Welcome to the Surrogate Economy

Surrogate Economy wants to replace everyday industrialized, synthetic products with low-carbon, bio-based alternatives. Can surrogate economy take off?

Editor’s Note 1: I don’t have an editor.

Editor’s Note 2: I returned few days ago from a holiday in Thailand and rebooting my newsletter. While I have written collaborative pieces outside, I have never published them inside this newsletter. New beginnings.

Editor’s Note 3: A heavily edited version of this article (albeit with a sterilized title) was published in The Hindu Business Line

What do AltM, HUID, Zero Cow Factory, Metastable Materials, BatX, Bambrew and Agri Leaf have in common?

Besides sounding like characters from a sci-fi movie, they are pioneering players in the Surrogate Economy—an emerging sector replacing industrialized, synthetic products with low-carbon, bio-based or recycled alternatives. And yes, many have raised venture capital.

What excites me? Their raw materials come from everyday by-products: pineapple fronds, coconut water, bacterial cultures, potato peels, cactus.

As sustainability pressures grow, and incentive mechanisms for greener supply chains mature, investors are waking up to the potential of these startups. But one question looms: Do they deserve venture capital’s rocket fuel? Can they deliver venture-scale returns?

What is Surrogate Economy?

The Surrogate Economy seeks to replace fossil-fuel-powered food, materials, fibers, and fuels with greener substitutes. While some of these materials—like recycled plastic, coconut husk composites, or bagasse-based fuels—have existed for decades, they were long considered dull, SME-run manufacturing plays.

Today, it’s old wine in a new bottle.

Rising climate awareness, India’s dependence on imported materials (e.g., lithium-ion), and the rise of nanomaterials (enhancing cement, textiles, electronics, and more) have reignited interest in this domain.

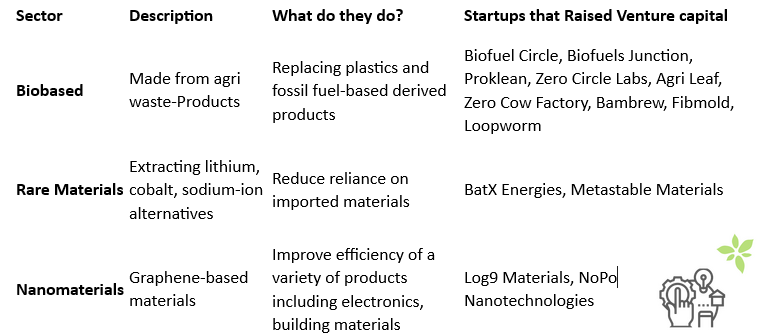

Broadly speaking, Surrogate economy falls into three buckets.

So why “Surrogate” and not “Bioeconomy”? Because this is broader. It includes biology, but also circular and engineered innovations. It isn’t just about swapping out fossil-based inputs—it’s about reimagining the supply chain through three pathways:

Bio-Based Surrogates: Using agri waste and biology (e.g., pineapple fiber leather, Hempcrete, Bioplastics)

Recycled/Circular Surrogates: Using post-consumer waste (e.g., Loop Industries' Plastic Monomers, Redwood Materials' Recycled Batteries)

Engineered/Advanced Surrogates: Nanomaterials, Fungi/mycelium, Enzymatic innovations, and synthetic analogues that outperform legacy inputs

Rocket Fuel For Surrogate Economy

Post-COVID, a flood of climate-focused capital has entered the market. (Why does venture capital chase the uncertain climate futures? I discovered the most candid answer to this question here)

While a major part of this capital is chasing a limited set of opportunities, mostly in electric mobility and energy transition, bolder bets in climate sectors such as cooling, climate-proofing agriculture, and carbon capture are being made in the sidelines.

Surrogate Economy represents a promising slice of a market that is in the throes of transition. Most commodity markets are worth hundreds of billions of dollars, so even a small shift toward alternative materials could create a massive opportunity. India has abundant underutilized biobased resources, low labor costs, and rising consumer awareness around sustainability.

Mountains of crop-residues are seen as a disposal problem. In India, tens of millions of rice straw are burned each year, wasting a precious resource. A new wave of founders, many emerging from top research institutes, is now building world-class products for both domestic and global markets.

Bolstering the opportunity is the fact that India has a long-standing culture of recycling. Plastic recycling has operated for years, supported by a well-developed ecosystem of waste suppliers, machinery manufacturers, and logistics providers.

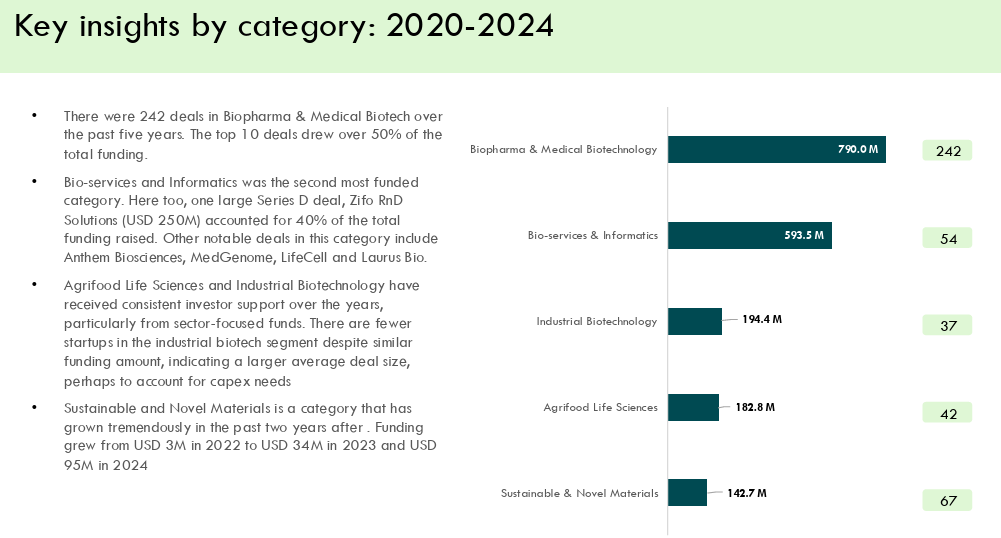

Funding for surrogate economy is slowly picking up momentum in India.

While early-stage interest is strong, growth-stage funding remains a challenge for many of the surrogate economy players. While seed and Series A deals have seen steady activity, Series B funding dropped sharply post-2022. Only 13 growth-stage deals (Series C & D) occurred in five years, mostly in pharma/health, highlighting the early stage of deep tech ventures in this space. (Data Credits: Omnivore’s Bioeconomy Report)

Will Early-Stage Investors See Returns?

For investors to see meaningful returns, these startups need their products to become mainstream, and they’ll require multiple rounds of funding to scale. But this path is far from straightforward.

Challenges of Selling to Corporate Customers

Most surrogate economy startups sell to other businesses. Gayatri Keskar, a materials science expert who advises brands on partnering with startups, selling to large corporations outlined three key challenges:

Sustainability Trade-offs

Corporates evaluate sustainability differently. A new plant-based packaging may not fit existing infrastructure. Sometimes, a refillable plastic package may seem more sustainable (and practical) than switching to bioplastics. Additionally, packaging only interacts with consumers for a few minutes, so making packaging sustainable may not be seen as critical.Cost Parity and Infrastructure Compatibility

Alternate materials must work within existing systems. For example, hemp yarn must be compatible with cotton-weaving machines. Bamboo granules should run on standard plastic injection molding machines. Bio-based silica should be compatible with silica mixing machines for tyre companies. Alternate materials should cost as much or less than their conventional counterparts.Slow Decision-Making Cycles

Large corporate buyers typically have long, complex procurement processes. Startups need capital and resilience to navigate these delays.

Some sectors like biofuels have walked the talk and shown demonstrable performance. Biofuels such as agri based pellets and biogas and ethanol are now able to offer performance that is very similar to the fossil fuels that substitute and Hemp and recycled battery materials also have potential, but it’s still early days.

Availability of Capital Throughout the Company Lifecycle

Surrogate economy startups generally fall into two types based on their lifecycle.

The first type are trade-oriented models, which act as intermediaries by converting agricultural or industrial waste into usable products such as fuels and consumer goods. These companies are largely aggregator businesses.

Many biofuels’ companies including Biofuel Circle, GPS Renewables which has raised its series B funding and Shubhshree Biofuels that went public have started scaling up.

The second type are deep-science startups. These follow a much longer journey, progressing from lab research to pilot plants and eventually to full-scale factories. While early-stage capital is often available for research and development, there is a significant funding gap for setting up the first commercial plant.

At this stage, startups typically need a few million dollars, they don’t have confirmed orders from clients yet (who want to see the infrastructure first) and do not have collateral or margin money needed for debt. VCs also find it difficult to meet this gap, uncertain whether these businesses can scale with asset-light models via contract manufacturing or setting up franchises.

What Does the Global Experience Tell Us?

Globally, several surrogate economy startups have raised multiple funding rounds and seen their valuations grow significantly. Some of the unicorns include Loop industries, which breaks old plastic material into its base chemicals, Redwood materials, a lithium-ion recycling company and Spiber, which makes biobased fabrics. While many of these companies are still working towards commercial-scale operations, a few, such as Redwood Materials and MycoWorks have started generating early revenues.

At the same time, not all have succeeded. In March 2025, Bioplastics Manufacturer Danimer Scientific and Northvolt (Battery recycling), shut down. Meanwhile, LanzaTech, which turns industrial gases into usable products, has seen its stock fall by nearly 90 percent over the last year because of execution delays.

Final Thoughts

Surrogate economy represent a massive opportunity in a world that is increasingly focused on reducing greenhouse gas emissions. Materials that solve real problems without asking consumers to pay a “green premium” are gaining strong momentum.

Surrogate Economy transcends greenwashing and addresses the tricky question of degrowth in Global South through a simple, but powerful question: Can we redesign how the world works, not just repaint it green? This economy champions functional, scalable, economically viable replacements — not just for niche products, but across core industrial domains.

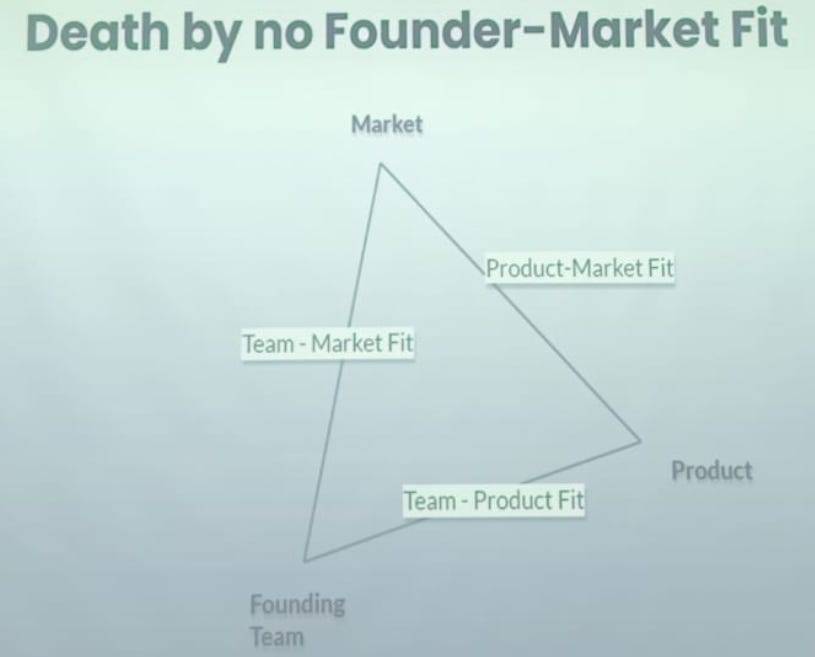

But VCs might need to recalibrate their expectations. Building these businesses will take longer, involve more tech risk and carry big execution challenges. Most surrogate economy startups remain in the early stages, often valued more on founders’ pedigrees than proven traction. Let’s not forget: The possibilities are immense.

Except for this tiny universe that typically reads this newsletter, the economy at large still sees agriculture as a burden. Decentralized surrogate economies run and managed by community-driven institutions and powered by the next wave of agritech-climate-tech-agribiotech- ventures could very well be the modern manifestation of the old dream called “Economy of Permanence”.

Will this possibility manifest? We’ll see:)

So, what do you think?

How happy are you with today’s edition? I would love to get your candid feedback. Your feedback will be anonymous. Two questions. 1 Minute. Thanks.🙏

💗 If you like “Agribusiness Matters”, please click on Like at the bottom and share it with your friend.