State of Agritech - 21st December 2023

Programming Note: This will be the last “State of Agritech” post for 2023. Going with the tradition (2022, 2021, 2020), The Agribusiness Matters 2023 Year in Review will be published on Saturday before I unwind and get into JOMO (Joy of Missing Out) vacation mode.

Wish you all a Merry Christmas and a wonderful New Year!

Every time the spirit of Christmas is alive, fond memories of singing (Oh yes, did I tell you that I sing and post them on LinkedIn of all places?) my favorite Christmas carols in my Salesian convent school choir waft in the chilly air:

Feliz Navidad

Feliz Navidad

Feliz Navidad

Prospero Ano y Felicidad.

In Today’s Edition:

1/ Making Sense of Vegrow’s Series-C Fundraise

In the afterglow of their fundraise, Vegrow (Aug’21 coverage) wants to be the ‘undisputed leader in every fruit category’. Can they tame the complexity of the fruit supply chain?

2/ How to misread the role of Venture Capital in Indian Agriculture?

Few reflections on The Morning Context’s hit job piece on How Indian VCs oversold tech disruption in Agriculture.

3/ Making Sense of ONOAg

1/ Making Sense of Vegrow’s Series-C Fundraise

When I analyzed Vegrow’s Series-A fundraise in Aug’21, I wrote,

“Vegrow raised $13 Mn based on one fundamental premise: There is a tremendous opportunity to bet on “Integrators” who are bringing together “Pure Input Focus”, “Pure advisory tech” and “Output Focused eCommerce”.

“Here is the unofficial but correct translation: Unlike pure input focus players like Agrostar, unlike pure advisory tech players like Fasal, unlike output focused eCommerce players like Agribazaar or Dehaat ( which makes more money on the output side than input side), Vegrow is attempting to build aggregation by integrating each of these components with the customer relationship they are building through their aggregator platform.”

Needless to say, a lot of water has passed under the bridge.

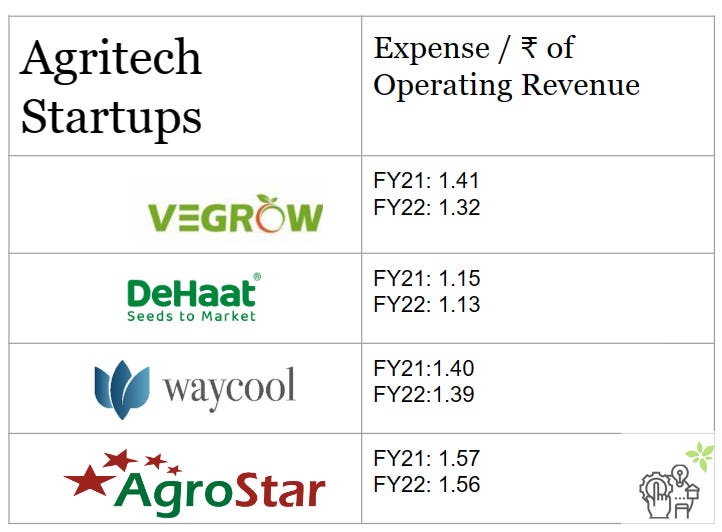

Vegrow has stuck to its guns by providing bundled farmgate services-’grading, packaging, logistics, and sales as a service’. In FY21, on a unit level, Vegrow spent Rs 1.41 to earn a single unit of operating revenue. In FY 22, the company spent Rs. 1.32 to earn a single unit of operating revenue.

With their new rocket-fuel (read as VC funding) reserves, Vegrow’s ambitions are growing:

“Our ambition is to establish ourselves as the undisputed leader in every fruit category, ensuring transparency and higher income for farmers, while also reducing carbon consumption through supply chain optimization.”- Shobhit Jain, Vegrow Co-Founder

Vegrow’s Co-founder Praneeth, in a post written several months ago, spelled out the underlying structural reasons that are driving their ambition.

Coincidentally, I spelled out this dual market theory when I wrote the deadlock of Industrial agriculture recently.

Growth in fruit commerce is a function of fruit-commerce-driven logistics.

The same views were echoed by Pawanexh Kohli, former chief executive officer of the National Cold Chain Development Authority (NCCD).

“...all fruits and vegetables, except for some like apples and pears, which are grown in the hilly regions, don’t have a big saleable life. While, in case of some fruits the saleable life can be extended up to 16-18 months by reducing oxygen levels.

However, tropical fruits like bananas and mangoes don’t have a saleable shelf life beyond a few weeks even in the best of cold chain facilities. Therefore, there is a need to reduce the time taken from farm to fork, which can only be done through pack houses near fields, reefer vans for quick and efficient transportation etc.”

In Feb’22, when I analyzed digital quality assaying players, based on FY19 data, I wrote,

“We have more than enough cold storages. We need more pack-houses, reefer vehicles and ripening chambers than cold-storages.”