some critical adjustments to traditional operating models such as better interface management and incentive structures for traders to react and take decisions quickly.” - Oliver Wyman- Commodity Trading’s Coming of Age Story)

No wonder, Covantis-The Avengers platform for Leading Six Agricultural Trading Companies has progressed further in 2023

“In 2023, Covantis captured an impressive 719 million metric tons of volume executed through its platform, representing a substantial increase compared to the previous year. This signifies a year-on-year growth of 37%, showcasing the platform’s increasing relevance and influence in the market.” - Covantis Blog

With AI and digital platforms further accelerating collaboration among trading players, much like what we are seeing in the agri-input ecosystem, we can expect to see more coalitions and ecosystemic gameplays.

2/ Making Sense of Jiva

I didn’t realize that Jiva was the lovechild of Olam and BCGX until I read BCGX’s sponsored post recently in Wired.

What is the origin story of Jiva?

“One such initiative is called Jiva, a digital platform for farmers that stemmed from Olam’s deep experience in originating commodities and strong on-the-ground presence in producing countries. Supported by BCG X—Boston Consulting Group’s (BCG) tech and venture-building arm—Jiva evolved from Olam’s network of local buying agents and, in some cases, direct engagement with farmers. Direct buying is notoriously difficult due to financial and digital literacy problems, but Olam found, in 2017, that it was possible—and profitable—to engage with farmers directly if you put in informed effort. Jiva was the endgame of that effort, an app-based platform that paired the buying-and-selling interface with three critical services: crop advisory, input sales, and financing options. Together, it represented a revolutionary digital service offering for farmers in some of the most remote parts of the world

Sounds great. How are they faring?

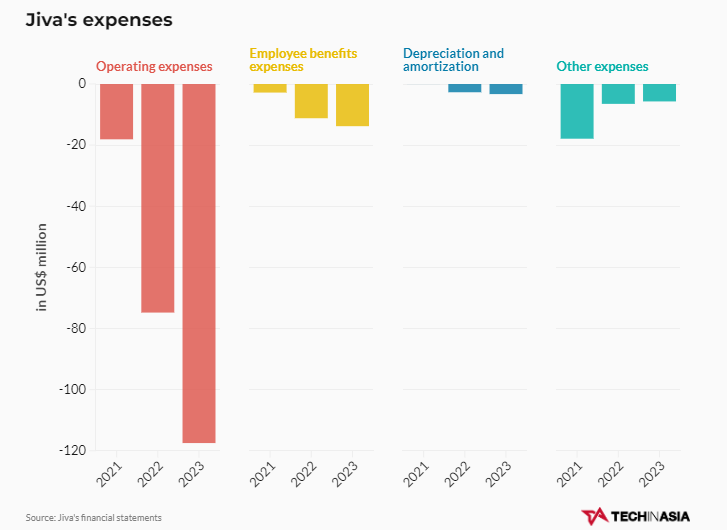

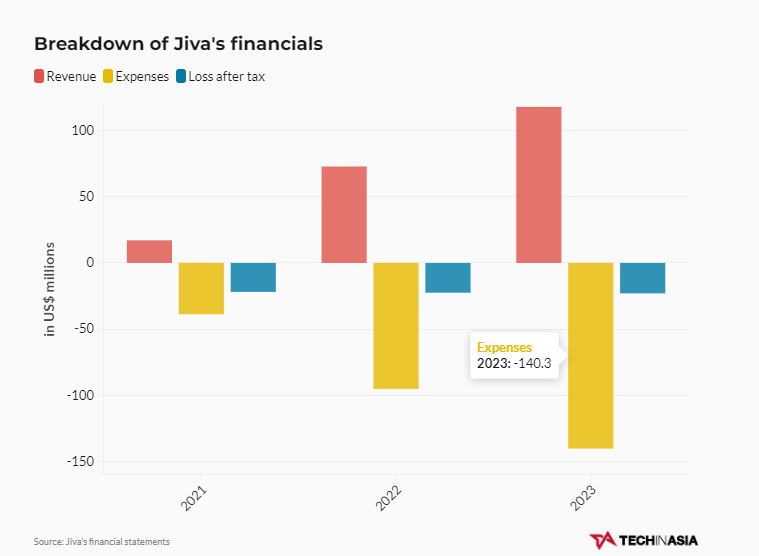

Jiva grew its revenues by 62%, while its operating expenses grew up by 47.5 % in 2023 to US$140.3 million.

Although their case studies and marketing narratives gave me the impression that they are working directly with farmers, when I read their internal service designers’ accounts of their everyday work, I get the sense that they also work with micro-collectors who engage with farmers, especially in Southeast Asia.

“In this case, it could also be the internal user, someone who’s part of the Jiva team itself, or it could also be people whom we are serving, such as the micro collectors (MCs)…a micro collector (MC) typically goes through the journey of awareness of Jiva, coming to know about Jiva, being recruited into Jiva, being trained, starting their transactions with Jiva, and then that relationship matures and grows from there on” (Source)

Update from Seamus Co-Founder Jiva- 30/08/24: “We have also always stated that we work to serve farming communities, of which rural entrepreneurs (including collectors and retailers) are a key part. We work with 150k farmers, and around 10K partners across collectors and retailers”

Thanks to inherited parent capital, both Agri-central and Jiva seem to have leveraged the scale game, although by focusing on micro-collectors, in the latter’s case, who are getting more fluent with digital and profit-based revenue-sharing models, the space is going to get more complex in retaining user loyalty.

As I write in the“Gatekeepers at the Edge” in my recent “Nine Mental Models for Agritech Founders and Investors” publication,

Agritech 1.0 (between ~2011-X) is about incumbent (but illegible) protocols (that stem from the traditional value chain) that are decentralized and governed by the gatekeepers at the edges of the network. Most of the value accrued to the edges of the network - retailers and middlemen (physical/digital)

If you are a global investor evaluating agritech 1.0 smallholding business models across the world, the critical question to ask is this: Would this particular business model survive if you remove these gatekeepers from the system?

Update from Seamus Co-Founder Jiva- 30/08/24: “I think your notion of “middle men” is also incorrect. The collectors that we refer to are often friends and relatives of the farmers that are selling.”

Are there any other exciting Indonesian agritech players’ gameplay I should evaluate for their unique approach to the market? I am all ears.

How happy are you with today’s edition?

I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.

You could cynically argue that ‘regenerative’ is becoming a platitude, albeit poorly understood.