My agrifintech coverage so far:

Indian Agrifintech Comes of Age (2021)- > State of Agrifintech Panel (2022) - Mapping Agrifintech based on Lending Structures (2023) - > Five Archetypes of Indian Agrifintech Players(2024) - Making FPOs Investable Assets (2024)

State of Agrifintech Landscape (2025)

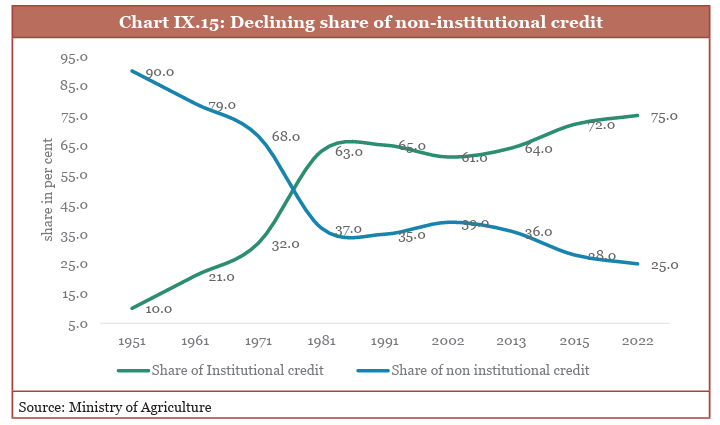

If you want to find out how the Indian Agrifintech wave has accelerated financial inclusion, you can point to good numbers on the sunny side from the Economic Survey 2024-25:

1/ The growth in Ground-Level Credit (GLC) from ₹8.45 lakh crore in FY15 to ₹25.49 lakh crore in FY24. The increase in credit flow to small and marginal farmers surged from ₹3.47 lakh crore in FY15 to ₹14.4 lakh crore in FY24.

2/ The outstanding credit to MSMEs by SCBs expanded by 20.9% in 2023-24. The number of operative Kisan Credit Cards (KCC) grew by 5.4% by March 2024, with the outstanding amount increasing by 10.9%

If you want to look for the half-empty glass, there are enough data narratives that show that we haven’t done enough:

1/ By international standards, India’s credit-to-GDP ratio is comparatively low, below Brazil's.

2/ The informal sector of India’s economy received a bad hit between 2016 and 2023 from 111.3 to 109.6 million workers, as per the Annual Survey of Unincorporated Sector Enterprises :

“Usually, the number of unincorporated enterprises grows by close to 2 million annually. Had the sector not faced these economic and natural shocks, the total number of such enterprises would have been close to 75 million. In effect, close to 10 million enterprises were lost. Given that an establishment provides employment to around 2.5-3 persons, close to 25-30 million jobs were lost in the process. Also, the number of people employed by them is still lower,”- Pronob Sen in Business Standard

3/ The Microfinance Sector has also been showing significant debt distress.

Dvara Research conducted a household-level survey in January 2024 involving 1,124 microfinance customers of an NBFC across three districts each in Odisha and Tamil Nadu, to analyse the characteristics of borrowers experiencing distress. Increase in NPA by 100 basis points, from a post-pandemic low of 0.9% in September 2023 to 1.9% in September 2024.

Portfolio-at-Risk (PAR) 31-60, PAR 61-90, and PAR 91-180 increased by 60, 70, and 90 basis points

Approx. 6% of borrowers have exposure to four or more lenders

68% of the borrowing households could be flagged as distressed (Data Sources)

These broadly correlate with NABARD’s All India Rural Financial Inclusion Survey 2021-22

Insight #2: 52.2% of households have outstanding debt, with an average outstanding debt of ₹90,372 (~1073 USD) per indebted household. 74.4% of loans are from institutional sources. The proportion of rural households that reported outstanding debt has grown from 47.4 per cent in 2016-17 to 52.0 per cent in 2021-22, even as their average monthly income jumped 57.5 per cent in the same period.

Many moons ago,

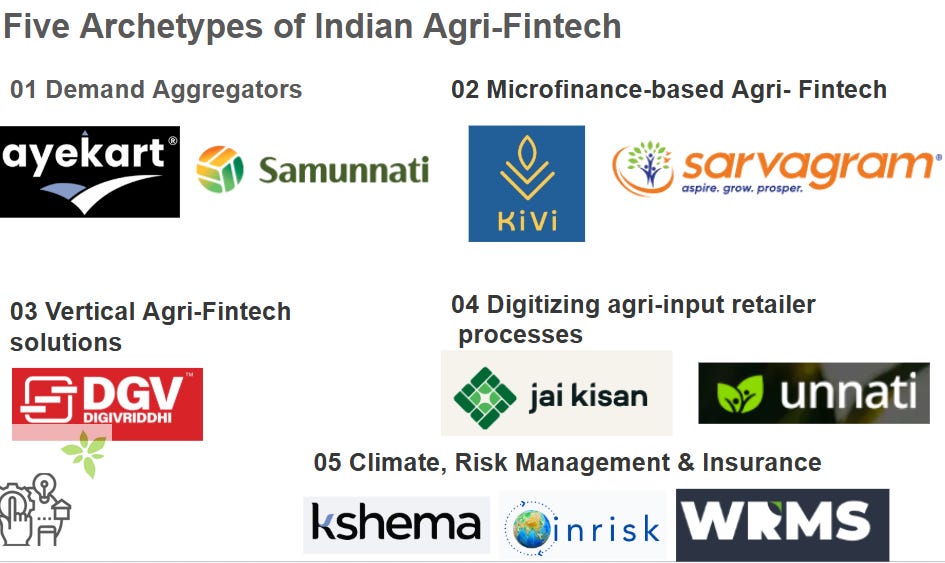

wrote a magisterial blog post where he argued that if the fintech sector were a startup, India’s fintech would have achieved Product Market Fit. But what about agri-fintech? As I detailed out earlier, I see five archetypes of agri-fintech players

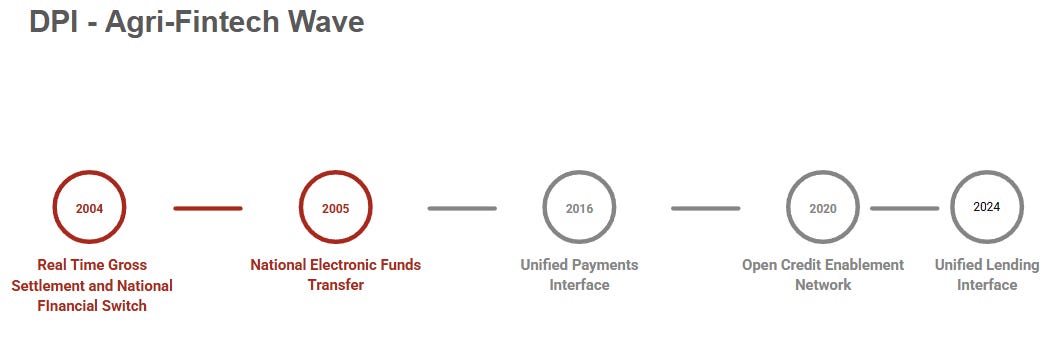

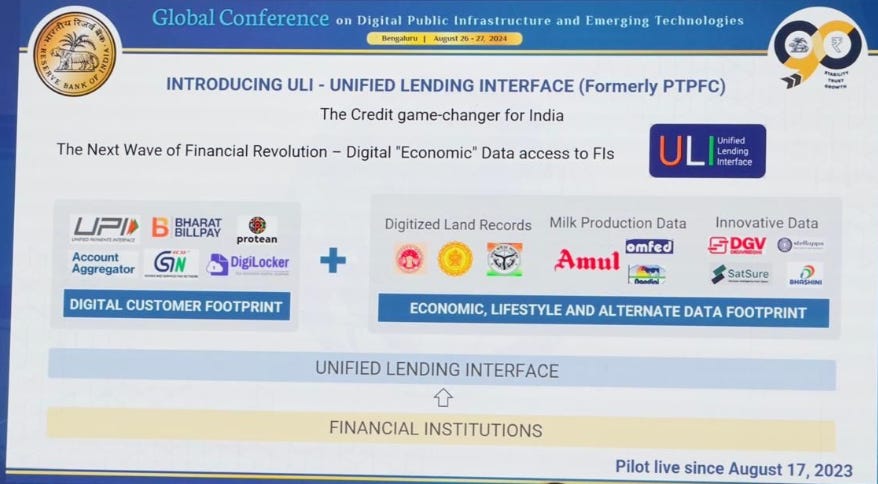

These archetypes are further evolving with the rapid technological evolution of the plumbing infrastructure provided by the third Digital Public Infrastructure wave.

Interesting experiments like the Unified Lending Interface have gained enough traction to create composable data assets that could better underwrite risk and reduce the cost of credit.

Given these developments, has the Indian Agrifintech sector cracked the product-market fit? Should we be concerned about the debt distress in the microfinance sector? I invited an eminent panel to find out the current state of agrifintech affairs.

Here are a key few insights I discovered from the dialogue if you are one of those content with “takeaways”. The real food lies in the dialogue.